Key Takeaways

- Strong demand for AI and Arm's technologies is driving record revenue and royalty earnings, enhancing future growth across markets.

- Expansion in data center adoption with major players boosts future royalty revenues, while strategic projects reinforce Arm's role in the AI ecosystem.

- Arm Holdings' expansive market ambitions, legal challenges, and high R&D costs could pressure revenue stability and net margins if growth expectations aren't met.

Catalysts

About Arm Holdings- Arm Holdings plc architects, develops, and licenses central processing unit products and related technologies for semiconductor companies and original equipment manufacturers rely on to develop products.

- Strong AI demand is driving significant momentum for Arm's ecosystem, with record revenue and royalty earnings due to the adoption of v9 and CSS technologies. This is expected to enhance future revenue growth as these technologies continue to gain traction across end markets.

- The expansion in data center adoption with significant players like AWS, Microsoft, Google, and NVIDIA utilizing Arm-based chips, suggests a robust pipeline that should boost future royalty revenues from the data center segment.

- High licensing revenue growth, driven by substantial deals in the AI and CSS domains, indicates an upswing in long-term commitments from partners. This sets a positive outlook for future license revenue and overall financial growth.

- Arm's continued investment in R&D, specifically targeting the next generation of technologies, is aimed at unlocking future revenue opportunities and competitive edge, potentially enhancing net margins through innovation and efficiency.

- The introduction of significant projects such as Stargate and Cristal intelligence positions Arm as a crucial player in the AI ecosystem, potentially driving substantial long-term royalty revenue as AI workloads increasingly run on Arm's pervasive compute platform.

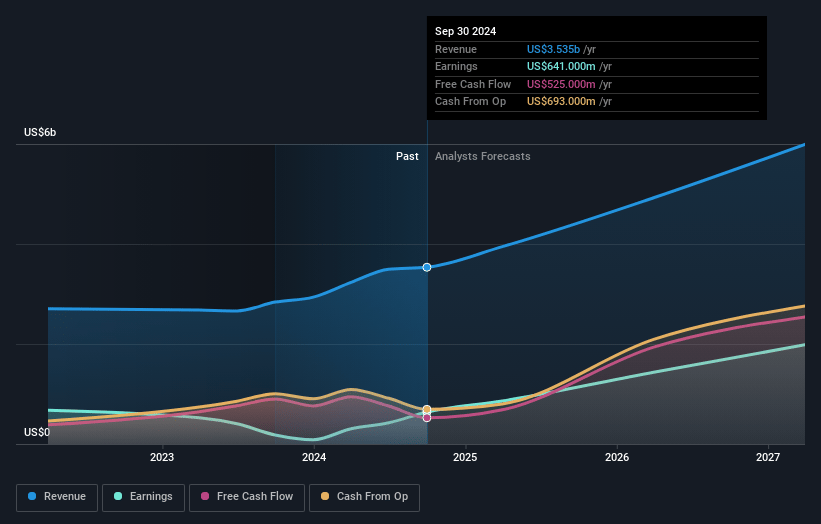

Arm Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arm Holdings's revenue will grow by 20.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.8% today to 31.5% in 3 years time.

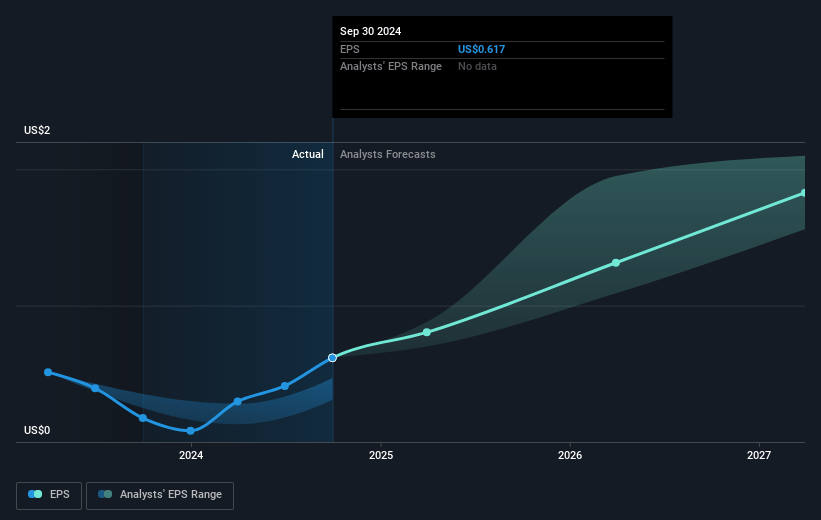

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $2.05) by about July 2028, up from $792.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.6 billion in earnings, and the most bearish expecting $1.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 95.4x on those 2028 earnings, down from 208.8x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.9x.

- Analysts expect the number of shares outstanding to grow by 0.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.67%, as per the Simply Wall St company report.

Arm Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arm Holdings faces execution risks related to its ambitious plans for market expansion and AI-driven projects like Stargate and Cristal intelligence, which could impact revenue consistency if challenges arise.

- The increased R&D spending, while necessary for future growth, has led to the highest level of non-GAAP operating costs, which might pressure net margins if not matched by commensurate revenue growth.

- Revenue guidance for the fourth quarter leaves room for uncertainty, with large license deals possibly slipping into the next fiscal year, which could impact short-term earnings.

- If there's a prolonged legal battle with Qualcomm, despite assumptions in Arm's financial forecasts, it could impose additional legal costs or affect anticipated revenue from Qualcomm products.

- Reliance on complex licensing agreements, which can face delays due to negotiation complexities, could impact the timing of revenue recognition and affect quarterly earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $142.281 for Arm Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $210.0, and the most bearish reporting a price target of just $76.54.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.9 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 95.4x, assuming you use a discount rate of 10.7%.

- Given the current share price of $156.5, the analyst price target of $142.28 is 10.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives