Narratives are currently in beta

Key Takeaways

- Innovation and new products in sensors and strategic OEM partnerships position Allegro for growth in automotive and semiconductor sectors.

- Localization and strategic inventory management aim to enhance market position, reduce costs, and support earnings growth through operational efficiency.

- Declining sales, inventory challenges, geopolitical risks, and increased interest expenses threaten Allegro MicroSystems' revenue, profitability, and margin stability.

Catalysts

About Allegro MicroSystems- Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific analog power ICs for motion control and energy-efficient systems.

- Allegro MicroSystems is focusing on innovation, exemplified by the launch of new XtremeSense TMR sensors, aimed at capturing demand in automotive, AI data centers, EV charging, and solar applications. This should drive revenue growth as their solutions gain traction.

- Expansion in automotive opportunities is evident through partnerships and design wins with major OEMs, benefiting from global demand for differentiated sensing and power semiconductor solutions, which could boost revenue.

- Localization efforts, such as establishing a China-based supply chain, are anticipated to enhance their market position in China and reduce costs, potentially increasing net margins.

- Allegro's strategic inventory management and proactive measures to rebalance inventory with their distribution partners aim to boost future revenue as they normalize supply chains, particularly in the recovering automotive sector in China.

- The company's focus on advancing their market position with innovative product lines, coupled with the removal of excess inventory and localization strategies, are expected to support earnings growth through operational efficiency and improved market penetration.

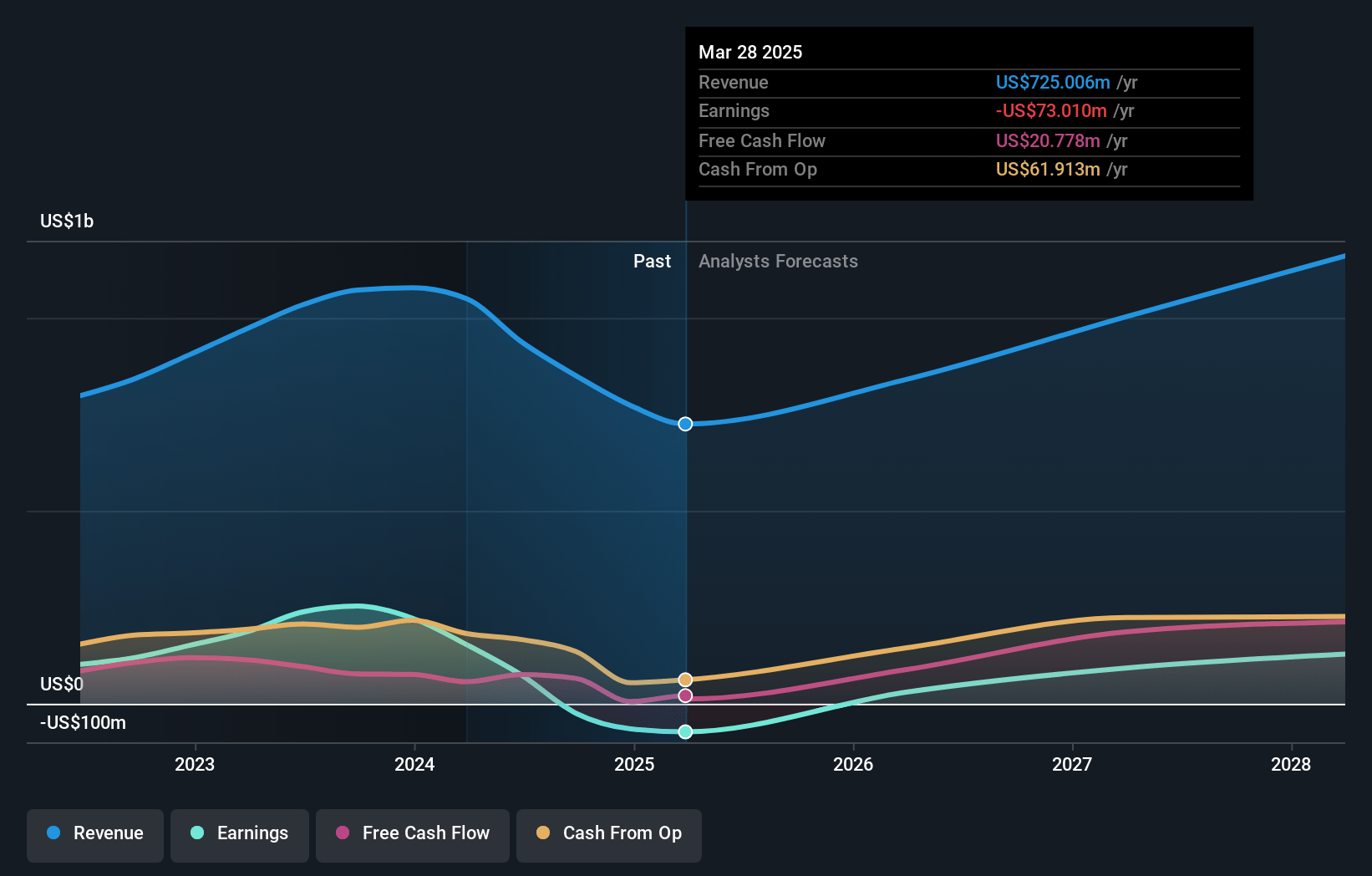

Allegro MicroSystems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Allegro MicroSystems's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.0% today to 13.0% in 3 years time.

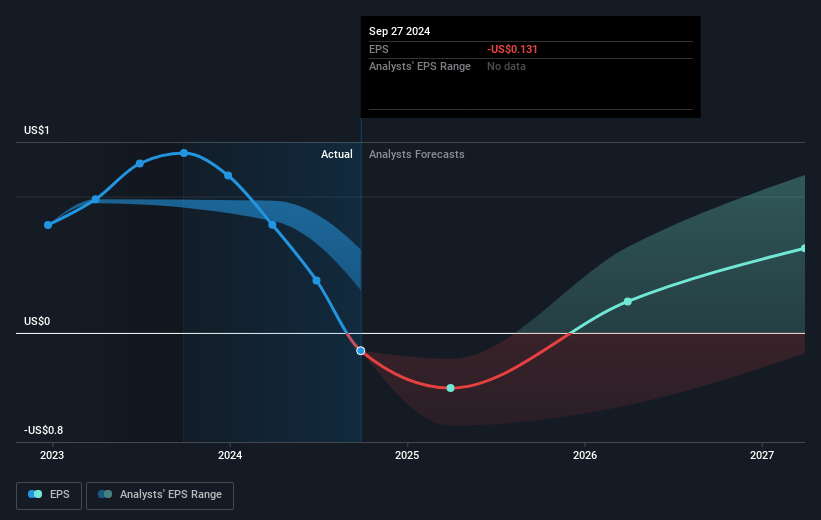

- Analysts expect earnings to reach $136.9 million (and earnings per share of $0.78) by about January 2028, up from $-25.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $154.6 million in earnings, and the most bearish expecting $-28 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.0x on those 2028 earnings, up from -162.5x today. This future PE is greater than the current PE for the US Semiconductor industry at 31.2x.

- Analysts expect the number of shares outstanding to decline by 1.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

Allegro MicroSystems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's sales declined significantly by 32% compared to the same quarter in the previous fiscal year, and auto sales saw a 28% year-over-year decline, potentially indicating decreased demand or market share loss affecting future revenues.

- The automotive market in North America and Europe continues to face inventory digestion challenges and production cuts, which could create ongoing volatility and unpredictability in revenue and profitability.

- Although there is strategic engagement with China, heavy reliance on this region poses risks due to geopolitical tensions and potential disruptions, which could adversely affect revenue streams.

- Recent changes in the capital structure, including a $200 million term loan to fund a share repurchase, may increase interest expenses, impacting net margins and overall earnings.

- Fiber margins were significantly lower than a year ago, and while some gross margin improvement is expected, there is lingering concern about price stability and competitive pressures that may hinder margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.52 for Allegro MicroSystems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $136.9 million, and it would be trading on a PE ratio of 48.0x, assuming you use a discount rate of 8.2%.

- Given the current share price of $22.19, the analyst's price target of $29.52 is 24.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives