Last Update01 May 25Fair value Increased 0.083%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Expansion into AI infrastructure and CXL technology positions Astera Labs for revenue growth and market share gain through innovative product lines like Leo and Scorpio.

- Strategic R&D investments and acquisitions aim to enhance IP and meet connectivity challenges, improving margins and opening new revenue streams from AI cluster interconnect solutions.

- Dependence on a few hyperscale customers, product reliance, and technological shifts pose revenue and market share risks for Astera Labs.

Catalysts

About Astera Labs- Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

- The expansion of Astera Labs' product portfolio, including Aries, Taurus, Leo, and Scorpio, is expected to support revenue growth, with significant contributions from AI and general-purpose compute infrastructure applications. This is anticipated to drive revenue growth.

- Astera Labs is positioned to enable the proliferation of CXL technology, with the LEO product family expected to begin volume ramping in the second half of 2025. This is likely to enhance earnings by capturing market share in the expanding AI infrastructure sector.

- The aggressive investment in R&D and strategic acquisitions aim to strengthen Astera Labs' IP capabilities and address next-generation connectivity challenges, potentially improving net margins by solving complex connectivity challenges efficiently.

- The company's involvement in initiatives like UALink to develop advanced interconnect solutions for AI clusters is expected to open new revenue streams, likely impacting revenue positively as AI clusters grow in size and complexity.

- The ramp-up of Scorpio Smart Fabric switches anticipates broadening engagements for scale-up and scale-out applications, which are projected to become Astera Labs' largest product line, thereby significantly contributing to revenue and margin expansion.

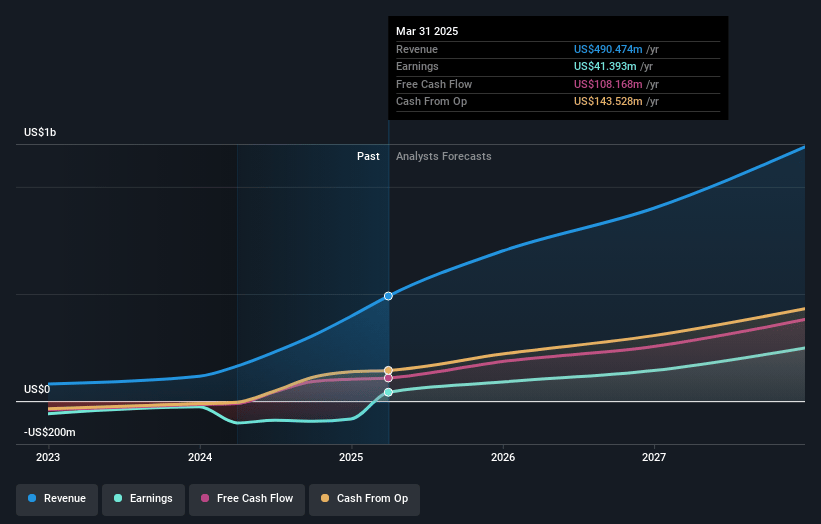

Astera Labs Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Astera Labs's revenue will grow by 44.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -21.1% today to 19.5% in 3 years time.

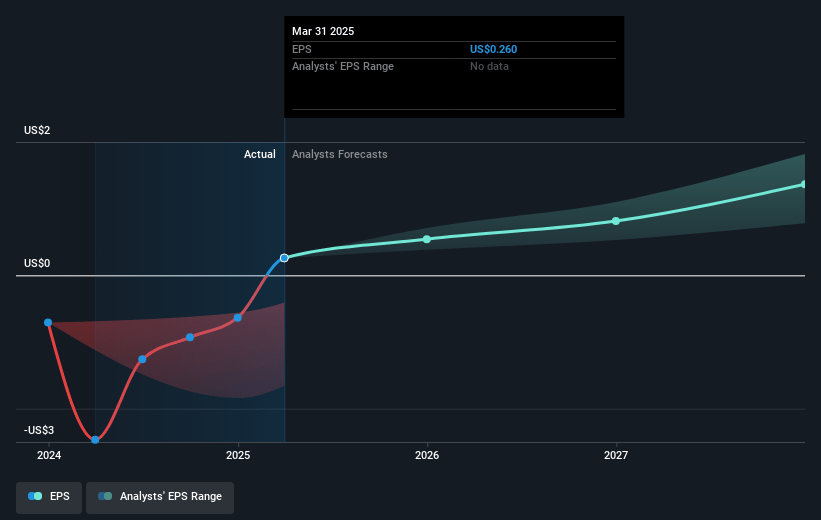

- Analysts expect earnings to reach $231.8 million (and earnings per share of $1.24) by about May 2028, up from $-83.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $316.7 million in earnings, and the most bearish expecting $164.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 113.0x on those 2028 earnings, up from -127.6x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.9x.

- Analysts expect the number of shares outstanding to grow by 4.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.8%, as per the Simply Wall St company report.

Astera Labs Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Astera Labs' significant reliance on a few large hyperscale customers could pose revenue concentration risks, potentially impacting revenue stability if these customers' demands fluctuate or if they favor competitors.

- The hardware module content, particularly from Aries and Taurus smart cable modules, affects gross margins, and reliance on these products could lead to variability or decline in gross margins as product mix shifts.

- While Astera Labs is investing aggressively in R&D, the ability to manage operating expenses efficiently is crucial; any mismatch between revenue growth and R&D spend could negatively impact net margins or profitability.

- The competitive landscape, particularly with established players in the PCIe and fabric switch market, presents risks to market share and could limit revenue growth if Astera's products do not differentiate sufficiently or face delayed adoption.

- Changes in technology, such as potential shifts to new standards like UALink or increased adoption of co-packaged optics for interconnect solutions, present risks if Astera is unable to adapt its offerings quickly enough to maintain its competitive position, possibly affecting future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $111.163 for Astera Labs based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $231.8 million, and it would be trading on a PE ratio of 113.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $65.65, the analyst price target of $111.16 is 40.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.