Last Update 07 Jul 25

Fair value Increased 68%New price target of $40.60 for 2030 for my mid case

If I go based off of the Book Value/share with a ROE of 18.7% it actually brings me a 5 year target of $195.60 based off of their current value of $4.17/share. However since a large part of their past earnings actually was a one time write off I ran it off of a current value of $0.87/share.

Bull Case: $195.60 (1,219.83% Increase)

Mid Case: $40.60 (173.95 % Increase)

Bear Case: $25.37 (71% Increase)

We will have a better estimate tomorrow as well with earnings for Q2 being tomorrow.

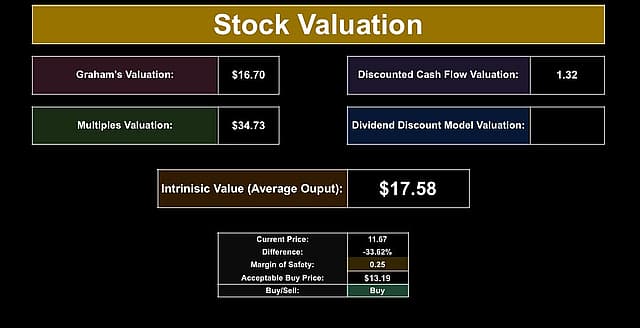

There are a couple of reasons that I like this stock, but I still need to look more into it, however I do currently own some shares. As of right now AEHR is in a good position with AI about to explode in the near future if they can make sure to best utilize their products so they can be most efficient in bringing in revenue. The demand is there, we just need to see if they can step up. Past that they have a good ROE and ROIC with both being above 22% and ROE almost hitting 30%. Their historical PE averages around 18 but for this model i left it at its current ratio for it to be a little more conservative. They have good profit margin with a ton of potential to grow, really it just comes down to now if they can step up to the plate. If they can I see them blowing past $20 in the next 3 years and honestly wouldn't be surprised if it eventually hit $100 just because of how big this market is and the high demand. For now I have my intrinsic value set to around $16 for the next year with my cap willing to pay as of right now, set to roughly $13. What I would need AEHR to hit to make me comfortable in 3 years would be roughly $20.16 with that being a rough 20% annual increase. As of right now I see them headed that way so I feel like it does seem like a solid investment, however it still does have a large amount of risk to it that could either take it to the moon or plumet really fast however since they are still not fully proven. I have confidence in this company however.

Willing to Pay: >= $13

Price: $11.67

TTM PE: 15.18 (10 Year Avg. 18.22)

ROE: 29.71%

Current Ratio: 931.18%

Gross Profit: 49.15%

Net Income: 50.07%

ROIC: 22.67%

Revenue/Share: $2.30

Net Income/Share: $1.15

Cash/Share: $1.71

Have other thoughts on Aehr Test Systems?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Zwfis has a position in NasdaqCM:AEHR. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.