Key Takeaways

- Growth in industrial automation, automotive sensing, and edge intelligence is driving long-term revenue streams and higher margins through innovative, high-density, low-power solutions.

- Strategic expansion into digital healthcare, AI infrastructure, and advanced manufacturing enhances market share, operational resilience, and profitability across multiple high-growth sectors.

- Heavy dependence on Asia, rising costs, stricter regulations, and intensifying competition threaten Analog Devices’ margins, supply chain stability, and long-term growth prospects.

Catalysts

About Analog Devices- Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

- Adoption of high-performance analog and mixed-signal solutions for industrial automation and edge intelligence is accelerating, as evidenced by ramping revenues from software-configurable I/O and connectivity products used across all major automation suppliers; this will drive durable, decade-long revenue streams and bolster net margins due to higher channel density and lower power consumption.

- The surge in electric vehicle and autonomous systems deployment is increasing the need for advanced automotive sensing, power management, and connectivity technologies, with Analog Devices nearly tripling revenue in its GMSL video connectivity portfolio and positioning for further record-setting growth in battery management systems and functionally safe power franchises—translating into higher automotive segment revenues and expanding share in high-margin applications.

- Expansion in digital healthcare and consumer wellness markets, supported by new design wins in high-precision sensors and signal chain solutions for remote monitoring and wearables, is expected to deliver double-digit growth and support outperformance in both top-line revenue and operating earnings as these high-reliability applications scale.

- Robust demand in AI-driven infrastructure and data centers is driving up content per system for signal chain and power management solutions, including the launch of 1.6 terabit optical controllers and vertical power systems for hyperscalers—factors that point to sustained revenue growth, increased average selling prices, and further improvement in gross margins as Analog Devices captures leadership in next-gen compute markets.

- Ongoing integration of advanced manufacturing capabilities, reinforced by supply chain localization and investments in U.S. and European fabs to achieve dual sourcing for 95% of products by 2026, will reduce risk, increase operational resilience, and secure long-term free cash flow generation and EPS growth by supporting stable supply to customers amid industry uncertainty.

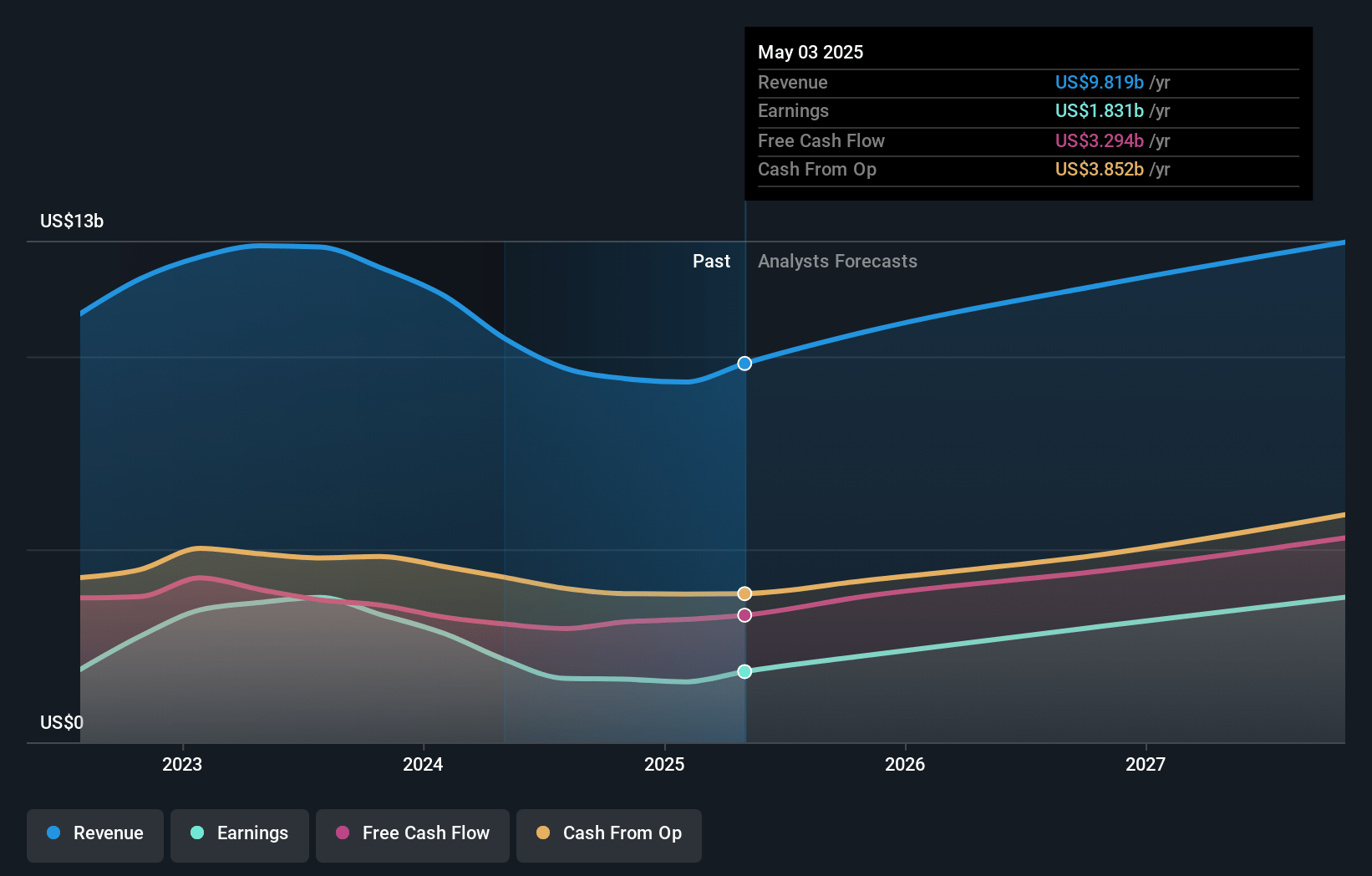

Analog Devices Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Analog Devices compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Analog Devices's revenue will grow by 15.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.7% today to 31.8% in 3 years time.

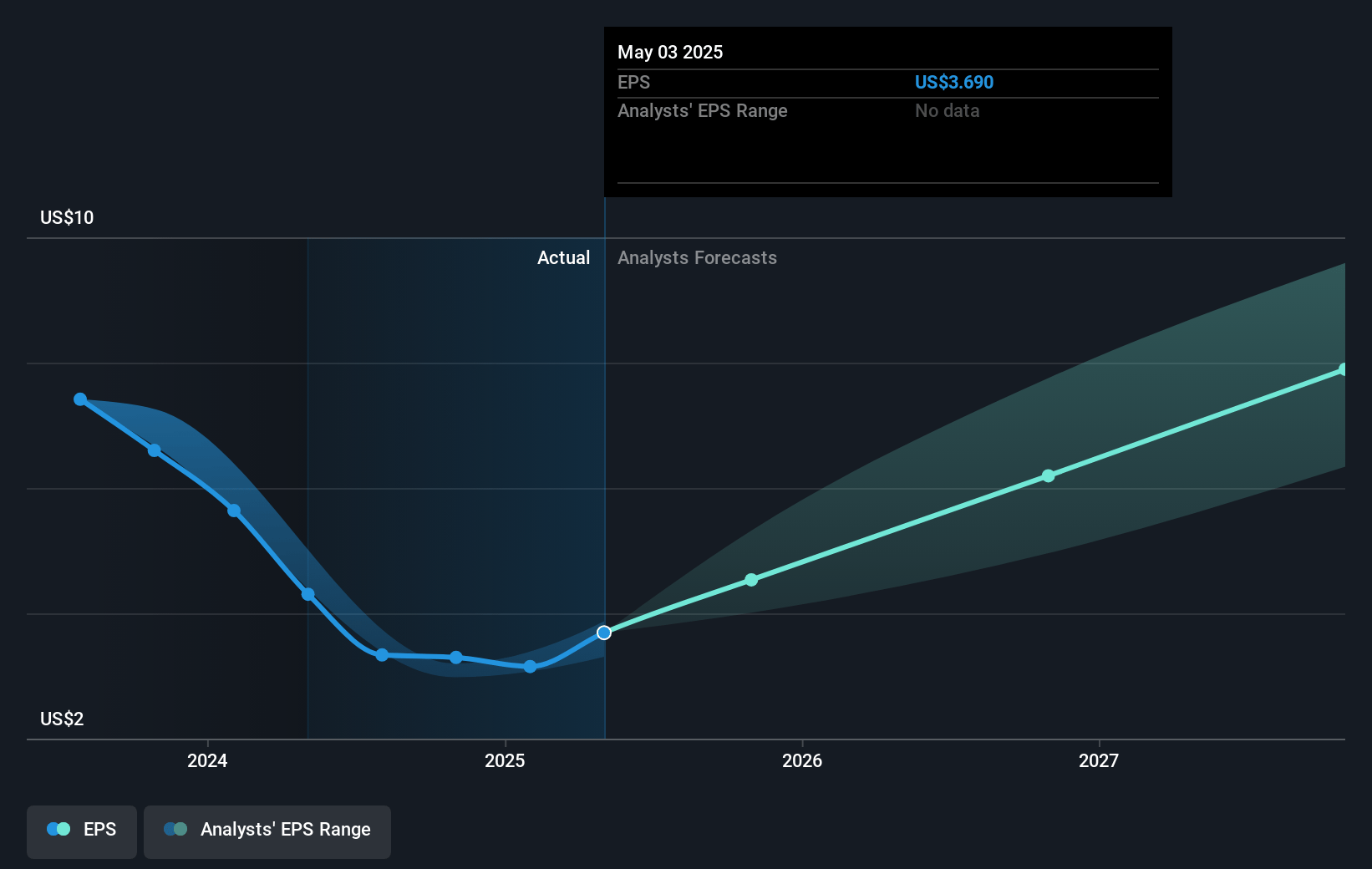

- The bullish analysts expect earnings to reach $4.5 billion (and earnings per share of $9.38) by about April 2028, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 42.7x on those 2028 earnings, down from 61.1x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.09%, as per the Simply Wall St company report.

Analog Devices Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Analog Devices’ reliance on China and Asia for both supply chain partnerships and a significant portion of automotive revenue exposes the company to risks from rising protectionism, potential tariffs, and US-China tech decoupling, which could negatively affect both future revenues and profit margins.

- The company’s ongoing investments to secure dual sourcing and onshore more manufacturing by 2026–2027 may drive higher capital expenditures and operating costs, threatening long-term margin expansion and limiting free cash flow.

- ADI’s approach to sustainability and regulatory compliance in its manufacturing footprint, especially as environmental standards become more stringent globally, may result in higher R&D and compliance expenses, adversely impacting operating margins.

- Rapid advancements in digital, AI-enabled, and software-centric solutions in the semiconductor industry could erode ADI’s competitive edge if the company fails to keep pace with rivals, leading to potential revenue stagnation from delayed project pipelines and loss of design wins.

- Increased competition and commoditization in analog and mixed-signal chip markets, combined with industry cycles leading to unpredictable swings in demand and inventory, could amplify revenue volatility and compress net margins, especially if market share is pressured by new entrants or existing competitors in Asia and globally.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Analog Devices is $300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Analog Devices's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $300.0, and the most bearish reporting a price target of just $170.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $14.2 billion, earnings will come to $4.5 billion, and it would be trading on a PE ratio of 42.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of $192.67, the bullish analyst price target of $300.0 is 35.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.