Last Update22 Aug 25Fair value Increased 40%

The sharp increase in ATRenew’s price target is primarily supported by a substantial drop in its future P/E ratio, indicating improved valuation despite a marginal decline in net profit margin, raising the fair value estimate from $5.00 to $7.00.

What's in the News

- ATRenew completed the repurchase of 12,061,224 shares (5.06% of shares outstanding) for $30.25 million under its buyback program announced March 2024.

- The company expects Q3 2025 revenues between RMB 5,050.0 million and RMB 5,150.0 million, up 24.7% to 27.1% year-over-year.

- ATRenew announced a new share repurchase program to buy back up to $50 million of its shares over 12 months, funded by existing cash balance.

- The Board of Directors authorized a new buyback plan.

Valuation Changes

Summary of Valuation Changes for ATRenew

- The Consensus Analyst Price Target has significantly risen from $5.00 to $7.00.

- The Future P/E for ATRenew has significantly fallen from 8.56x to 1.97x.

- The Net Profit Margin for ATRenew has fallen from 3.42% to 3.10%.

Key Takeaways

- Government policies and shifting consumer preferences are driving greater adoption of device recycling and recommerce, expanding ATRenew's addressable market and recurring revenue potential.

- Strategic partnerships, investments in refurbishment, and technology-driven efficiency are improving supply quality, strengthening margins, and enhancing long-term profitability.

- Heavy reliance on government support, high fixed costs, intensifying competition, thin margins, and rising regulatory burdens threaten ATRenew's profitability and long-term growth prospects.

Catalysts

About ATRenew- Operates pre-owned consumer electronics transactions and services platform in the People’s Republic of China.

- The continued integration of government-backed trade-in subsidies and eco-friendly consumption policies is accelerating consumer adoption of device recycling and recommerce in China, presenting a structural long-term tailwind for transaction volume and revenue growth.

- Rising consumer preference for sustainable consumption and the normalization of secondhand trading, particularly among younger demographics, are expanding ATRenew's addressable market and likely to drive sustained increases in user acquisition, boosting recurring revenues.

- Expansion of partnerships with leading electronics brands and e-commerce platforms (e.g., JD.com, Apple, Xiaomi) is increasing high-quality supply sources and sticky trade-in channels, contributing to improved inventory turnover and revenue growth, while supporting gross margin stability.

- Ongoing investment in refurbishment capacity and multi-category recycling, including for laptops and wearables, is enabling higher-margin value-added services to account for a growing share of revenue, supporting further gross margin expansion and ultimately improving net margins.

- The company's scale-driven efficiency improvements-enhanced by AI-enabled order dispatch, in-store and to-door fulfillment, and a rapidly growing nationwide store network-are expected to lower per-unit fulfillment and operational costs, expanding profitability and operating margins over time.

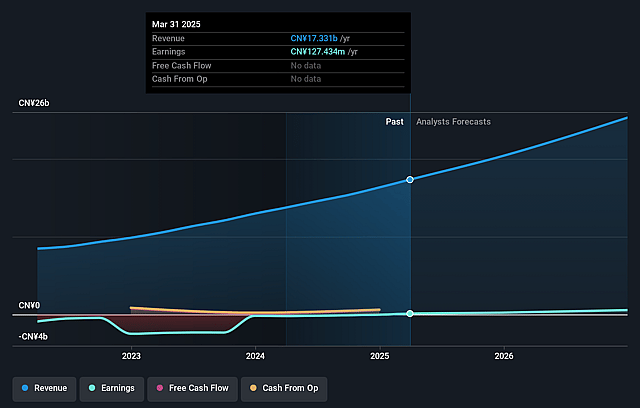

ATRenew Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ATRenew's revenue will grow by 24.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.1% today to 3.1% in 3 years time.

- Analysts expect earnings to reach CN¥1.1 billion (and earnings per share of CN¥8.4) by about September 2028, up from CN¥210.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, down from 35.4x today. This future PE is lower than the current PE for the US Specialty Retail industry at 19.2x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

ATRenew Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ATRenew's heavy dependence on Chinese government subsidies and national trade-in stimulus policies introduces long-term uncertainty; any reduction or withdrawal of these subsidies could materially reduce transaction volume and slow revenue growth.

- Rapid store expansion and significant investment in offline infrastructure expose the company to high fixed operating costs and overcapacity risks, particularly if digital-first or peer-to-peer competitors disrupt traditional retail channels, which could pressure margins and future profits.

- Competitive pressure from both multinational electronics brands moving toward direct-to-consumer trade-in programs and the proliferation of alternative recommerce marketplaces may compress take rates, erode pricing power, and negatively impact ATRenew's revenue and net earnings.

- Margins remain thin-operating profit margin is stuck around 2.4% despite scale-suggesting persistent margin pressure from high personnel, advertising, logistics, and technology expenses, which could limit future earnings growth and shareholder value if not addressed.

- Increasingly stringent data privacy, e-waste, and compliance regulations (both within China and for potential overseas expansion) may raise ongoing compliance costs and operational complexities, threatening long-term net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.0 for ATRenew based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥35.8 billion, earnings will come to CN¥1.1 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 8.9%.

- Given the current share price of $4.67, the analyst price target of $7.0 is 33.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.