Key Takeaways

- Expansion in logistics and automation boosts efficiency and margins, supporting revenue growth through international and domestic avenues.

- Strategic service diversification seeks to enhance customer engagement and increase revenue through expanded offerings.

- Currency fluctuations, high spending on acquisitions, and expansion initiatives may pressure Coupang's margins and earnings despite strategic growth investments.

Catalysts

About Coupang- Owns and operates retail business through its mobile applications and internet websites in South Korea and internationally.

- Coupang's potential for revenue growth is driven by the expansion of its fulfillment and logistics capabilities, including increased automation and AI, which can enhance efficiency, leading to margin expansion. (Impact: revenue, net margins)

- The company's strategic decision to launch and expand its Rocket Delivery and WOW membership program in Taiwan indicates promising international growth opportunities, contributing to revenue growth. (Impact: revenue)

- Farfetch's successful operational turnaround and ongoing restructuring aims to solidify its position in luxury commerce, promising future profitability and contributing to consolidated net earnings. (Impact: earnings)

- Continued investments in automation and AI technologies are expected to drive operational efficiency, reducing costs, and improving net margins over time. (Impact: net margins)

- Coupang's strategy to expand service offerings, such as same-day installation services and increased fresh assortment, aims to deepen customer engagement, increase wallet share, and drive revenue growth. (Impact: revenue)

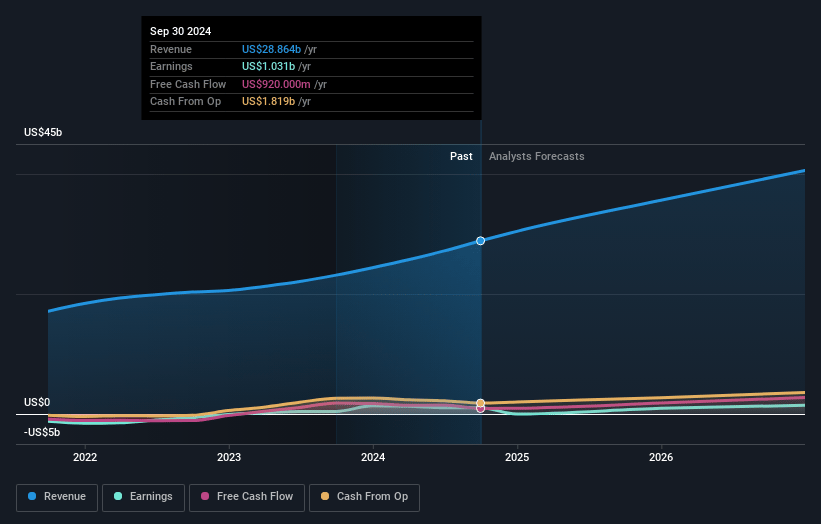

Coupang Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coupang's revenue will grow by 13.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.5% today to 4.5% in 3 years time.

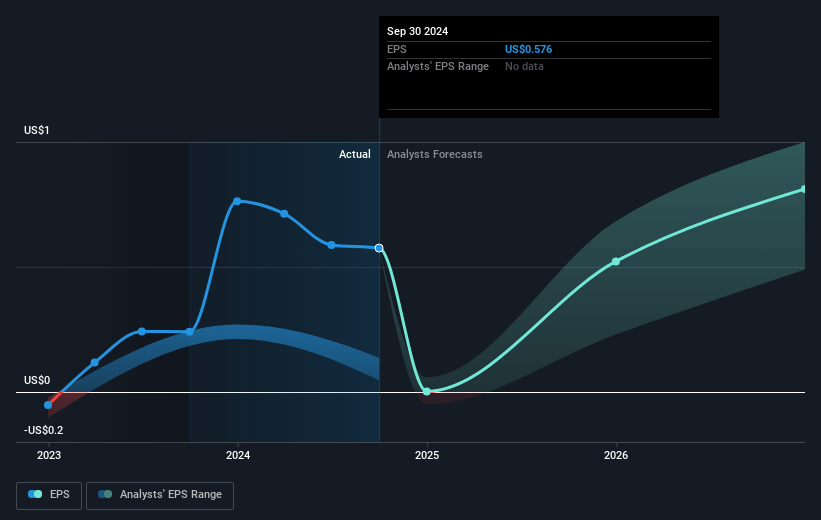

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $1.1) by about April 2028, up from $154.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.6 billion in earnings, and the most bearish expecting $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.5x on those 2028 earnings, down from 254.2x today. This future PE is greater than the current PE for the US Multiline Retail industry at 15.0x.

- Analysts expect the number of shares outstanding to grow by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.71%, as per the Simply Wall St company report.

Coupang Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The weakening of the Korean won against the U.S. dollar has negatively impacted revenues when reported in U.S. dollars, which could affect top-line growth and profitability in international financial statements.

- The acquisition and restructuring of Farfetch involve significant costs, pushing OG&A expenses higher, which could pressure net margins if the integration doesn't yield expected synergies or efficiencies.

- Increased technology and infrastructure expenses, particularly investments in AI and automation, while aimed at driving future growth and margin expansion, may strain current earnings if returns from these investments do not materialize as anticipated.

- The guidance for continued high effective tax rates, despite cash tax obligations being lower, could temporarily impair net income calculations and reported earnings performance.

- The developing offerings segment, particularly new initiatives like entry into the Japanese food delivery market, carries inherent risks of overinvestment without assurance of profitable business outcomes, potentially impacting overall earnings and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.788 for Coupang based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $44.4 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 34.5x, assuming you use a discount rate of 7.7%.

- Given the current share price of $21.68, the analyst price target of $29.79 is 27.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.