Key Takeaways

- Product line expansion and tech-driven personalization strategies target younger demographics, aiming for increased customer engagement and long-term revenue growth.

- International market focus, coupled with operational efficiencies, supports growth in net sales and maintains profitability amid ongoing investments.

- Bath & Body Works faces challenges with declining sales growth and economic uncertainty, while relying on collaborations and investments that carry execution risks.

Catalysts

About Bath & Body Works- Operates a specialty retailer of home fragrance, body care, and soaps and sanitizer products.

- Expansion of product lines, including Everyday Luxuries and new body care forms, is expected to attract a younger, diverse customer base and drive long-term revenue growth.

- International sales are poised for significant growth, especially in markets not affected by geopolitical unrest, contributing positively to future revenue and net sales.

- Continued growth in the loyalty program, with enhanced customer engagement and planned improvements, may increase customer retention and spending, thereby boosting earnings.

- The Fuel for Growth cost-saving initiative, having already exceeded targets, continues to enhance operational efficiencies and maintain margins despite new investments.

- Strategic investments in technology and marketing aim to improve customer experience and personalization, potentially increasing conversion rates and driving revenue growth.

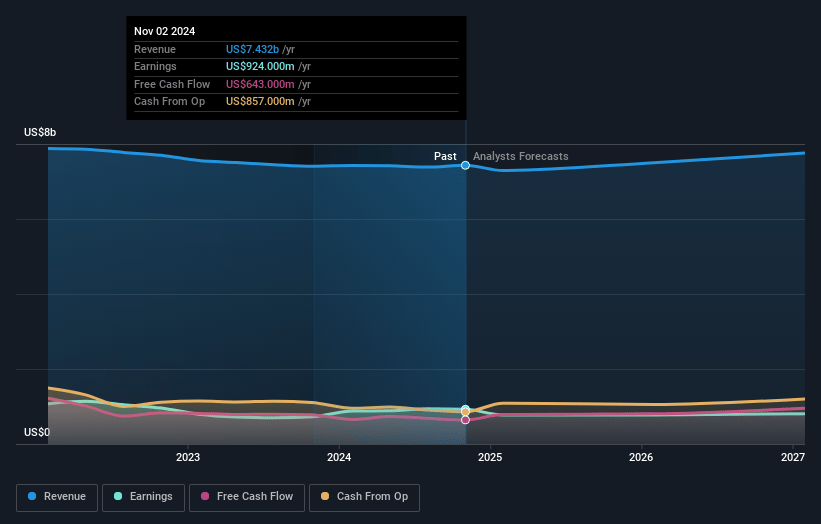

Bath & Body Works Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bath & Body Works's revenue will grow by 3.0% annually over the next 3 years.

- Analysts are assuming Bath & Body Works's profit margins will remain the same at 10.9% over the next 3 years.

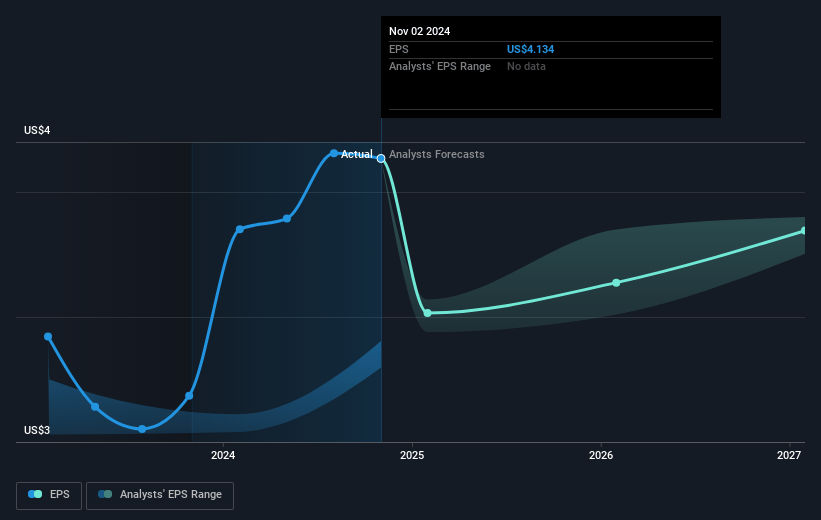

- Analysts expect earnings to reach $867.4 million (and earnings per share of $4.23) by about April 2028, up from $798.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from 8.3x today. This future PE is lower than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to decline by 4.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.27%, as per the Simply Wall St company report.

Bath & Body Works Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Although Bath & Body Works reported growth in certain areas, net sales in the fourth quarter decreased by 4% compared to the previous year, suggesting potential challenges in maintaining top-line growth momentum. This could impact revenue stability and growth projections adversely.

- The company is significantly focusing on growth via collaborations and new product lines, which involves execution risks. Any misalignment with consumer preferences or inability to sustain interest could affect revenue and margins negatively.

- Despite strategies to manage costs, new investments in technology and real estate are expected. If these investments don't yield expected returns, it could pressure net margins and earnings.

- Bath & Body Works' international segment, which represents a smaller portion of total sales, still relies heavily on geopolitical stability in certain regions. Continuing or escalating tensions could pose risks to international revenue streams and growth.

- The macroeconomic environment and consumer sentiment remain uncertain, and no assumptions of improvement were included in the guidance. If the economic conditions worsen, consumer spending may decrease, negatively affecting revenue and earnings expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $44.667 for Bath & Body Works based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.0 billion, earnings will come to $867.4 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 9.3%.

- Given the current share price of $30.83, the analyst price target of $44.67 is 31.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.