Key Takeaways

- Expanded omnichannel strategy and agile inventory management are increasing customer engagement and driving higher margins without proportional cost growth.

- Focus on brand repositioning, inclusivity, and sustainability is strengthening customer loyalty and enhancing pricing power for sustained profit improvements.

- Reliance on physical stores, intense competition, shifting demographics, and sustainability pressures create structural risks to Abercrombie & Fitch’s revenue growth and profit margins.

Catalysts

About Abercrombie & Fitch- Through its subsidiaries, operates as an omnichannel retailer in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

- Accelerated global expansion, particularly in key regions such as the UK, Germany, China, and the fast-growing India market, is set to drive long-term customer growth and elevate total company revenue as rising middle-class consumers in emerging markets seek aspirational brands.

- Omnichannel investment, including seamless integration of digital and physical experiences and targeted technology enhancements, will increase customer engagement and conversion rates, expanding sales without a proportional rise in operating costs, boosting both revenue per customer and operating margins.

- Adoption of a disciplined, agile inventory management model enables Abercrombie & Fitch to quickly respond to evolving trends and consumer demand, reducing markdowns and keeping margins elevated while supporting full-price sell-through, which directly benefits gross margin and net earnings.

- Strong performance in direct-to-consumer channels, with digital comprising nearly half of sales and highly productive store openings, positions the company to capture higher margins and customer lifetime value through improved data capture, brand control, and premiumized product offerings.

- The company’s authentic approach to inclusivity, brand repositioning, and sustainable sourcing has strengthened customer loyalty, improved pricing power, and driven double-digit average unit retail growth over multiple years, providing durable improvements to both revenue and net income.

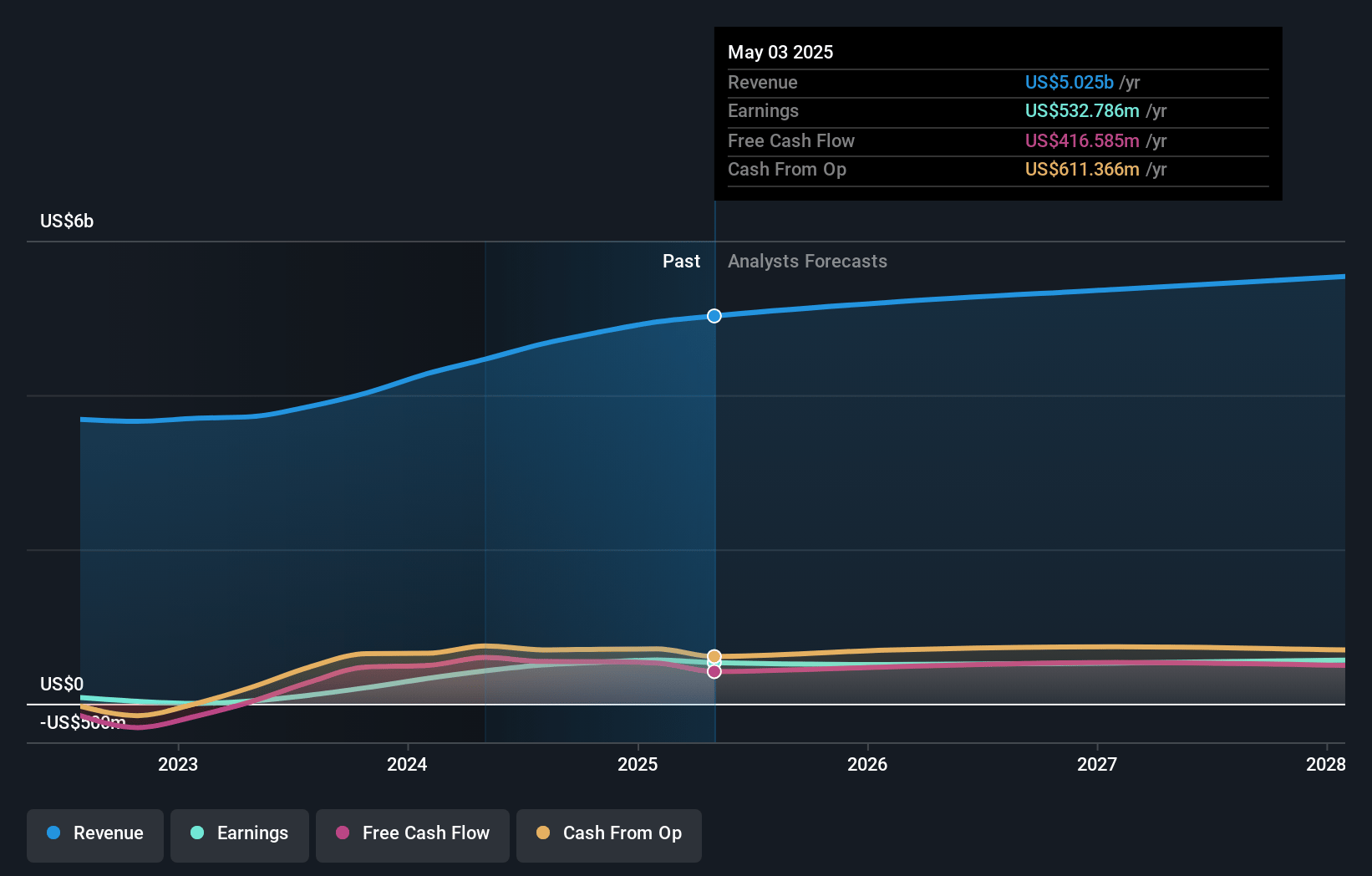

Abercrombie & Fitch Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Abercrombie & Fitch compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Abercrombie & Fitch's revenue will grow by 3.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 11.4% today to 9.2% in 3 years time.

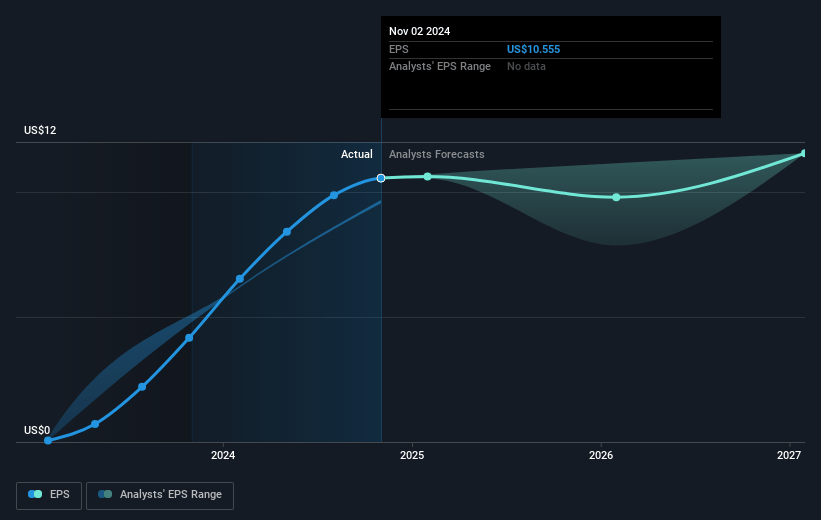

- The bullish analysts expect earnings to reach $502.9 million (and earnings per share of $11.25) by about April 2028, down from $566.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, up from 6.3x today. This future PE is greater than the current PE for the US Specialty Retail industry at 14.4x.

- Analysts expect the number of shares outstanding to decline by 4.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

Abercrombie & Fitch Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing decline in mall foot traffic and the proliferation of e-commerce marketplaces is a structural headwind, as Abercrombie & Fitch continues to maintain a large physical retail footprint, which may lead to declining store revenues and pressure on operating margins over time.

- Increased competition from digitally native, direct-to-consumer brands and global fast fashion companies like Shein, Zara, and H&M could erode Abercrombie & Fitch’s pricing power and force higher promotional activity, negatively affecting revenue growth and compressing net margins.

- Long-term demographic shifts, including a shrinking teenage population in developed markets and increasingly diverse apparel tastes among Gen Z and Gen Alpha, threaten the stability of Abercrombie & Fitch’s core customer base and pose risks to sustaining or growing revenues.

- The cost and complexity of adapting to consumer demand for sustainable and circular fashion may require significant investment in supply chain overhaul; if Abercrombie & Fitch is slow to respond, this puts them at risk of margin compression and reputational damage that could harm future earnings.

- Efforts to revitalize and reposition the brand carry execution risk that could alienate legacy customers while failing to fully resonate with younger cohorts, leading to inconsistent revenue trends and potential long-term brand dilution that limits operating profit expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Abercrombie & Fitch is $171.2, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Abercrombie & Fitch's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $171.2, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.5 billion, earnings will come to $502.9 million, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of $72.98, the bullish analyst price target of $171.2 is 57.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:ANF. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.