Key Takeaways

- Expansion of dd's DISCOUNTS and strategic improvements in store and marketing could drive revenue and enhance customer experience.

- Enhanced supply chain investments and shareholder returns through buybacks and dividends are key to improving EPS growth.

- Vulnerability to macroeconomic, geopolitical, and seasonal factors, combined with pressures on profit margins, poses risks to revenue growth and future earnings stability.

Catalysts

About Ross Stores- Operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd’s DISCOUNTS brand names in the United States.

- The planned expansion of dd's DISCOUNTS and the rebuilding of the store pipeline in newer markets is expected to drive future revenue growth as these segments have shown strong sales performance recently.

- The anticipation of more opportunities for closeout merchandise, due to the volatile external environment, could enhance merchandise margins as Ross Stores capitalizes on better buying opportunities.

- The focus on enhancing store environment and developing marketing strategies may help improve customer experience and drive higher traffic, which could positively impact revenue and net margins.

- The increased investment in supply chain and merchant processes, including a new distribution facility, is expected to support long-term growth and improve efficiency, potentially positively impacting net margins.

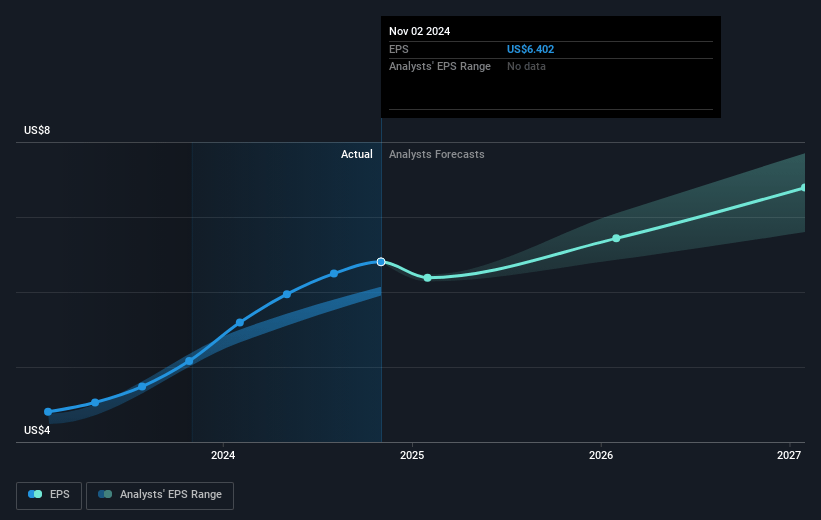

- The ongoing share buyback program and increased dividend reflect a commitment to returning value to shareholders, which can support earnings per share (EPS) growth even in a challenging macroeconomic environment.

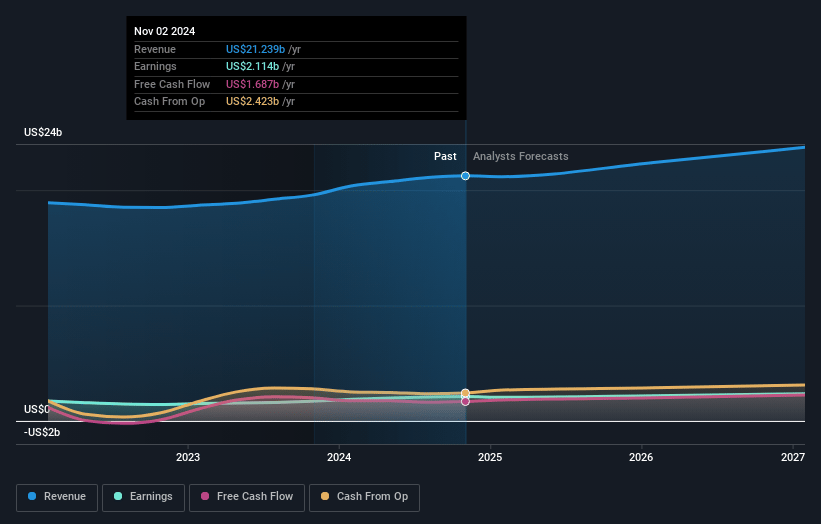

Ross Stores Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ross Stores's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.9% today to 10.0% in 3 years time.

- Analysts expect earnings to reach $2.4 billion (and earnings per share of $7.82) by about April 2028, up from $2.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $2.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 20.4x today. This future PE is greater than the current PE for the US Specialty Retail industry at 16.2x.

- Analysts expect the number of shares outstanding to decline by 2.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.77%, as per the Simply Wall St company report.

Ross Stores Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in fourth-quarter earnings per share ($1.79 from $1.82) and net income ($587 million from $610 million) despite high sales performance highlights potential risks in maintaining profit margins, which could impact future earnings.

- The company's fiscal 2025 guidance indicates cautious expectations with projected same-store sales to be down 1% to up 2%, reflecting uncertainties including macroeconomic volatility that may pressure revenue and profit growth.

- Planned declines in merchandise margins and unfavorable timing of packaway-related costs suggest pressure on profit margins, potentially impacting net earnings if these issues persist without offsetting gains.

- Increased inventory levels, driven primarily by higher planned packaway levels, may suggest potential for sales markdowns if the expected demand does not materialize, affecting revenue and operating margins.

- External factors such as consumer confidence impacts, geopolitical issues, and unseasonable weather are cited as potential risks to traffic and sales, highlighting the vulnerability of revenue and profitability to broader market conditions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $156.378 for Ross Stores based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $188.0, and the most bearish reporting a price target of just $127.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $24.5 billion, earnings will come to $2.4 billion, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 7.8%.

- Given the current share price of $129.11, the analyst price target of $156.38 is 17.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.