Narratives are currently in beta

Key Takeaways

- Monro leverages manufacturer-funded promotions and service enhancements to boost revenue growth in value-focused tire and service categories.

- Productivity improvements and strategic capital allocations enhance margins and shareholder returns, supported by Monro's strong financial position.

- Shifts in consumer behavior, decreased customer traffic, and higher interest expenses pressure Monro's margins, revenue, and profitability, necessitating strategic adjustments to mitigate risks.

Catalysts

About Monro- Engages in the operation of retail tire and automotive repair stores in the United States.

- Monro is capitalizing on market dynamics by leveraging manufacturer-funded promotions to meet the needs of value-oriented consumers, aiming to enhance revenue growth through improved tire and service category sales.

- The company is implementing productivity improvements and labor optimization, which are expected to enhance net margins through increased efficiency in operations and attachment selling initiatives.

- Monro's strategic focus on key service categories, such as oil changes and brakes, along with the implementation of the ConfiDrive Digital Courtesy Inspection process, is poised to drive revenue growth by increasing store traffic and sales.

- The continuation of more balanced sales in tire categories, despite consumer trade-down dynamics, may stabilize revenue, while efforts to restore gross margins to pre-COVID levels aim to bolster earnings.

- Monro’s strong financial position, characterized by solid cash flow and a low net bank debt-to-EBITDA ratio, positions it to prioritize capital allocations effectively, including dividends, which could positively impact shareholder returns and EPS.

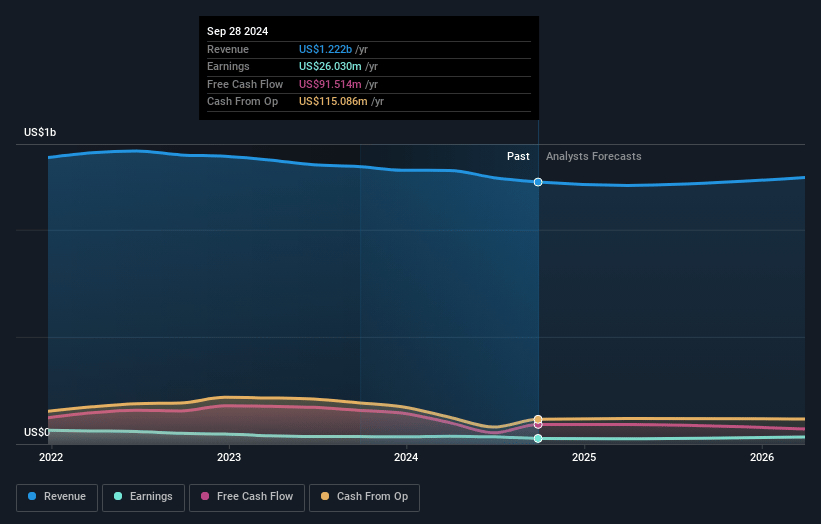

Monro Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Monro's revenue will decrease by -0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 3.4% in 3 years time.

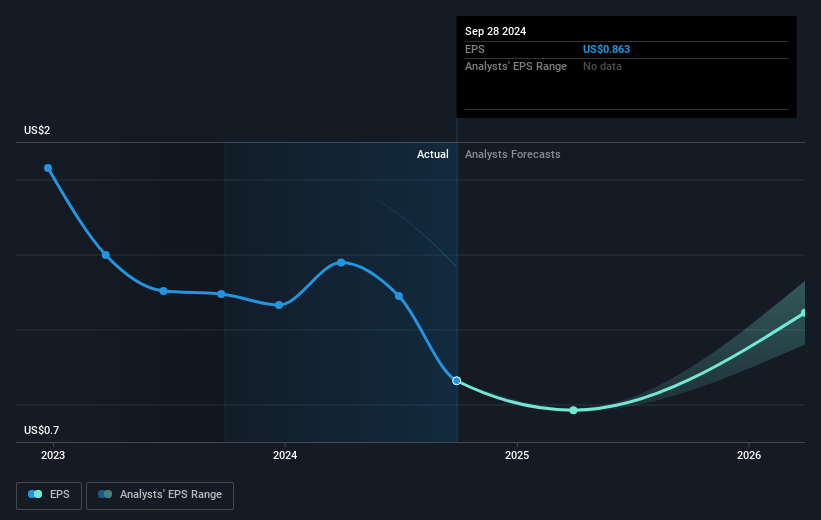

- Analysts expect earnings to reach $41.6 million (and earnings per share of $1.31) by about October 2027, up from $33.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2027 earnings, up from 24.1x today. This future PE is greater than the current PE for the US Specialty Retail industry at 14.5x.

- Analysts expect the number of shares outstanding to grow by 2.15% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 8.35%, as per the Simply Wall St company report.

Monro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift in consumer purchasing behavior towards Tier 3 and Tier 4 tires could negatively impact Monro's material margins, thereby pressuring gross margins. This trend could lead to a decline in earnings if higher-margin product sales do not improve.

- A significant decline in customer traffic, with a reported decrease of approximately 9%, could affect Monro’s overall revenue and profitability if this trend is not reversed.

- Increased interest expenses due to a higher weighted average interest rate and substantial financing lease obligations may lead to reduced net income and earnings.

- Year-over-year sales decreased by 6.4%, primarily driven by a 5.8% decline in comparable store sales, which may continue to pressure revenue and earnings if underlying issues are not addressed.

- Operating expenses as a percentage of sales increased due to lower year-over-year comparable store sales and increased advertising spend, potentially limiting net margins if sales do not improve significantly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.33 for Monro based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.2 billion, earnings will come to $41.6 million, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $26.79, the analyst's price target of $29.33 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives