Key Takeaways

- Strategic partnerships and e-commerce improvements are expected to strengthen Kirkland’s financial position and support future revenue and margin growth.

- Reengaging core customers and optimizing product offerings are key strategies anticipated to enhance revenue and operational efficiency.

- Kirkland's faces revenue challenges from declining e-commerce sales, reduced store count, and higher interest expenses, threatening margins and profitability amid a challenging promotional landscape.

Catalysts

About Kirkland's- Operates as a specialty retailer of home décor and furnishings in the United States.

- Strategic partnership with Beyond is expected to provide capital to retire expensive debt and improve Kirkland's balance sheet, supporting new growth opportunities and positioning for future revenue growth and margin improvement.

- Reengaging the core customer base has resulted in a 39% reactivation of lapsed customers and increased customer loyalty, which should drive future revenue growth through higher transaction volumes.

- The refocused product assortment, emphasizing frequently updated, faster-turning items with value price points, is anticipated to enhance revenue growth and improve inventory turns, positively impacting gross margins.

- Leveraging Beyond's e-commerce expertise to improve Kirkland's online platform can enhance e-commerce performance, potentially increasing revenue and providing more efficient operations to improve net margins.

- Planned opening of new Bed Bath & Beyond neighborhood stores in 2025, anticipated to generate at least twice the revenue of current Kirkland’s Home stores, is expected to drive significant revenue growth and increase overall earnings.

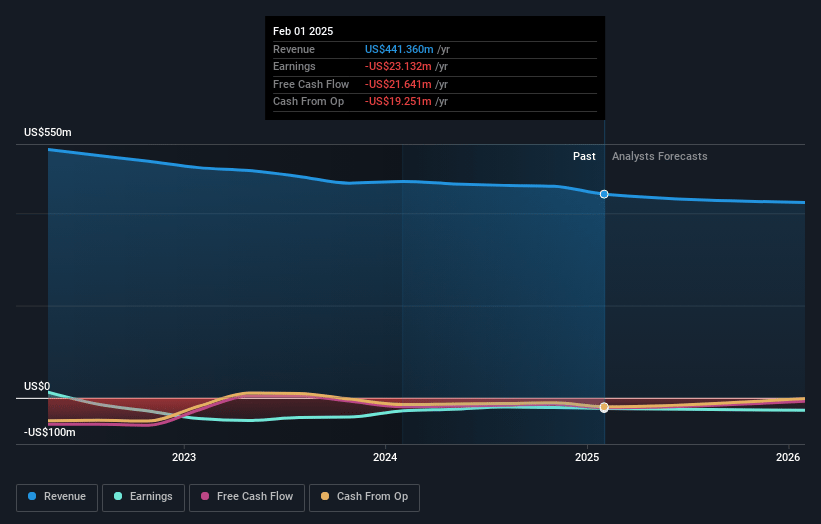

Kirkland's Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kirkland's's revenue will decrease by 2.1% annually over the next 3 years.

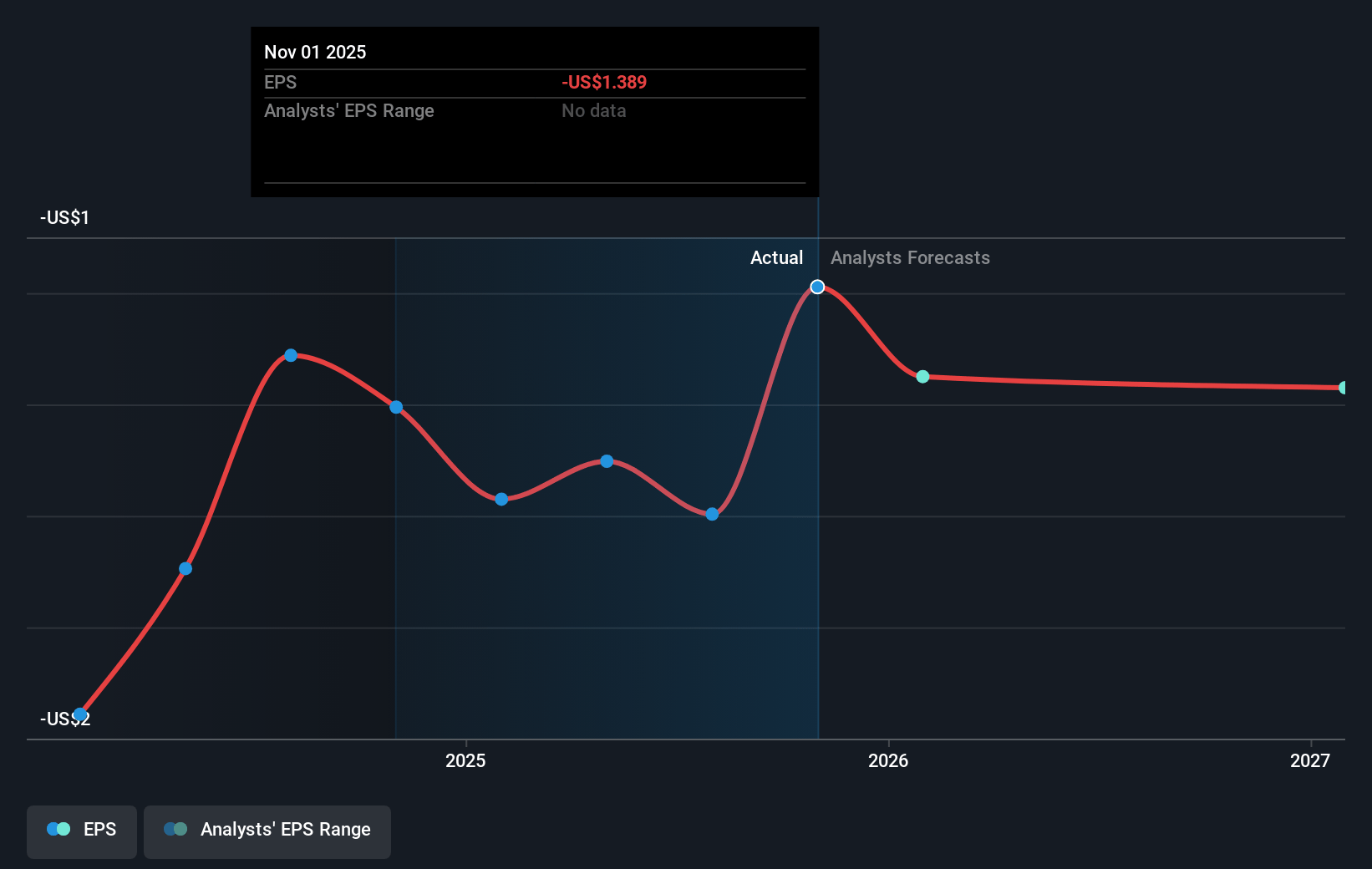

- Analysts are not forecasting that Kirkland's will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Kirkland's's profit margin will increase from -4.6% to the average US Specialty Retail industry of 4.4% in 3 years.

- If Kirkland's's profit margin were to converge on the industry average, you could expect earnings to reach $18.9 million (and earnings per share of $1.46) by about May 2028, up from $-20.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.9x on those 2028 earnings, up from -0.9x today. This future PE is lower than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Kirkland's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kirkland's faces challenges in its e-commerce channel, with a 14.9% decline in sales and an overall decrease in e-commerce conversion, impacting its revenue potential and digital market competitiveness.

- The company reported net sales of $114.4 million, which is lower than the previous year's $116.4 million, partly due to a 4% decline in store count and a decrease in comparable sales, which could impact overall revenue growth.

- Despite some positive store performance, the overall comparable sales declined by 3%, driven by declines in the consolidated average ticket and a challenged promotional environment, which places pressure on net margins and earnings.

- The company anticipates a promotional environment to continue as a factor in the fourth quarter, potentially further impacting merchandise margins and profitability, putting strain on net margins and earnings.

- Interest expenses increased to $1.7 million due to higher borrowing levels and interest rates, adding financial pressure that could affect Kirkland’s net margins and ability to find cost efficiencies in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.0 for Kirkland's based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $429.9 million, earnings will come to $18.9 million, and it would be trading on a PE ratio of 1.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of $1.37, the analyst price target of $2.0 is 31.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.