Key Takeaways

- Strategic partnerships with OEMs and autonomous vehicle firms position EVgo to capitalize on high-value market segments, boosting revenue and utilization rates.

- Cost efficiency measures targeting infrastructure expansion and new technology integrations are set to reduce capital expenditure, improving net margins and earnings.

- EVgo's growth and profitability face risks from reliance on federal incentives, competition, and potential delays in expansion funding, impacting margins and revenue.

Catalysts

About EVgo- Owns and operates a direct current fast charging network for electric vehicles in the United States.

- The closure of a $1.25 billion loan guarantee with the Department of Energy ensures EVgo is fully funded to more than triple its installed base over the next five years across the United States, which is likely to drive substantial revenue growth as capacity expands.

- EVgo's focus on increasing charging infrastructure, particularly in partnership with leading autonomous vehicle firms and rideshare companies, is poised to drive utilization rates and operational scale, thereby potentially improving net margins.

- The expansion of dedicated stalls for autonomous vehicles and partnerships with major OEMs, such as GM and Meijer, signify a strategic capture of high-value market segments which could enhance revenue reliability and earnings from diversified user bases.

- The introduction of standardized NACS connectors, allowing EVgo to attract Tesla drivers, offers a substantial opportunity to increase network throughput and attract a wider range of electric vehicle users, which should positively impact revenue.

- Cost efficiency measures, such as a joint development agreement with Delta Electronics for next-gen charging architecture, aim to reduce gross CapEx per store by 30%. This reduction in capital expenditure could improve net margins and reduce capital constraints, enhancing overall earnings.

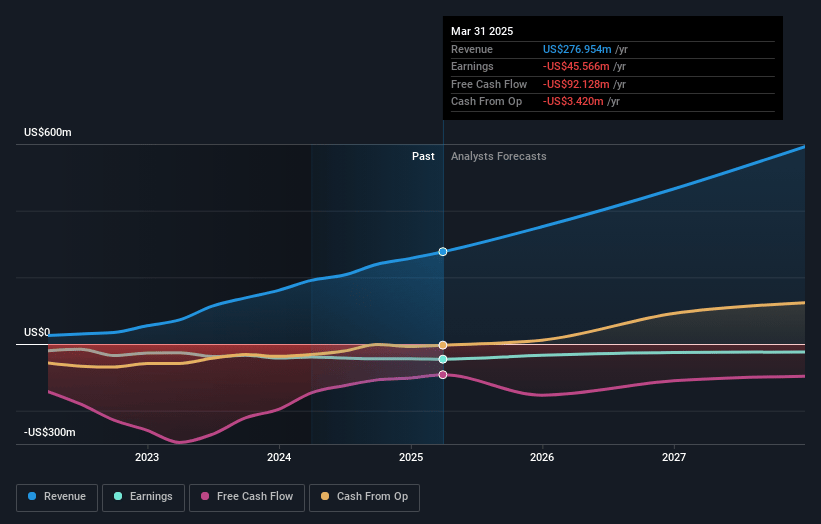

EVgo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EVgo's revenue will grow by 32.1% annually over the next 3 years.

- Analysts are not forecasting that EVgo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate EVgo's profit margin will increase from -17.1% to the average US Specialty Retail industry of 4.4% in 3 years.

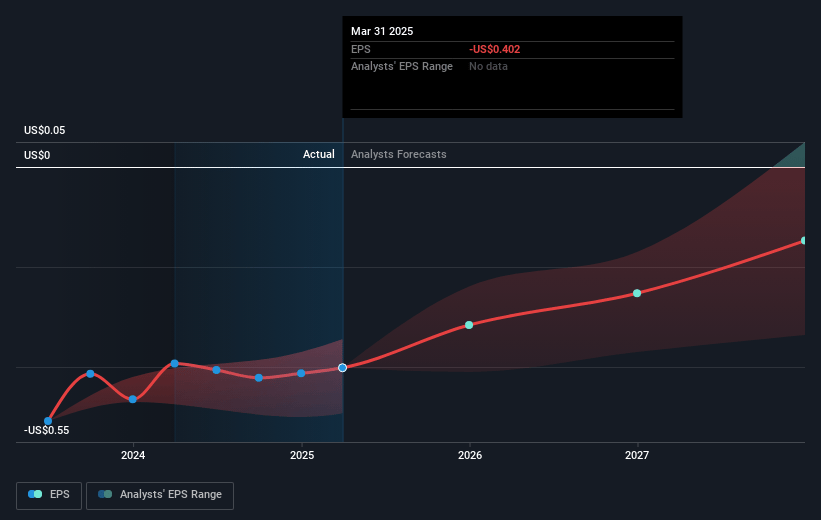

- If EVgo's profit margin were to converge on the industry average, you could expect earnings to reach $26.1 million (and earnings per share of $0.07) by about May 2028, up from $-44.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 111.5x on those 2028 earnings, up from -8.6x today. This future PE is greater than the current PE for the US Specialty Retail industry at 15.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.66%, as per the Simply Wall St company report.

EVgo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EVgo's reliance on federal incentives, such as the 30C alternative fuels credit and NEVI, represents a vulnerability. If these incentives were reduced or eliminated, they could impact EVgo's ability to offset CapEx, potentially affecting net margins and cash flows.

- The growth in dedicated stalls for AV partners has been separated from the public revenue stream, suggesting potential dilution of focus and resources. If not managed efficiently, this could impact core public charging revenue and overall earnings.

- Despite record utilization, EVgo faces the risk of declining U.S. EV sales or a slowdown in new charger development, which could alter future revenue projections and stall network growth, potentially impacting revenue and profitability.

- EVgo's planned expansion and capital deployment might be negatively influenced if the DOE loan is delayed or withdrawn, pressuring CapEx budgeting and potentially creating a cash flow shortfall.

- Increasing competition from other charging networks, like IONNA's national expansion plans, may pressure EVgo’s market share and utilization rates. This could impact EVgo's ability to maintain its revenue growth trajectory and achieve desired margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.208 for EVgo based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $592.2 million, earnings will come to $26.1 million, and it would be trading on a PE ratio of 111.5x, assuming you use a discount rate of 7.7%.

- Given the current share price of $2.83, the analyst price target of $6.21 is 54.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.