Key Takeaways

- Product personalization, advanced technology, and engaged sellers reinforce Etsy’s competitive edge and support ongoing revenue growth and customer retention.

- Global expansion, effective marketing, and alignment with marketplace trends position Etsy to benefit from e-commerce and creator economy tailwinds.

- Increasing competition, commoditization, high marketing costs, seller dissatisfaction, and limited international reach threaten Etsy's growth, differentiation, and long-term profitability.

Catalysts

About Etsy- Operates two-sided online marketplaces that connect buyers and sellers worldwide.

- Etsy’s strong alignment with consumer demand for unique and personalized goods, including major improvements to the personalization experience and targeted marketing for events like gifting occasions, is expected to increase both transaction volumes and customer loyalty, supporting future revenue growth and higher repeat purchase rates.

- Enhancements in artificial intelligence, machine learning, and new app experiences are likely to make product discovery more immersive and relevant, which should drive higher conversion rates, boost gross merchandise sales growth, and expand Etsy’s marketplace revenue over time.

- The transition to a more robust, engaged, and healthy seller base, driven by deliberate onboarding policies and support tools, ensures continued inventory differentiation and supply diversity, which reinforces Etsy’s competitive moat and leads to more resilient long-term earnings.

- International expansion and localization efforts, as well as better use of high-growth marketing channels like connected TV and paid social, position Etsy to capture a larger share of the global e-commerce market, directly impacting top-line growth and enabling further geographic revenue diversification.

- Secular shifts toward the gig and creator economies, coupled with a growing emphasis on sustainable and ethically sourced goods, play into Etsy’s strengths as a marketplace for small businesses and artisans—trends that are likely to expand Etsy’s total addressable market and provide ongoing tailwinds to gross merchandise sales and long-term EBITDA margin improvement.

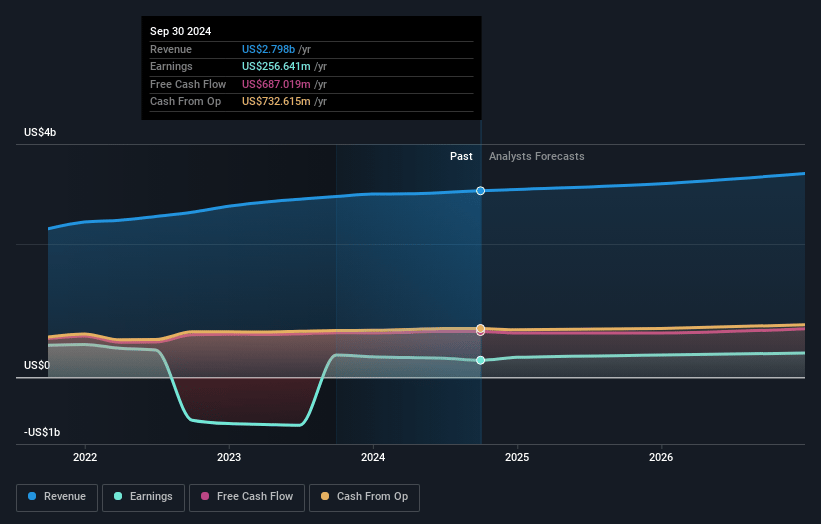

Etsy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Etsy compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Etsy's revenue will grow by 8.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.8% today to 17.3% in 3 years time.

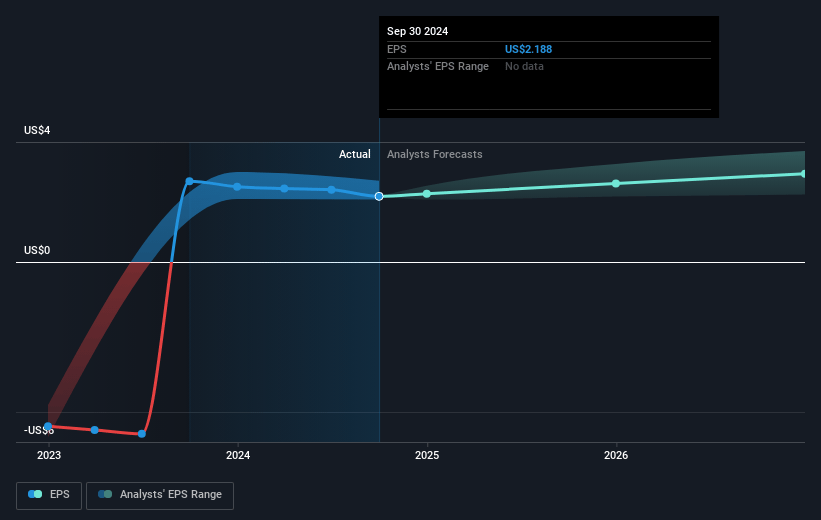

- The bullish analysts expect earnings to reach $619.8 million (and earnings per share of $5.58) by about April 2028, up from $303.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.3x on those 2028 earnings, down from 16.2x today. This future PE is greater than the current PE for the US Multiline Retail industry at 15.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

Etsy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift toward AI-driven mass customization and automation threatens the unique value proposition of handmade goods, potentially eroding Etsy’s differentiation and putting long-term pressure on Gross Merchandise Sales, which may limit revenue growth.

- Saturation and commoditization in Etsy’s core product categories such as jewelry and home décor, coupled with increasing competition from marketplaces like Amazon and Walmart that are investing in similar offerings, could hamper Etsy’s ability to sustain meaningful growth in GMS and compress margins.

- Persistently rising costs of digital advertising and customer acquisition across all platforms challenge Etsy’s ROI on marketing spend, with the company already spending over 30 percent of revenue on marketing in 2024; any further increases or deterioration in efficiency could pressure net margins and reduce profitability.

- Ongoing declines in the active seller count, ongoing seller dissatisfaction related to fee increases, and changes in marketplace rules risk driving top creators away, which could decrease the breadth and quality of inventory, dampening GMS and negatively affecting overall revenues.

- Limited international penetration, with roughly three-quarters of GMS coming from US buyers and underperformance in non-US markets, means Etsy’s addressable market growth is constrained; this restriction dampens the company’s long-term potential to significantly grow earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Etsy is $85.66, which represents two standard deviations above the consensus price target of $54.77. This valuation is based on what can be assumed as the expectations of Etsy's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.45, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $619.8 million, and it would be trading on a PE ratio of 15.3x, assuming you use a discount rate of 8.8%.

- Given the current share price of $45.79, the bullish analyst price target of $85.66 is 46.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:ETSY. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.