Key Takeaways

- Direct-to-factory sourcing and fulfillment center improvements are set to reduce costs and enhance margins through logistics and product innovation.

- Mobile-first strategy and retail portfolio optimization aim to boost revenue by increasing sales through mobile channels and strategic store locations.

- Operational challenges, declining retail sales, and leadership changes may pressure Duluth Holdings' growth, profitability, and financial flexibility.

Catalysts

About Duluth Holdings- Sells casual wear, workwear, outdoor apparel, and accessories for men and women under the Duluth Trading brand in the United States.

- The shift to direct-to-factory sourcing is expected to reduce product costs and allow Duluth to introduce innovative products more frequently, which can enhance both revenue and net margins.

- The development and optimization of the Adairsville fulfillment center, which processes 60% of total volume at a lower cost, will improve logistic efficiencies, potentially increasing net margins through reduced operational costs.

- The mobile-first digital strategy and growth in mobile sales, where conversion rates are above industry averages, are likely to drive revenue by capturing more sales through the preferred shopping channel of customers.

- The comprehensive revitalization and strategic evaluation of their retail store portfolio, including closing underperforming stores and opening new ones in priority markets, is designed to improve revenue and operational efficiency.

- Enhanced inventory management strategies, including resetting the depth and frequency of promotions and improving operational execution, are poised to increase gross margins and consequently improve earnings through higher full-price sales and better inventory turns.

Duluth Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Duluth Holdings's revenue will decrease by 4.8% annually over the next 3 years.

- Analysts are not forecasting that Duluth Holdings will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Duluth Holdings's profit margin will increase from -7.0% to the average US Specialty Retail industry of 4.4% in 3 years.

- If Duluth Holdings's profit margin were to converge on the industry average, you could expect earnings to reach $23.9 million (and earnings per share of $0.68) by about April 2028, up from $-43.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.1x on those 2028 earnings, up from -1.4x today. This future PE is lower than the current PE for the US Specialty Retail industry at 13.9x.

- Analysts expect the number of shares outstanding to grow by 0.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

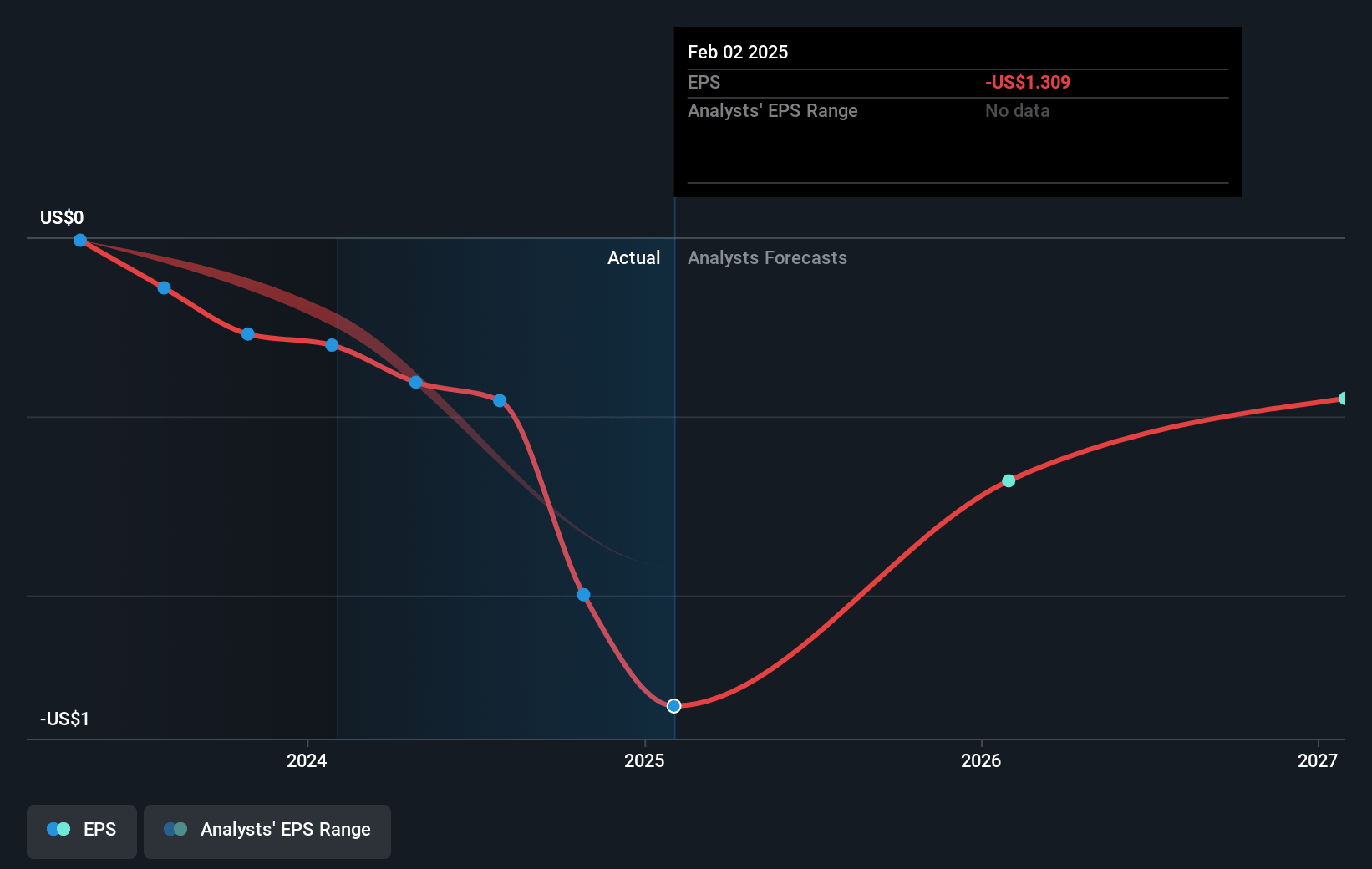

Duluth Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Processing delays at Duluth Holdings' legacy Belleville fulfillment center led to order backlogs and constrained top-line growth during the fourth quarter, impacting net sales.

- The company experienced a decline in retail store sales by 6.9%, driven by decreased foot traffic, which may continue to pressure revenues if physical store performance doesn't improve.

- The adjustment to promotional strategies after Cyber Monday led to reduced average unit retail prices, impacting gross margins and ultimately affecting profitability.

- Inventory increased by 32% year-over-year, including excess seasonal inventory, which suggests potential challenges in inventory management and capital tied up, affecting working capital and financial flexibility.

- The CEO’s announced retirement and transition may introduce leadership uncertainty, potentially affecting strategic continuity and execution risks, which could impact future earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $2.0 for Duluth Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $541.5 million, earnings will come to $23.9 million, and it would be trading on a PE ratio of 4.1x, assuming you use a discount rate of 11.4%.

- Given the current share price of $1.7, the analyst price target of $2.0 is 15.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.