Key Takeaways

- Rescheduling cannabis to Schedule III could enhance tenant profitability and boost NewLake's rental income significantly.

- Potential stock uplisting and strategic M&A activities may increase liquidity, attracting investors and improving shareholder returns.

- Regulatory uncertainty, market dynamics, and tenant challenges could hinder revenue growth and impact NewLake's profitability and shareholder value.

Catalysts

About NewLake Capital Partners- An internally-managed real estate investment trust that provides real estate capital to state-licensed cannabis operators through sale-leaseback transactions and third-party purchases and funding for build-to-suit projects.

- The rescheduling of cannabis from Schedule I to Schedule III by the DEA could lead to significant tax savings for tenants, amounting to over $500 million, potentially increasing tenant profitability and positively impacting rental income for NewLake.

- Strong support for medical cannabis across the U.S. and legislative changes at state levels may lead to increased demand for NewLake's properties, potentially driving future rental revenue growth.

- The completion of construction projects and further disbursements for building improvements are likely to enhance property value and result in higher rental income and asset appreciation.

- The potential uplisting of NewLake’s stock on exchanges like TSX may enhance stock liquidity and attract more investors, possibly leading to an increased stock price and better capital access for future expansion.

- Strategic focus on sale-leaseback transactions during upcoming industry M&A activities may provide additional revenue streams and capital for growth, impacting earnings and shareholder returns positively.

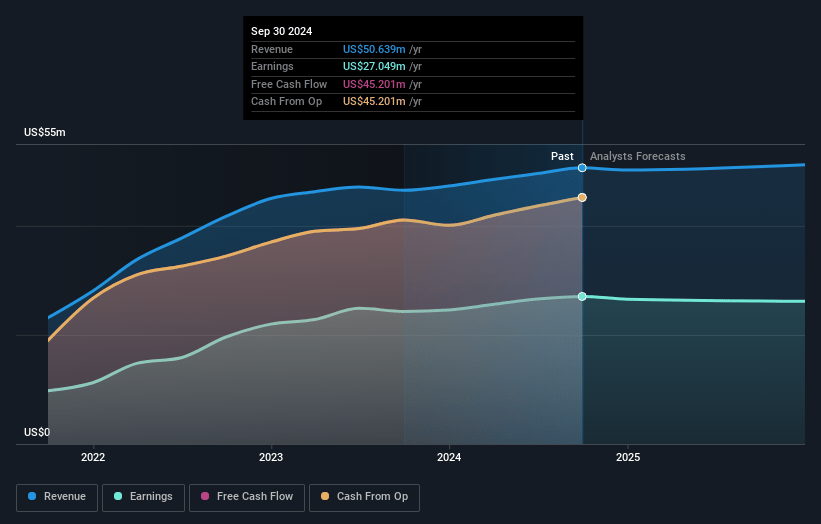

NewLake Capital Partners Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NewLake Capital Partners's revenue will decrease by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 53.4% today to 48.1% in 3 years time.

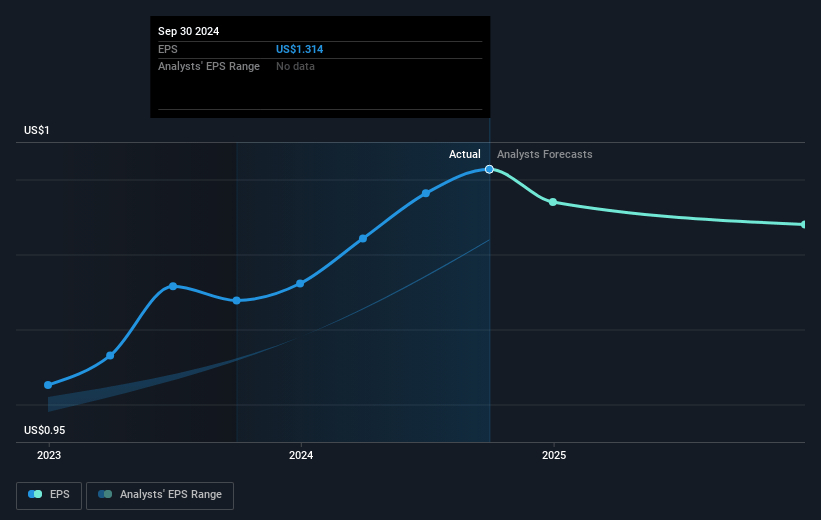

- Analysts expect earnings to reach $25.1 million (and earnings per share of $1.15) by about February 2028, down from $27.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.6x on those 2028 earnings, up from 12.6x today. This future PE is lower than the current PE for the US Industrial REITs industry at 34.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

NewLake Capital Partners Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The cannabis industry faces headwinds from competition with hemp-derived products and the slow rollout of new state legal programs, which might suppress revenue growth.

- Revolutionary Clinics and Calypso have ongoing issues with rent payments and operational challenges, which could negatively impact the company's earnings and profitability.

- The uncertainty around federal cannabis policy reform and the pace of state-level legalization efforts may lead to unpredictable revenue streams and hinder growth.

- The inability to list on major exchanges limits the liquidity and custody options for NewLake's shares, potentially affecting shareholder value and market liquidity.

- The potential oversupply issues and evolving regulatory environment in key markets like Florida could affect the company's net margins and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.5 for NewLake Capital Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $52.1 million, earnings will come to $25.1 million, and it would be trading on a PE ratio of 22.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of $16.64, the analyst price target of $23.5 is 29.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives