Key Takeaways

- Strategic acquisitions and a specialized focus on skilled nursing position the company to benefit from rising demographic demand and occupancy shifts in health care real estate.

- Predictable earnings growth is supported by embedded rent escalators, stable government-backed revenue streams, and improving regulatory reimbursement rates for tenants.

- Overexposure to government reimbursements, geographic concentration, rising labor costs, high leverage, and shifts toward home care threaten the REIT's revenue growth and margin stability.

Catalysts

About Strawberry Fields REIT- A self-administered real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing and certain other healthcare- related properties.

- The company's continued selective acquisitions in strategic and demographically favorable markets-supported by a $300 million active acquisition pipeline and demonstrated integration success-position it to capitalize on the growing need for skilled nursing as the U.S. population ages, which is likely to drive both revenue and net operating income growth over time.

- Embedded 3% annual rent escalators in new and existing leases, combined with a disciplined approach to adding properties that offer immediate 10% unlevered cash returns, set the stage for recurring and predictable earnings growth, supporting improving net margins as more higher-yielding assets enter the portfolio.

- The pure-play focus on skilled nursing and long-term care facilities, an asset class benefitting from the ongoing shift of care away from acute hospitals and toward post-acute and long-term care settings, enables Strawberry Fields REIT to capture increasing demand and occupancy, which should positively influence portfolio-level rental rates, EBITDARM coverage, and revenue stability.

- The defensive nature of health care real estate, underpinned by government-backed tenant revenue streams (Medicare/Medicaid) and growing health care expenditures as a percentage of U.S. GDP, supports resilient tenant demand and stable rent collections-factors that reduce credit risk, guard AFFO, and can command a higher valuation multiple in volatile markets.

- Improvements in CMS reimbursement rates and state-level Medicaid rate increases (as recently seen in Missouri and Tennessee) are already boosting tenant rent coverage ratios; this regulatory clarity is expected to drive further EBITDARM improvement and underpin long-term AFFO and EBITDA growth.

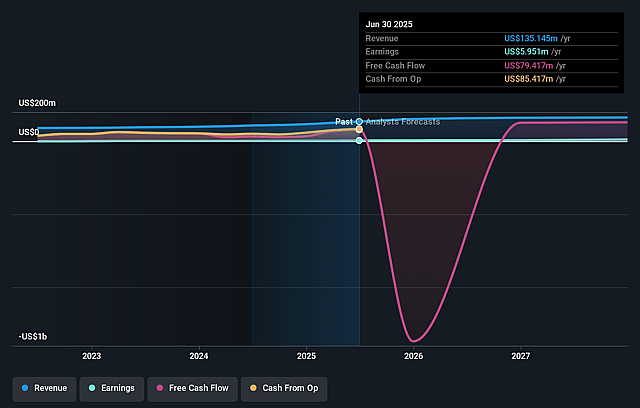

Strawberry Fields REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Strawberry Fields REIT's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 7.6% in 3 years time.

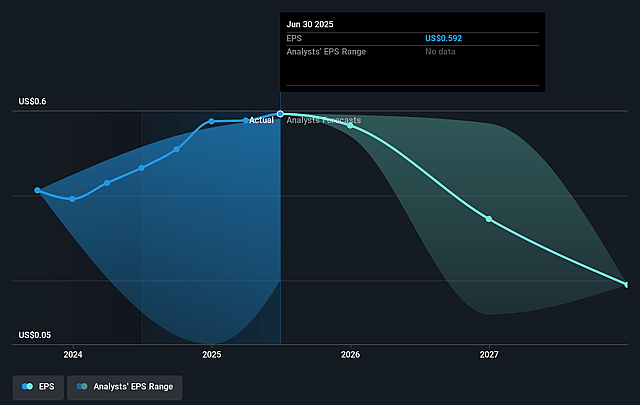

- Analysts expect earnings to reach $12.2 million (and earnings per share of $0.19) by about September 2028, up from $6.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 96.1x on those 2028 earnings, up from 25.9x today. This future PE is greater than the current PE for the US Health Care REITs industry at 33.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.97%, as per the Simply Wall St company report.

Strawberry Fields REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on government reimbursement programs such as Medicaid, particularly in states like Illinois and Indiana, exposes Strawberry Fields REIT to regulatory and legislative risk-potential changes or delays in provider taxes or reimbursement rates could pressure tenant financial health and reduce rent collections, impacting future revenue and net margins.

- The company's substantial portfolio concentration in skilled nursing facilities (over 91%), and within certain states (e.g., Indiana at 25% of rent from a single tenant/operator), creates exposure to demographic shifts or state-specific population stagnation, which could lead to long-term occupancy challenges and weaker same-property NOI growth over time.

- Rising labor costs and union-negotiated wage increases, especially in lagging states like Illinois where reimbursements have not kept pace, present structural long-term risks to tenant operating margins, potentially leading to higher tenant default risk or demand for rent concessions, pressuring net income and cash flow stability for Strawberry Fields REIT.

- The company's aggressive acquisition-driven growth strategy, fueled by increasing leverage (net debt to net assets at 49.1% and net debt to AEBITDA at 5.6x), raises financial risk if capital markets tighten or interest rates rise; elevated debt levels may force the REIT to resort to dilutive equity issuance during downturns, adversely affecting earnings per share and shareholder returns.

- Long-term secular trends favoring home/community-based care ("aging in place") and potential technological disruption from telehealth may reduce demand for traditional skilled nursing facilities, threatening long-term occupancy rates, rental growth, and future asset values, thereby constraining Strawberry Fields's revenue growth and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.5 for Strawberry Fields REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $160.8 million, earnings will come to $12.2 million, and it would be trading on a PE ratio of 96.1x, assuming you use a discount rate of 9.0%.

- Given the current share price of $11.86, the analyst price target of $13.5 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.