Key Takeaways

- Strong presence in growing Sunbelt markets and focus on service-oriented tenants are driving leasing demand, higher rents, and resilient earnings growth.

- Redevelopment, strategic acquisitions, and capital recycling in affluent neighborhoods support superior rental rate growth, asset value appreciation, and margin expansion.

- Heavy Sunbelt concentration, retail exposure, high leverage, reliance on acquisitions, and rising competition collectively threaten long-term growth, profitability, and operational stability.

Catalysts

About Whitestone REIT- Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

- Whitestone's concentration in high-growth Sunbelt markets (Texas, Arizona) continues to benefit from robust population and commercial in-migration, driving persistent leasing demand, higher rents, and strong occupancy rates-trends that are likely to continue supporting above-average same-store revenue growth and FFO.

- The company's emphasis on open-air retail centers anchored by service and experiential tenants positions it to capture the growing consumer shift away from traditional enclosed malls, helping sustain tenant mix upgrades and rental rate expansion, supporting future net operating income and earnings margins.

- Opportunistic acquisition and capital recycling into high-value neighborhoods with affluent, upwardly mobile demographics (as seen by recent deals in Austin and Fort Worth) enables Whitestone to realize superior mark-to-market rent growth and asset value appreciation relative to legacy properties, providing a catalyst for long-term revenue and earnings expansion.

- Ongoing redevelopment and remerchandising efforts, particularly in rapidly developing or revitalizing communities (e.g., Lion Square, Garden Oaks), are increasing rent rolls, attracting higher-quality tenants, and capturing incremental NOI growth as projects deliver, enhancing asset values and margin expansion.

- Accelerating regional development around key centers (e.g., new infrastructure, mixed-use projects, large corporate investments near major properties) increases surrounding foot traffic and commercial density, directly supporting higher occupancy, rental rates, and long-term same-store NOI and FFO growth.

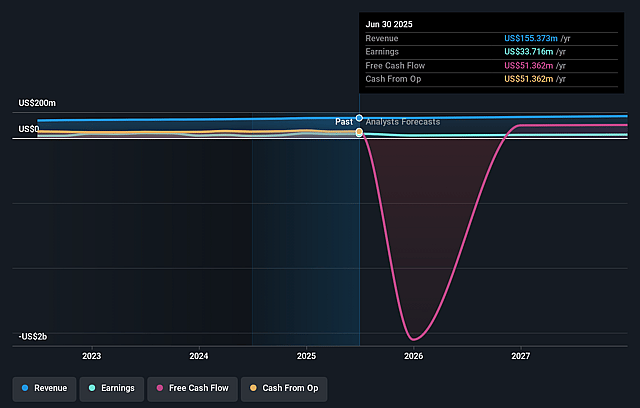

Whitestone REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Whitestone REIT's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 21.7% today to 14.7% in 3 years time.

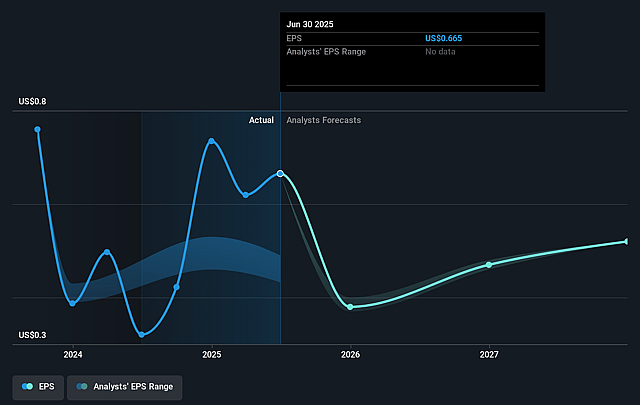

- Analysts expect earnings to reach $25.6 million (and earnings per share of $0.5) by about August 2028, down from $33.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.5x on those 2028 earnings, up from 18.7x today. This future PE is greater than the current PE for the US Retail REITs industry at 26.3x.

- Analysts expect the number of shares outstanding to grow by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.12%, as per the Simply Wall St company report.

Whitestone REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Whitestone's high geographic concentration in the Sunbelt, particularly Texas and Arizona, exposes it to regional risks and economic downturns; if growth in these markets falters due to overdevelopment, population shifts, or local oversupply, occupancy and rent growth could stagnate or decline, negatively impacting revenues and net operating income (NOI).

- The company's ongoing reliance on retail property performance, despite broader secular shifts to e-commerce and direct-to-consumer models, leaves it vulnerable to persistent industry headwinds like increased retail vacancies or declining brick-and-mortar demand, which could reduce tenant stability and long-term revenue growth.

- Elevated leverage remains a risk, with debt-to-EBITDAre hovering at 7x; if interest rates remain high or credit conditions tighten, refinancing could become more expensive or difficult, increasing interest expense and compressing earnings and margins.

- Whitestone's growth strategy depends heavily on acquisitions and portfolio recycling; delays in dispositions or difficulties in efficiently reinvesting capital into higher-yielding properties could result in unproductive asset holdings, capital drag, or asset write-downs, ultimately constraining FFO and earnings growth.

- While mixed-use neighborhood developments nearby are seen as positives, intensified competition from non-REIT investors and new mixed-use supply could dilute pricing power, increase tenant incentives, or cap rent growth, thereby limiting same-store NOI growth and compressing long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.929 for Whitestone REIT based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $173.4 million, earnings will come to $25.6 million, and it would be trading on a PE ratio of 39.5x, assuming you use a discount rate of 9.1%.

- Given the current share price of $12.39, the analyst price target of $14.93 is 17.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.