Narratives are currently in beta

Key Takeaways

- Increased competition in North America could pressure cap rates, complicating future asset acquisitions and affecting revenue growth.

- Uncertainty in tenant credit and potential rent disruptions from bankrupt tenants like True Value may impact net margins and cash flow unpredictably.

- W. P. Carey’s diversified investment focus, strong deal pipeline, and financial flexibility position it for future growth and stability in revenue and earnings.

Catalysts

About W. P. Carey- W. P. Carey ranks among the largest net lease REITs with a well-diversified portfolio of high-quality, operationally critical commercial real estate, which includes 1,424 net lease properties covering approximately 173 million square feet and a portfolio of 89 self-storage operating properties as of December 31, 2023.

- The increased competition in the transaction environment, particularly in North America, could pressure cap rates, potentially affecting future revenue growth as W. P. Carey may find it harder to acquire assets at favorable terms.

- Execution risk associated with U.S. retail expansion might impact earnings, as the company plans to increase its deal volume in this segment despite potential constraints from less favorable lease escalations compared to industrial assets.

- Uncertainty in tenant credit, particularly concerning major tenants like Hellweg and True Value, may result in rent disruptions or additional re-tenanting costs in 2025, negatively impacting net margins.

- Reliance on sales of self-storage assets and student housing to fund future investments without raising equity until 2026 could constrain future liquidity, potentially affecting earnings growth if asset sales are unable to meet expectations.

- Limited visibility into resolution timelines for tenants undergoing bankruptcy, such as True Value, introduces unpredictability in cash flows, which may impact AFFO (Adjusted Funds From Operations) growth projections for 2025.

W. P. Carey Future Earnings and Revenue Growth

Assumptions

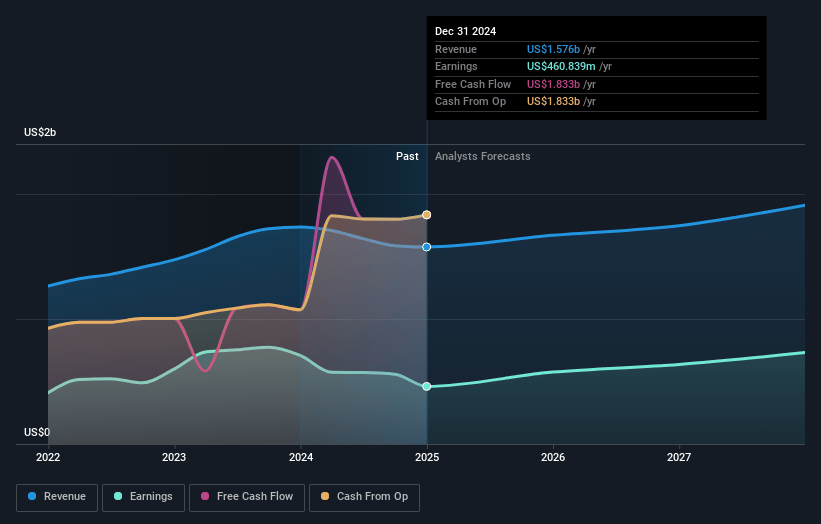

How have these above catalysts been quantified?- Analysts are assuming W. P. Carey's revenue will grow by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 35.2% today to 35.1% in 3 years time.

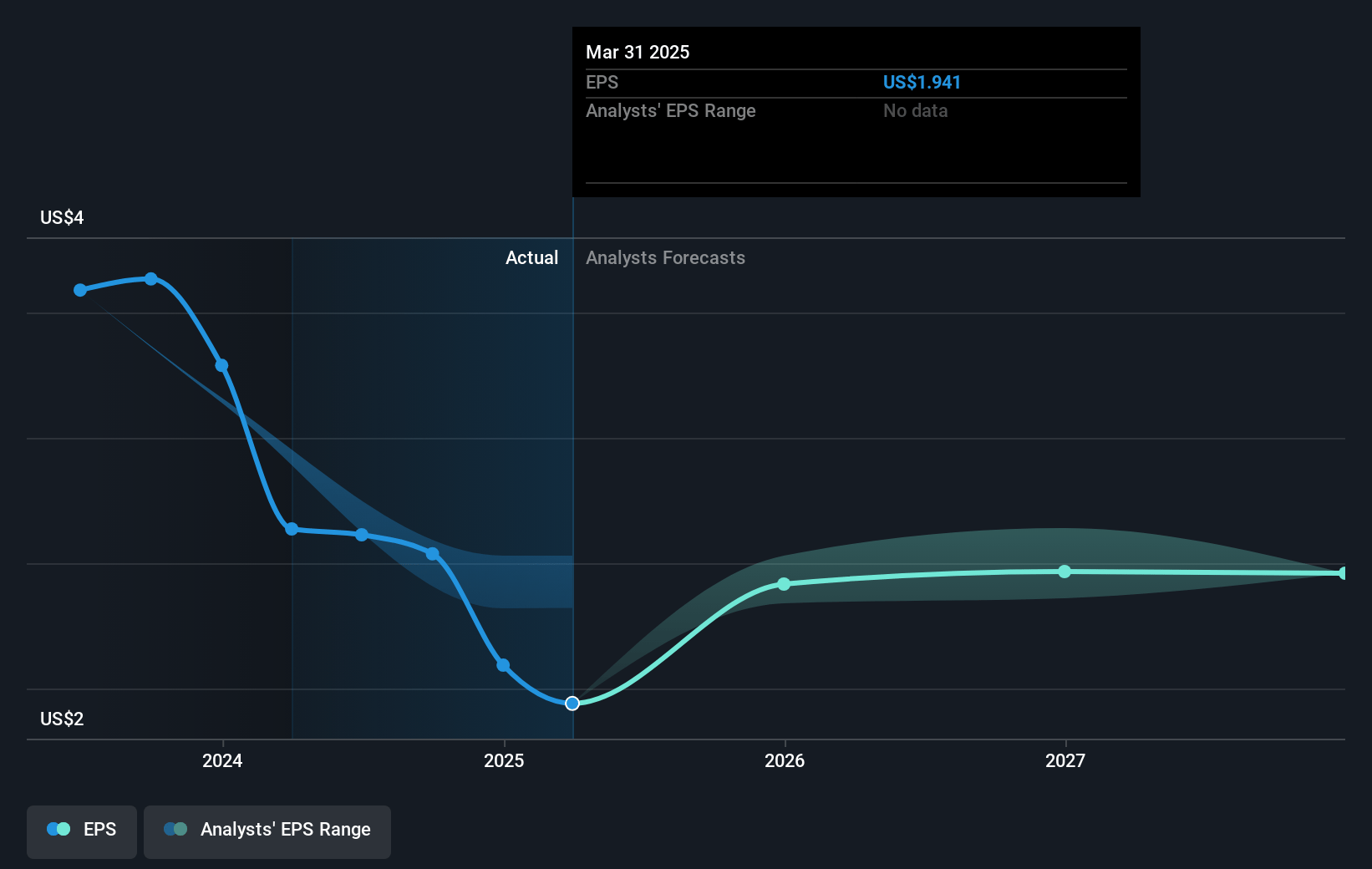

- Analysts expect earnings to reach $686.1 million (and earnings per share of $1.79) by about November 2027, up from $558.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.9x on those 2027 earnings, up from 22.1x today. This future PE is greater than the current PE for the US REITs industry at 29.1x.

- Analysts expect the number of shares outstanding to grow by 20.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.18%, as per the Simply Wall St company report.

W. P. Carey Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- W. P. Carey has a strong deal pipeline, with identified deals totaling over $500 million and deal volume expected to be in the top half of the $1.25 billion to $1.75 billion range, which could support AFFO growth in 2025. This indicates potential for increased revenue and earnings.

- The company has diversified its investment focus, expanding into U.S. retail in addition to its traditional emphasis on industrial and warehouse assets. This diversification could enhance revenue stability and growth by tapping into new market opportunities.

- W. P. Carey reports sector-leading rent growth from leases and expects this trend to continue, potentially boosting long-term revenue and net margins.

- With significant liquidity, including a $2 billion undrawn revolver and $800 million in cash, the company does not anticipate needing to raise additional equity until 2026. This financial flexibility may positively affect net margins and earnings by reducing the reliance on external financing.

- The company's ability to cover capital needs through retained cash flow and asset dispositions without needing to go above long-term target ranges for leverage suggests steady financial health and potential for stable or improved net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $61.18 for W. P. Carey based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $56.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $2.0 billion, earnings will come to $686.1 million, and it would be trading on a PE ratio of 41.9x, assuming you use a discount rate of 7.2%.

- Given the current share price of $56.48, the analyst's price target of $61.18 is 7.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives