Key Takeaways

- Sale of non-core assets allows Sun Communities to strengthen MH and RV segments, enhancing revenue reliability and reducing net debt.

- Enhanced operational efficiency and strategic focus on core segments aim to improve margins and stabilize earnings through cost reduction and occupancy-driven strategies.

- Leadership transition and narrow market focus pose risks to strategic direction, while variable interest debt and U.K. costs threaten margins and profitability.

Catalysts

About Sun Communities- Established in 1975, Sun Communities, Inc.

- The sale of Safe Harbor Marinas for $5.65 billion allows Sun Communities to refocus on its core MH (Manufactured Housing) and RV (Recreational Vehicle) segments, which are expected to drive higher NOI contribution, improving margins and earnings predictability. This strategic repositioning can increase revenue-to-free cash flow conversion, directly benefiting earnings.

- The reduction of leveraged assets by using the proceeds from the marina sale to pay down debt is expected to improve the company's balance sheet, reducing net debt-to-EBITDA ratio to approximately 2.5 to 3x. This deleveraging can improve net margins by decreasing interest expenses, enhancing overall earnings.

- An increase in operational efficiency through expense management, technology leverage, and data-driven performance improvement initiatives in MH and RV segments is aimed at reducing operating costs, which should improve net margins and enhance overall earnings.

- The transformation strategy, including strategic dispositions of non-core assets worth approximately $570 million and refocusing on North American MH and RV segments with growing same-property NOI, is designed to increase and sustain top line revenue growth, thus boosting operating margins.

- The focus on converting RV transient sites to annual leases and the ongoing high occupancy levels in MH, along with strategic pricing increases, is designed to support steady and predictable revenue growth. These measures target to enhance revenue over time and stabilize earnings.

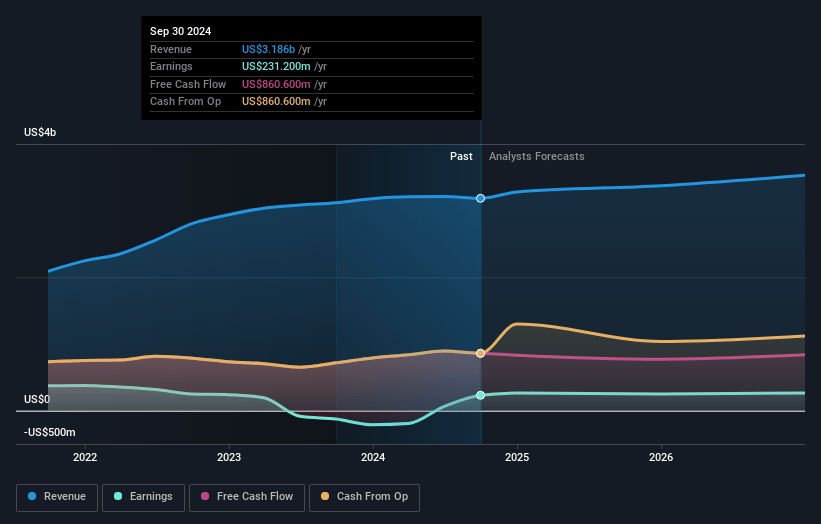

Sun Communities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sun Communities's revenue will decrease by 7.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.8% today to 19.6% in 3 years time.

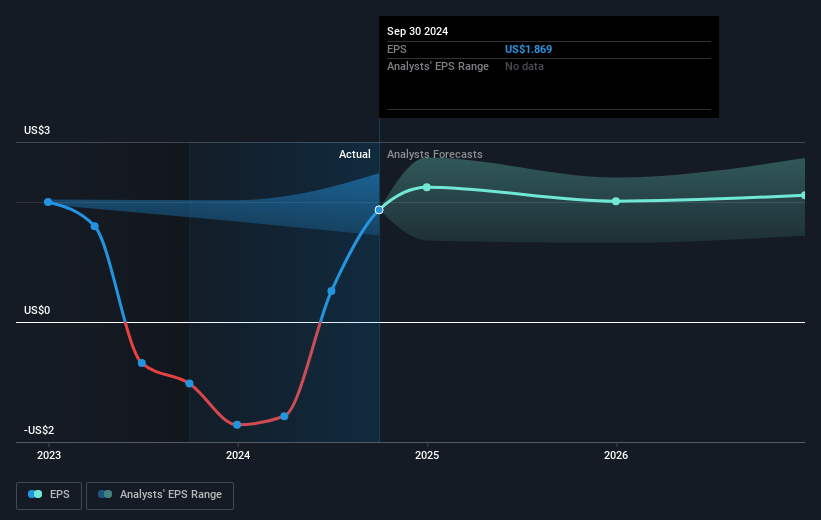

- Analysts expect earnings to reach $498.6 million (and earnings per share of $2.56) by about April 2028, up from $88.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.7x on those 2028 earnings, down from 177.5x today. This future PE is greater than the current PE for the US Residential REITs industry at 40.3x.

- Analysts expect the number of shares outstanding to grow by 2.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.8%, as per the Simply Wall St company report.

Sun Communities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite the expected earnings growth following the repositioning and sale of non-core assets, the company is undergoing a CEO search, which introduces uncertainty and potential leadership transition risks that could impact strategic direction and execution, possibly affecting future revenue and earnings.

- The reliance on a narrow focus of manufactured housing (MH) and recreational vehicle (RV) segments could increase exposure to economic downturns affecting those specific markets, potentially impacting revenue and net margins.

- Although the company has reduced its debt and plans further deleveraging, significant portions of its debt are subject to variable interest rates, which could lead to increased interest expenses if rates rise, impacting net margins and earnings.

- Operations in the U.K. face increased payroll and operating expenses due to government wage and tax mandates, which could erode the margins and reduce the profitability of its U.K. portfolio.

- The company's financial outlook and strategic decisions hinge on the successful completion of the Marina sale, and any delays or issues could affect planned debt reductions and capital allocations, potentially impacting cash flow and earnings projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $140.308 for Sun Communities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $124.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.5 billion, earnings will come to $498.6 million, and it would be trading on a PE ratio of 47.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $123.27, the analyst price target of $140.31 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.