Narratives are currently in beta

Key Takeaways

- Strategic recycling of non-core assets and cost-saving measures aim to streamline operations and enhance long-term revenue stability.

- Debt reduction and rental rate increases are expected to improve net margins, strengthen the balance sheet, and support sustainable earnings growth.

- Sun Communities' financial struggles, cost pressures, and restructuring efforts may hinder revenue growth and earnings stability, indicating potential execution risks.

Catalysts

About Sun Communities- Established in 1975, Sun Communities, Inc.

- Sun Communities is focused on strategic asset recycling by disposing of non-strategic properties, which could lead to improving long-term revenue stability and enhanced earnings via a streamlined portfolio.

- Reduction of debt by approximately $450 million from the end of 2023 and a shift in the debt structure could lead to lower interest expenses, thereby improving net margins and profitability.

- Significant cost-saving measures, including reorganization of operations and technology optimization, are expected to result in $15 million to $20 million in annualized savings, enhancing earnings and potentially increasing net margins.

- Anticipated strong rental rate increases in 2025 (e.g., 5.2% in manufactured housing), with converted transient to annual RV sites contributing to more stable and predictable revenue growth.

- Capital recycling strategies, including potential additional asset sales for $100 million to $200 million, aimed at further reducing debt and strengthening the balance sheet to support sustainable earnings growth.

Sun Communities Future Earnings and Revenue Growth

Assumptions

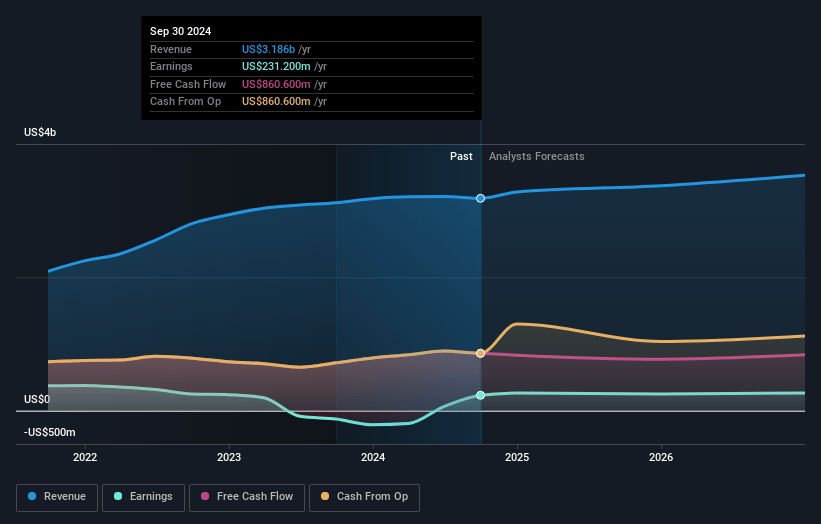

How have these above catalysts been quantified?- Analysts are assuming Sun Communities's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.3% today to 7.6% in 3 years time.

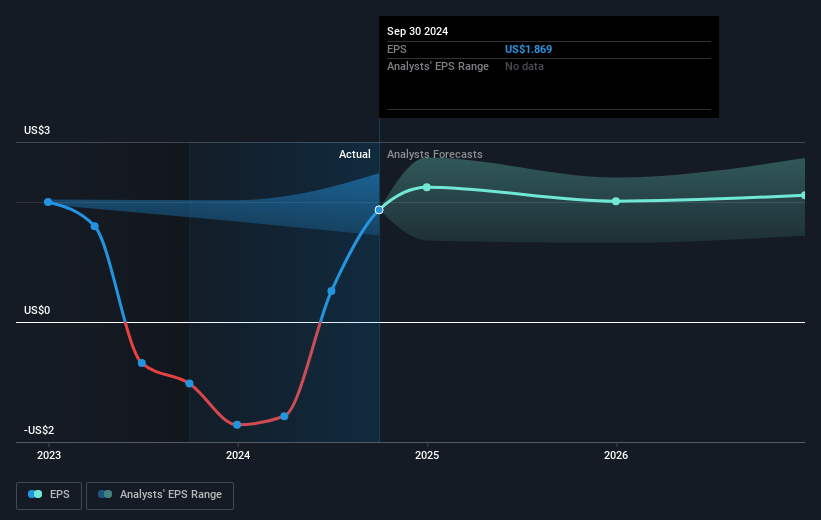

- Analysts expect earnings to reach $287.1 million (and earnings per share of $2.32) by about November 2027, up from $231.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $351.9 million in earnings, and the most bearish expecting $179.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 72.2x on those 2027 earnings, up from 69.8x today. This future PE is greater than the current PE for the US Residential REITs industry at 37.4x.

- Analysts expect the number of shares outstanding to decline by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Sun Communities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported disappointing third-quarter results and revised its outlook for 2024, which may indicate challenges in achieving revenue and earnings growth.

- Sun Communities is experiencing continuing volatility in transient components of its business and cost pressures, which could negatively impact net margins.

- The company is facing headwinds in its RV segment, with a reported 10.4% reduction in transient revenue, reflecting ongoing challenges that could affect earnings stability.

- Elevated operating expenses, such as higher supply and repair costs, are undermining the benefits of revenue growth, potentially impacting net income.

- The management highlighted an ongoing Corporate restructuring and repositioning due to underperformance, indicating execution risks that could delay financial improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $138.73 for Sun Communities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $172.0, and the most bearish reporting a price target of just $110.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.8 billion, earnings will come to $287.1 million, and it would be trading on a PE ratio of 72.2x, assuming you use a discount rate of 6.7%.

- Given the current share price of $126.61, the analyst's price target of $138.73 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives