Last Update07 May 25Fair value Increased 3.85%

Key Takeaways

- Strategic refocus on U.S. operations may enhance long-term growth by improving efficiencies and targeting synergistic markets.

- Potential revenue boost from healthy Pacific Northwest demand, despite near-term headwinds in timber pricing and real estate.

- Rayonier's refocus on U.S. operations may face pressure from challenging timber markets and debt levels, impacting financial flexibility and earnings stability.

Catalysts

About Rayonier- Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand.

- Rayonier's decision to sell its New Zealand joint venture for $710 million is aimed at focusing growth on core U.S. operations, potentially improving revenue and efficiencies by concentrating on synergistic markets with better long-term growth prospects.

- The anticipated use of 50% of the New Zealand sale proceeds to reduce leverage and return capital to shareholders through buybacks and a special dividend could enhance earnings per share and attract long-term investors, despite current net losses.

- Ongoing salvage operations resulting from Hurricane Helene are expected to weigh on timber pricing in the U.S. South through the first half of 2025, impacting revenue negatively but with potential for recovery in the latter half as conditions stabilize.

- The increase in harvest volumes and pricing expected in the Pacific Northwest due to healthy sawmill demand and higher duties on Canadian lumber could provide a boost to revenue and margins in the region, countering some of the losses from other segments.

- Reduced closing activity in the Real Estate segment is projected to rebound in the second half of 2025, supporting adjusted EBITDA growth, but weighs on near-term revenue expectations with only a modest contribution in the first half.

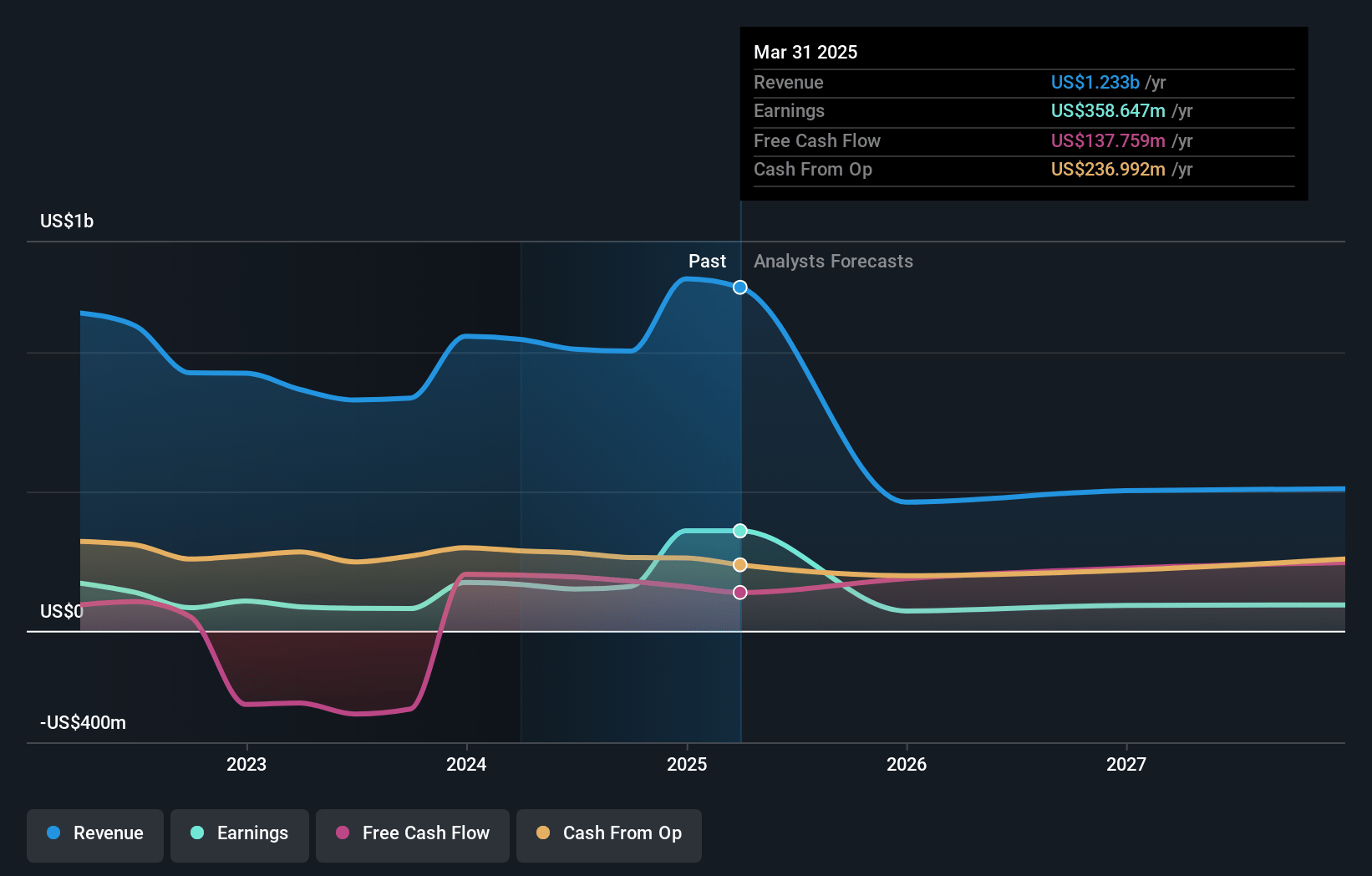

Rayonier Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Rayonier compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Rayonier's revenue will decrease by 25.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 29.1% today to 15.1% in 3 years time.

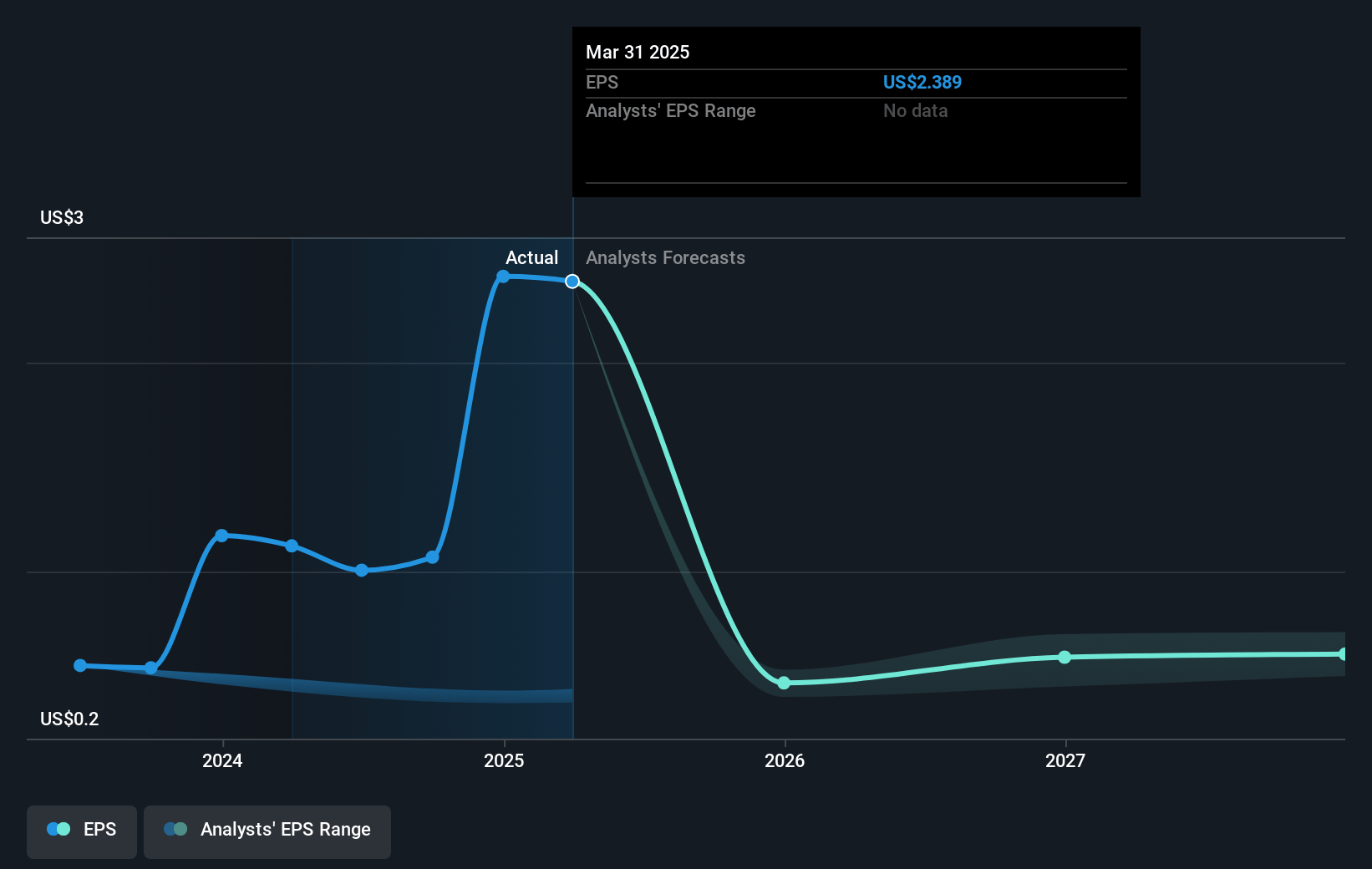

- The bearish analysts expect earnings to reach $76.3 million (and earnings per share of $0.5) by about May 2028, down from $358.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 78.2x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the US Specialized REITs industry at 29.5x.

- Analysts expect the number of shares outstanding to grow by 4.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

Rayonier Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of the New Zealand business could lead to a temporary reduction in revenue and earnings as the company transitions to focusing solely on U.S. operations.

- Challenging timber market conditions in the U.S. South, including lower demand from mills and impacts from Hurricane Helene, have led to significant price declines and lower adjusted EBITDA, which could continue to pressure revenues.

- The current debt levels, combined with higher interest rates, could impact net margins adversely if the anticipated financial gains from asset dispositions do not materialize as expected.

- The reliance on favorable long-term growth prospects in U.S. timberland markets might not offset the current headwinds if macroeconomic conditions, such as housing starts and lumber demand, remain weak, affecting revenue growth.

- The company's aggressive share repurchase plans, while potentially supportive of share value, could limit capital available for reinvestment or buffer against unexpected market shifts, affecting the broader financial flexibility and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Rayonier is $27.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Rayonier's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $506.0 million, earnings will come to $76.3 million, and it would be trading on a PE ratio of 78.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $23.47, the bearish analyst price target of $27.0 is 13.1% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives