Key Takeaways

- Collaborative lease strategies with the Postal Service and rent escalations boost revenue and net margins through predictable income streams.

- Strategic acquisitions and asset disposals enhance earnings growth and improve net margins by expanding and optimizing the property portfolio.

- Reliance on the U.S. Postal Service and acquisitions poses risks due to potential policy changes, tenant concentration, interest rates, and market volatility impacting revenue growth.

Catalysts

About Postal Realty Trust- Postal Realty Trust, Inc. (NYSE: PSTL) is an internally managed real estate investment trust that owns properties primarily leased to the United States Postal Service ("USPS").

- Postal Realty Trust's programmatic approach to re-leasing and collaboration with the Postal Service enhances the timing of lease executions, resulting in same-store cash NOI growth projections of over 4% for 2023, at least 3.25% for 2024, and at least 3% in 2025, positively impacting revenue and earnings.

- The incorporation of 3% annual rent escalations in newly executed leases increases the percentage of leases with escalations to 21%, directly contributing to revenue growth and improved net margins through predictable income streams.

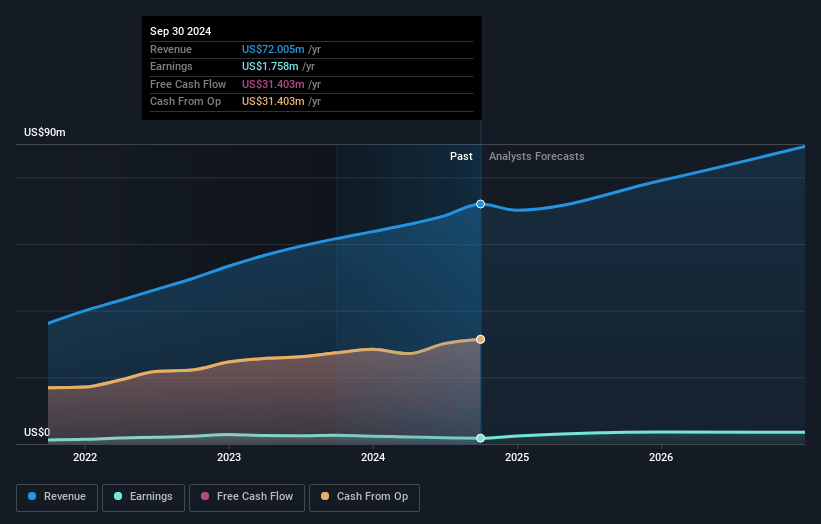

- Postal Realty Trust is targeting $90 million in acquisitions at a weighted average cap rate of 7.5% for 2024, which could drive future revenue and earnings growth by expanding their property portfolio.

- The company's focus on disposing of non-core assets at favorable cap rates and reinvesting the proceeds in higher-yielding properties is expected to enhance earnings and potentially improve net margins.

- Postal Realty Trust's recent amendment to its credit facility, increasing their term loan capacity and reducing exposure to floating rate debt, positions the company well to fund growth initiatives and manage interest expenses, sustaining earnings momentum.

Postal Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Postal Realty Trust's revenue will grow by 9.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 2.8% in 3 years time.

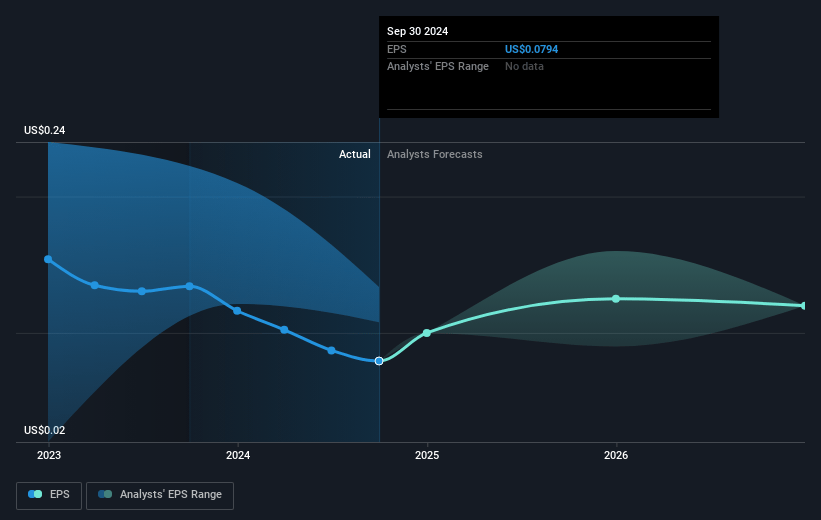

- Analysts expect earnings to reach $2.6 million (and earnings per share of $0.13) by about January 2028, up from $1.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.6 million in earnings, and the most bearish expecting $1.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 144.6x on those 2028 earnings, down from 174.7x today. This future PE is greater than the current PE for the US Office REITs industry at 31.9x.

- Analysts expect the number of shares outstanding to decline by 9.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

Postal Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces risks associated with changes in postal service policies or political shifts, which could potentially impact lease negotiations and the terms of agreements, potentially affecting revenue growth.

- The ability to maintain or improve same-store cash NOI growth projections of at least 3% annual growth for 2025 may be challenging if operational efficiencies do not meet expectations, thus impacting net margins.

- A significant portion of their portfolio is concentrated with a single tenant, the U.S. Postal Service, which presents a risk if their leasing strategy or financial health changes, affecting the company's earnings stability.

- The company is experiencing reliance on acquisitions to drive growth, which could be impacted by changes in the interest rate environment affecting cap rates and overall acquisition costs, potentially impacting earnings.

- There is an ongoing risk in meeting acquisition targets due to market volatility and seller pricing expectations, which could affect the company's ability to achieve its revenue growth goals.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.62 for Postal Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $95.6 million, earnings will come to $2.6 million, and it would be trading on a PE ratio of 144.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of $13.08, the analyst's price target of $15.62 is 16.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives