Narratives are currently in beta

Key Takeaways

- Significant RevPAR growth and strong demand in key markets suggest potential for increased revenue and improved margins.

- Capital recycling and strategic share buy-backs are enhancing operational efficiency and boosting earnings per share and shareholder value.

- Labor strikes, weather disruptions, and slow international travel recovery could impact revenues and stability, while economic conditions may hinder capital recycling and strategic growth.

Catalysts

About Park Hotels & Resorts- Park is one of the largest publicly traded lodging REITs with a diverse portfolio of market-leading hotels and resorts with significant underlying real estate value.

- Park Hotels & Resorts is seeing significant RevPAR growth in key markets like Orlando, Key West, and Miami due to redevelopment projects and strong group and leisure demand. This indicates potential for increased revenue growth in the coming quarters.

- Recent renovations, such as those at the Waldorf Astoria Orlando, are achieving prestigious recognition and positioning these properties to capitalize on healthy group and leisure trends, which could improve net margins through superior pricing power.

- The company's focus on capital recycling—disposing of noncore assets and reinvesting in core portfolio renovations and expansions—is expected to unlock embedded value and drive earnings growth by boosting the operational efficiency of its top properties.

- Park Hotels & Resorts is experiencing strong group business demand with robust future bookings, suggesting continued revenue growth in group-related segments, which historically contribute significantly to F&B and overall hotel revenues.

- The operational strategy to buy back shares using capital from asset sales, especially at discounts to net asset value, is likely to positively impact earnings per share (EPS) by reducing diluted share count and enhancing shareholder value.

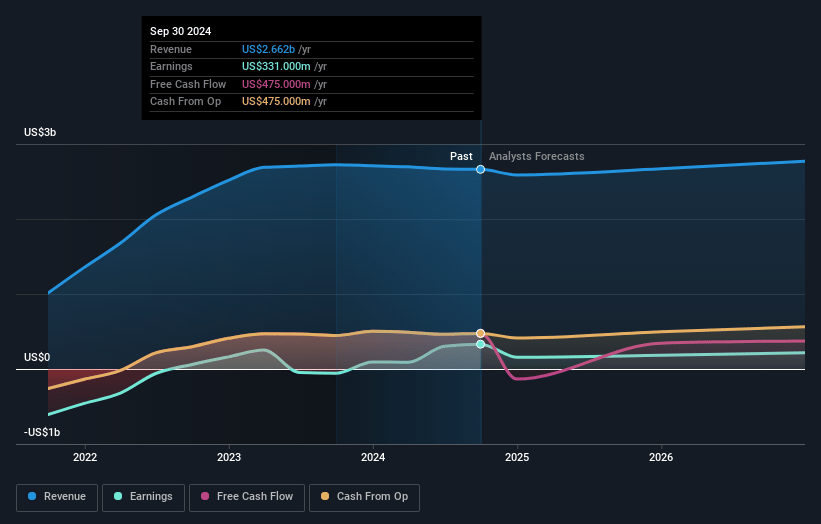

Park Hotels & Resorts Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Park Hotels & Resorts's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.4% today to 11.0% in 3 years time.

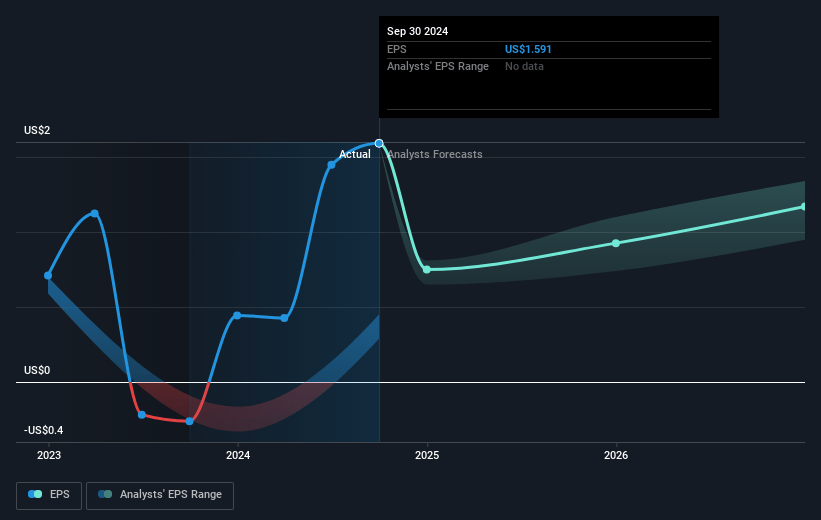

- Analysts expect earnings to reach $324.5 million (and earnings per share of $1.64) by about December 2027, down from $331.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2027 earnings, up from 9.4x today. This future PE is lower than the current PE for the US Hotel and Resort REITs industry at 18.4x.

- Analysts expect the number of shares outstanding to decline by 1.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.97%, as per the Simply Wall St company report.

Park Hotels & Resorts Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Labor strikes at key properties like the Hilton Hawaiian Village can lead to disruptions and losses in occupancy and group bookings, potentially affecting revenues and net margins.

- Weather-related disruptions, such as hurricanes, have impacted operations and revenues in multiple markets, including Key West and Hawaii, posing ongoing risks to earnings.

- The slower-than-expected return of international travelers, particularly from Japan to Hawaii, may suppress RevPAR growth expectations for key properties, impacting overall revenue growth.

- Uncertainty around labor negotiations creates difficulties in providing financial guidance, which could lead to investor uncertainty and impact share price stability.

- The broader economic environment, marked by interest rate fluctuations and potential buyer-seller mismatches in asset sales, could delay capital recycling and affect long-term strategic growth initiatives aimed at boosting returns on invested capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.7 for Park Hotels & Resorts based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $3.0 billion, earnings will come to $324.5 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 10.0%.

- Given the current share price of $15.07, the analyst's price target of $17.7 is 14.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives