Key Takeaways

- Investment in hotel upgrades and focus on unique, lifestyle experiences are driving market share gains, stronger occupancy rates, and improved operating margins.

- Operational efficiency, flexible work trends, and a strong balance sheet enable resilient revenue growth and support long-term returns to shareholders.

- Concentration in urban markets and exposure to labor, climate, regulatory, and competitive pressures heighten risk and constrain long-term growth, profitability, and capital returns.

Catalysts

About Pebblebrook Hotel Trust- Pebblebrook Hotel Trust (NYSE: PEB) is a publicly traded real estate investment trust (“REIT”) and the largest owner of urban and resort lifestyle hotels and resorts in the United States.

- Significant capital investments in property upgrades, amenities, and redevelopments are enabling recently renovated hotels and resorts to command higher ADRs, gain market share, and drive above-market RevPAR growth, which is likely to boost long-term revenues and support higher operating margins.

- The company is benefiting from a sustained preference among younger travelers and professionals for "experiential travel" and unique, lifestyle-focused hotels, fueling strong leisure demand at upscale urban and resort locations-positively impacting portfolio-wide occupancy rates and non-room ancillary revenues.

- Expansion of flexible work models is supporting the increasing trend of "bleisure" travel, leading to healthier mid-week and weekend occupancy as business and leisure segments blur, stabilizing revenue streams and improving same-property revenue growth.

- Relentless operational focus on cost reductions, procurement, energy efficiency, and technology-enabled labor management is driving persistent improvements in portfolio-wide expense ratios and net margins, resulting in higher and more resilient EBITDA even in uncertain demand environments.

- The company's balance sheet strength, substantial free cash flow, and proactive share buybacks offer flexibility to take advantage of undervalued assets or return capital to shareholders, supporting FFO per share and long-term shareholder returns.

Pebblebrook Hotel Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pebblebrook Hotel Trust's revenue will grow by 2.5% annually over the next 3 years.

- Analysts are not forecasting that Pebblebrook Hotel Trust will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Pebblebrook Hotel Trust's profit margin will increase from -3.5% to the average US Hotel and Resort REITs industry of 3.3% in 3 years.

- If Pebblebrook Hotel Trust's profit margin were to converge on the industry average, you could expect earnings to reach $51.3 million (and earnings per share of $0.45) by about July 2028, up from $-51.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.2x on those 2028 earnings, up from -24.6x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 28.3x.

- Analysts expect the number of shares outstanding to decline by 1.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.24%, as per the Simply Wall St company report.

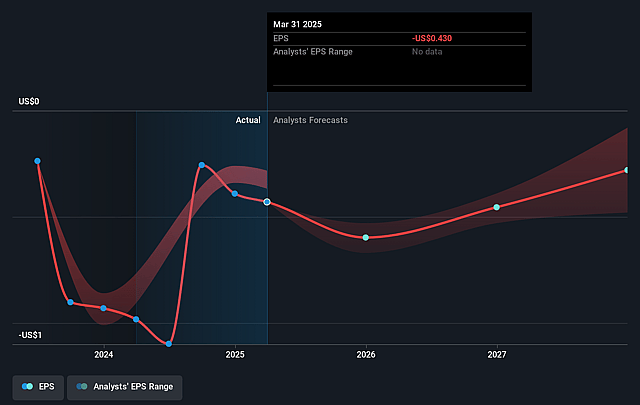

Pebblebrook Hotel Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy geographic concentration in major urban gateway markets (e.g., Los Angeles, San Francisco, Washington D.C.) exposes the company to localized shocks, slow post-pandemic urban recovery, and economic downturns in those cities, increasing long-term revenue volatility and earnings risk.

- Rising wage pressures, persistent labor shortages, and growing regulatory/litigation costs in the hospitality sector may outpace operational efficiencies, leading to structurally higher operating expenses and margin compression over time, negatively impacting net income.

- Heightened climate change risks and recurring natural disasters (e.g., wildfires, hurricanes) in key markets, along with regulatory and insurance cost inflation, are likely to increase ongoing capital expenditure needs and reduce free cash flow and dividend growth potential.

- Declining inbound international travel and increased competition from alternative accommodations (such as Airbnb and boutique rentals), particularly in urban markets, threaten to reduce occupancy rates and limit revenue growth, especially if long-term consumer preferences shift away from traditional hotels.

- Exposure to potential increases in tariffs, disrupted supply chains, and reliance on imported materials for renovations could result in higher capital costs and delayed property upgrades, undermining the intended EBITDA uplift from asset repositioning initiatives and constraining long-term return on invested capital (ROIC).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.854 for Pebblebrook Hotel Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.5, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $51.3 million, and it would be trading on a PE ratio of 36.2x, assuming you use a discount rate of 11.2%.

- Given the current share price of $10.67, the analyst price target of $11.85 is 10.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.