Key Takeaways

- Exiting the New York MTA contract and Southeastern storms could pose challenges to revenue growth and profitability.

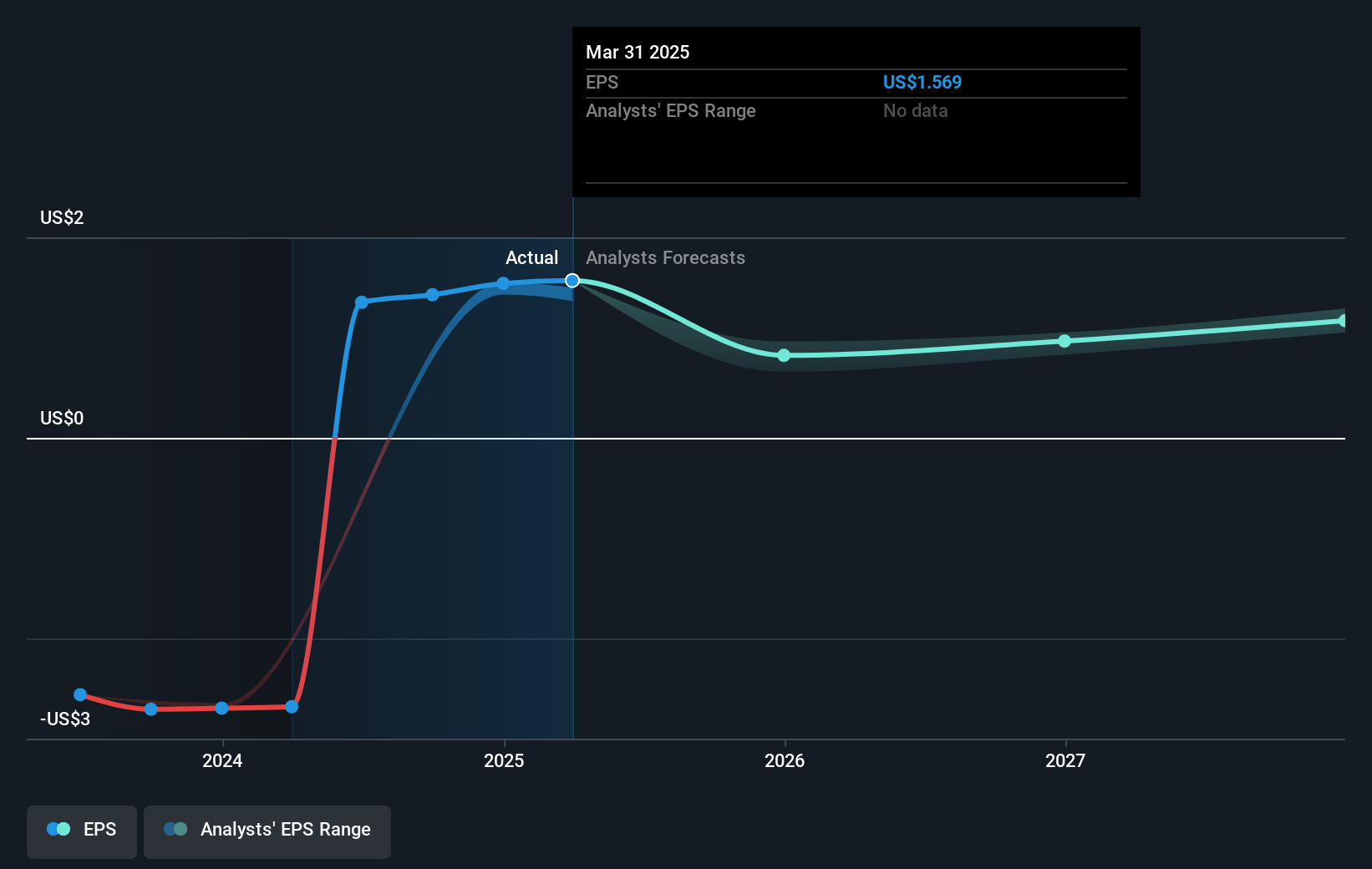

- Rising costs and shareholder dilution plans may compress net margins and negatively affect earnings per share.

- OUTFRONT Media's growth in digital and transit revenue, along with strong cash liquidity, supports financial stability and potential for future investment and profit margin improvement.

Catalysts

About OUTFRONT Media- OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in North America.

- The recent exit from a billboard contract with the New York MTA will create a revenue headwind in Q4 2024 and will continue into 2025, which could impact revenue growth negatively despite anticipated margin enhancement.

- The impact of recent storms in the Southeast may present a small revenue headwind as operations were disrupted, potentially affecting the company's future revenue and overall profitability if similar events occur.

- The company's ongoing automation and transition toward digital buying may bring new advertisers and potentially higher CPMs, but it's unclear if this shift will fully compensate for headwinds in traditional revenue streams, possibly affecting overall revenue consistency.

- On the cost side, U.S. Media posting, maintenance, and other expenses are rising by about 10% year-over-year, driven by compensation-related expenses and increased business activity, which may compress net margins if revenue growth does not keep pace.

- The company's special dividend, funded partly by stock, may lead to shareholder dilution despite plans for a reverse stock split, potentially influencing earnings per share negatively if not managed effectively.

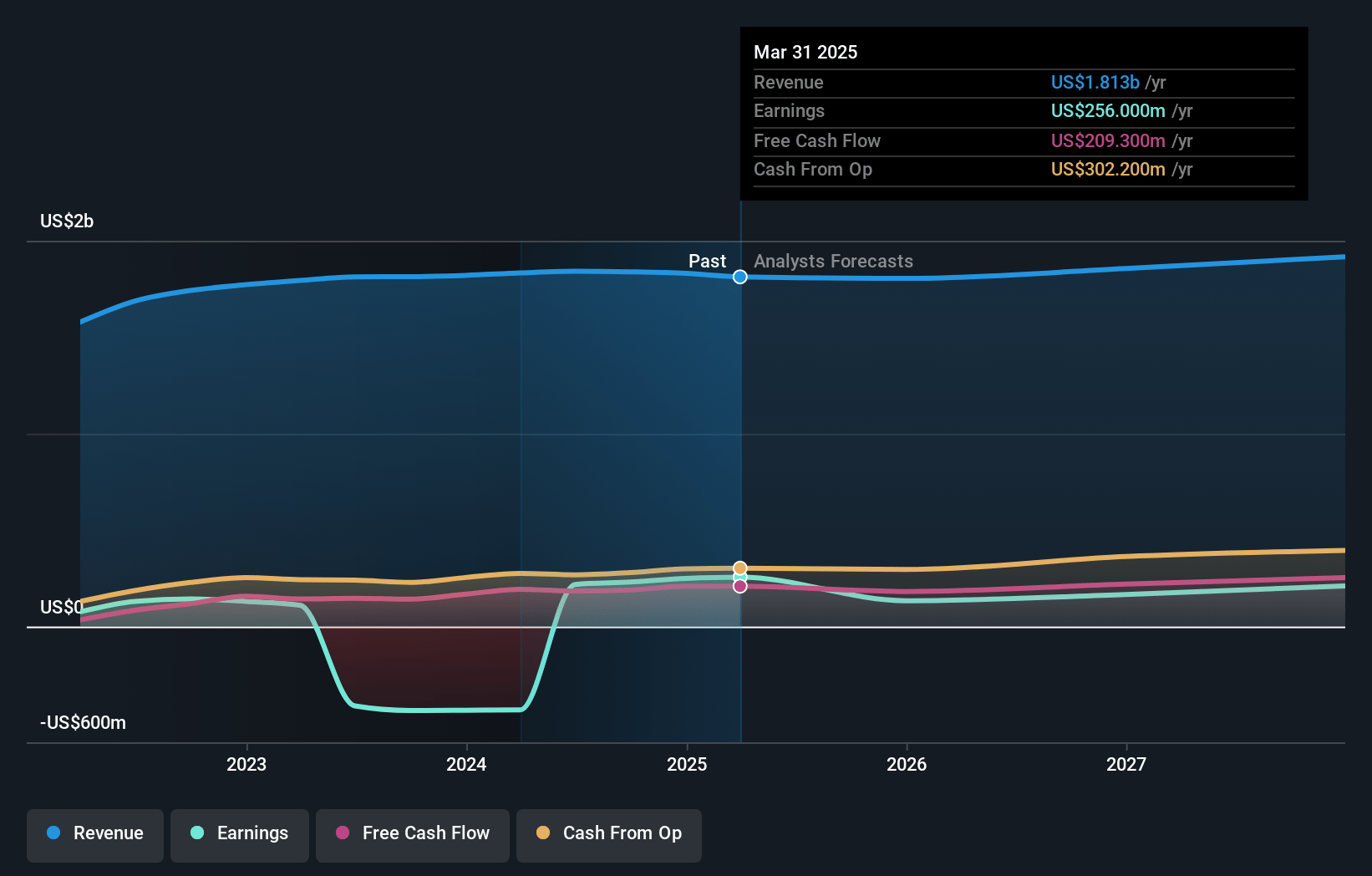

OUTFRONT Media Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OUTFRONT Media's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.5% today to 6.6% in 3 years time.

- Analysts expect earnings to reach $128.1 million (and earnings per share of $0.76) by about January 2028, down from $230.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, up from 13.5x today. This future PE is greater than the current PE for the US Specialized REITs industry at 25.6x.

- Analysts expect the number of shares outstanding to grow by 0.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.73%, as per the Simply Wall St company report.

OUTFRONT Media Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The U.S. Media segment of OUTFRONT Media showed revenue growth over 5%, driven by billboard and transit improvements, indicating potential stability and improvement in their top-line performance. This growth could lead to increased revenue.

- Adjusted OIBDA for U.S. Media grew by over 11% due to revenue growth and controlled expense growth, suggesting that the company is maintaining healthy profit margins and increasing earnings.

- The company's transit revenue growth of 7.3% was driven by solid performances from local and national teams, particularly New York MTA, which points to ongoing potential for revenue generation in transit sectors.

- OUTFRONT's digital performance was strong, with digital revenue growing by 10%, indicating a successful transition to digital that could continue to boost future revenue streams.

- The cash liquidity position remains strong with over $600 million in committed liquidity, enabling financial flexibility, potentially reducing financial risk, and supporting future capital investments or dividend distributions impacting net margins positively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.51 for OUTFRONT Media based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.54, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $128.1 million, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of $18.81, the analyst's price target of $20.51 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives