Key Takeaways

- Same-store revenue and street rate declines indicate potential challenges in pricing and future revenue growth amid a competitive environment.

- Decreased FFO per share and occupancy trends signal near-term earnings pressure and potential difficulties in stabilizing future revenue.

- NSA's operational efficiencies, conservative debt management, and strategic acquisitions enhance its financial stability, with potential revenue and earnings growth despite market challenges.

Catalysts

About National Storage Affiliates Trust- A real estate investment trust headquartered in Greenwood Village, Colorado, focused on the ownership, operation and acquisition of self storage properties predominantly located within the top 100 metropolitan statistical areas throughout the United States.

- The decline in same-store revenue by 3.5% due to a drop in occupancy and rent revenue per square foot could indicate a challenging pricing environment that might slow future revenue growth.

- Street rates decreased by 17% during the third quarter and with expectations of further declines, this could potentially compress net operating income if not counteracted by sufficient occupancy gains.

- As the Sunbelt markets with elevated new supply pose ongoing challenges, this could lead to pressure on margins and earnings due to increased competition and potentially limited pricing power.

- The FFO per share decrease of 7.5% over the prior year period highlights near-term earnings pressure, suggesting difficulties in achieving net income growth.

- The seasonal decline in occupancy projected and the lack of significant growth in customer demand may cause headwinds for future revenue stabilization and growth initiatives.

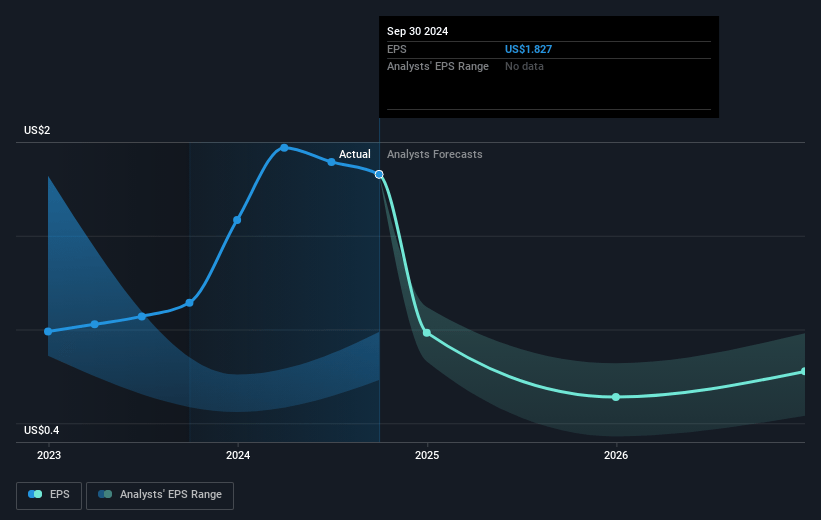

National Storage Affiliates Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National Storage Affiliates Trust's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.2% today to 4.9% in 3 years time.

- Analysts expect earnings to reach $40.3 million (and earnings per share of $0.75) by about January 2028, down from $143.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 66.1x on those 2028 earnings, up from 20.0x today. This future PE is greater than the current PE for the US Specialized REITs industry at 25.3x.

- Analysts expect the number of shares outstanding to decline by 25.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.87%, as per the Simply Wall St company report.

National Storage Affiliates Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite challenges, National Storage Affiliates has experienced an uplift in occupancy in certain markets, such as a 600 basis point increase on the West Coast of Florida, which could lead to improved revenues.

- The internalization of the PRO structure is ahead of schedule, with significant progress in transitioning stores to NSA management, potentially enhancing operational efficiencies and improving earnings in the future.

- NSA has successfully closed on portfolio transactions, adding properties in markets where they have strong footprints, which can increase portfolio quality and operational efficiencies, potentially boosting net margins.

- The company anticipates benefits from transaction internalization, improved acquisitions environment, and eventual recovery in the housing market, suggesting potential earnings growth.

- NSA’s conservative debt management and ample liquidity with a revolver balance of roughly $400 million, along with disciplined acquisition strategies, can provide a stable financial position, mitigating risks to net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.19 for National Storage Affiliates Trust based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $828.6 million, earnings will come to $40.3 million, and it would be trading on a PE ratio of 66.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $37.67, the analyst's price target of $41.19 is 8.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives