Key Takeaways

- Transition to SHOP structures and strategic investments are expected to drive cash flow, enhance valuations, and boost revenue and margins.

- Strengthened financial position through reduced leverage and loan extensions supports investment agility and earnings stability.

- Changes in lease structures, Medicaid instability, and market reliance could pressure margins and hinder growth and earnings for National Health Investors.

Catalysts

About National Health Investors- Incorporated in 1991, National Health Investors, Inc.

- NHI is increasing its investment activity, with over $150 million announced during the quarter at an initial yield of 8.5%, which could drive future revenue and earnings growth.

- There is a strategic plan to transition some senior housing assets to SHOP structures to capitalize on the senior housing industry's strong market fundamentals, potentially increasing cash flow and real estate valuations, positively impacting revenue and net margins.

- An increase in SHOP NOI is forecasted, with expectations of 12% to 15% growth in 2025 driven by occupancy improvements and strategic RevPOR (Revenue Per Occupied Room) increases, contributing to future earnings growth.

- NHI is optimistic about closing $225 million in new investments with an average yield of 8.1% as part of its 2025 guidance. This reflects confidence in future revenue and FFO (Funds From Operations) growth.

- NHI's reduced balance sheet leverage and the strategic extension of its term loan are strengthening its financial position, enabling faster action on investment opportunities without significantly increasing risk, thereby supporting future earnings stability.

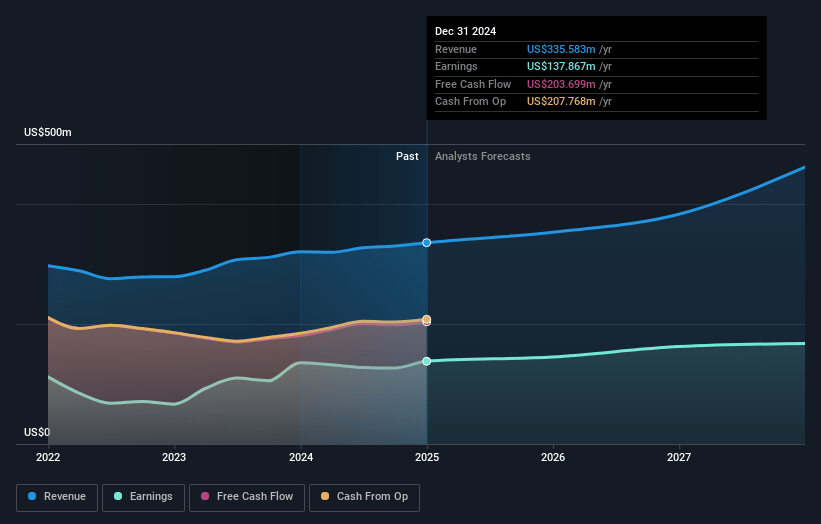

National Health Investors Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming National Health Investors's revenue will grow by 12.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 41.1% today to 34.8% in 3 years time.

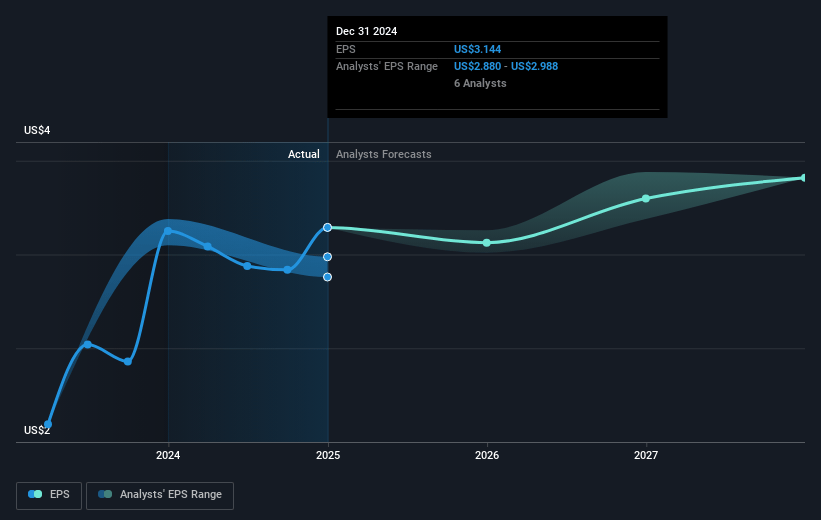

- Analysts expect earnings to reach $168.1 million (and earnings per share of $3.41) by about March 2028, up from $137.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.8x on those 2028 earnings, up from 24.6x today. This future PE is lower than the current PE for the US Health Care REITs industry at 34.4x.

- Analysts expect the number of shares outstanding to grow by 5.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

National Health Investors Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The SLM properties underperforming expectations could lead to potential rent defaults or reduced rental income, impacting revenue and future earnings.

- NHI’s growth guidance heavily relies on reinvestment from deferred rent collections, which may not repeat at the same levels as 2024, potentially affecting revenue growth and earnings.

- The decision to convert triple-net leases to SHOP (RIDEA) structures could result in transition costs and transition trauma, which may negatively impact net margins and short-term earnings.

- The reliance on capital markets for acquisitions and refinancing may create financial strain in a rising interest rate environment, potentially impacting net margins and FFO.

- Potential instability in Medicaid as a result of federal budget changes might impact the skilled nursing sector, posing a risk to revenue stability for NHI’s portfolio.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $80.857 for National Health Investors based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $91.0, and the most bearish reporting a price target of just $68.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $483.5 million, earnings will come to $168.1 million, and it would be trading on a PE ratio of 31.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $74.15, the analyst price target of $80.86 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives