Last Update24 Apr 25Fair value Decreased 0.91%

Key Takeaways

- Modiv Industrial's strategic acquisitions and property expansion plans signal potential growth in revenue and earnings once market conditions improve.

- Focus on cost-saving measures and cautious financial policies aim to enhance net margins and stabilize earnings, making the stock more attractive to investors.

- Heavy debt, cautious acquisitions, and tariff uncertainties could strain financial performance, limit flexibility, and impact revenue, while equity issuance may dilute shares.

Catalysts

About Modiv Industrial- An internally managed REIT that is focused on single-tenant net-lease industrial manufacturing real estate.

- Modiv Industrial is being strategic and patient about acquisitions, indicating a potential for future growth once the market conditions are more favorable, which can lead to increased revenue and earnings.

- The reduction of their revolver to $30 million, down from $150 million, and the expectation of reduced G&A expenses suggest a focus on enhancing net margins through cost saving measures.

- Modiv has identified opportunities for property development and expansion with existing tenants expressing interest in increased footprints, signaling potential growth in rental revenue and AFFO.

- The company's cautious financial policy, including hedging interest rates and planning for preferred stock refiancing, can positively impact earnings stability, which may attract more investors leading to higher stock valuation.

- Modiv holds flexible options to recycle properties totaling approximately $80 million, leading to improved AFFO through redeployments and strategic asset sales, which can enhance both revenue and net margins.

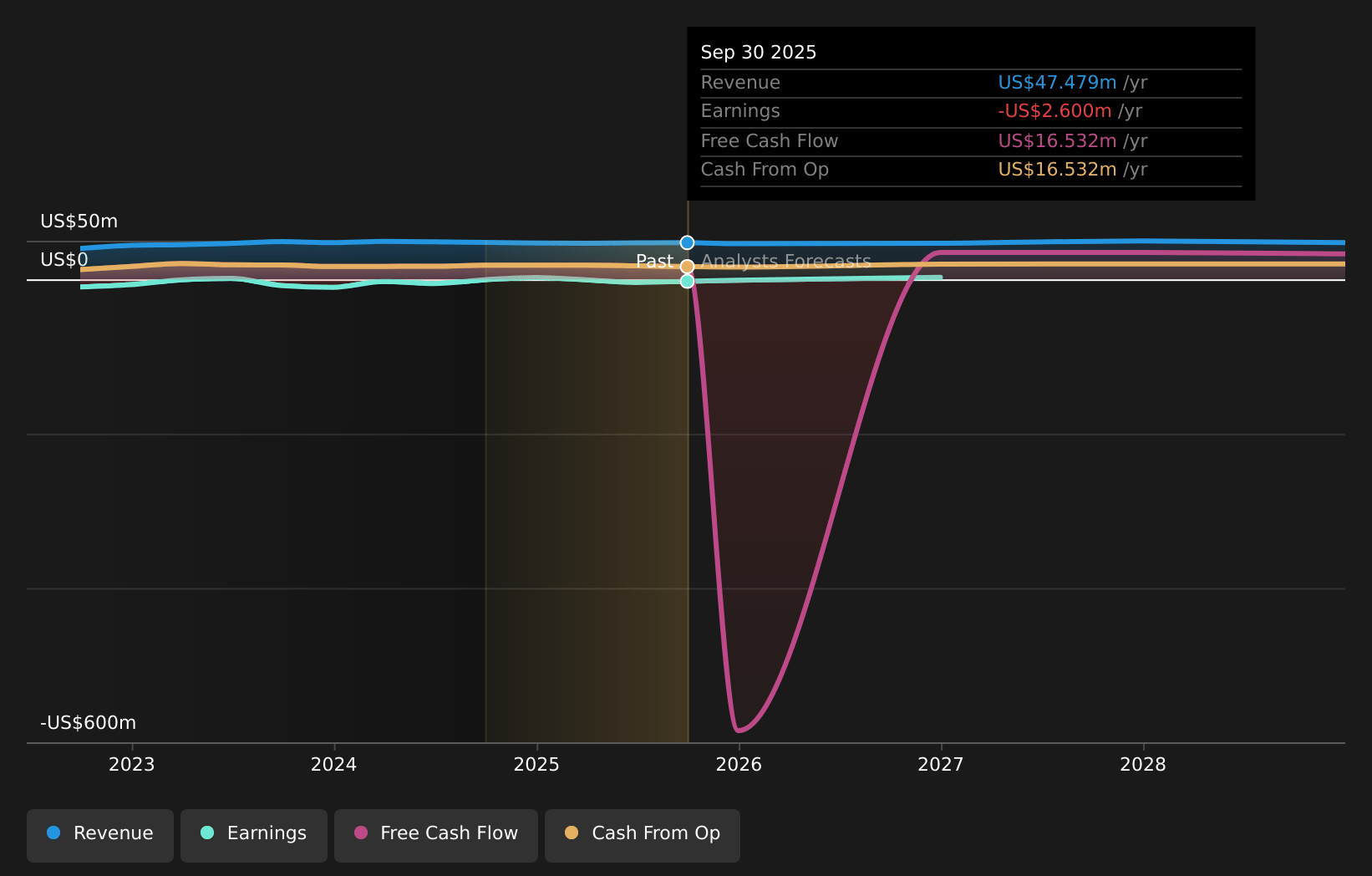

Modiv Industrial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Modiv Industrial's revenue will grow by 1.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.0% today to 4.4% in 3 years time.

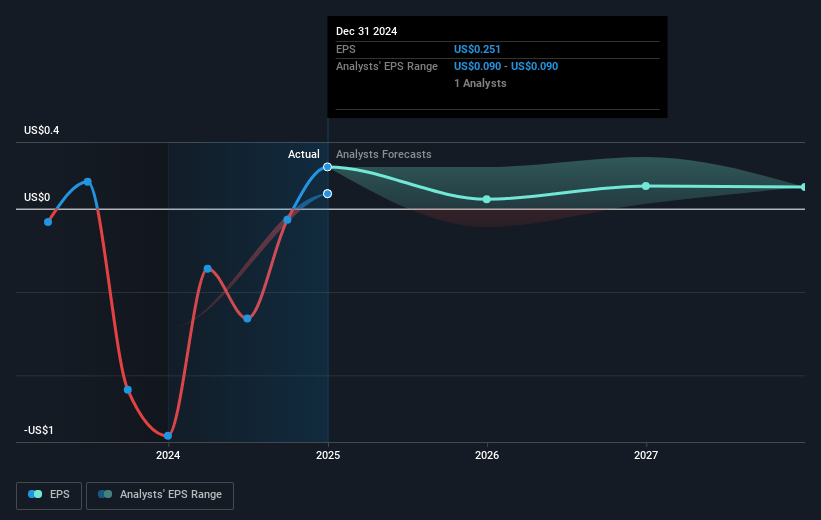

- Analysts expect earnings to reach $2.2 million (and earnings per share of $0.13) by about April 2028, down from $2.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 138.0x on those 2028 earnings, up from 68.2x today. This future PE is greater than the current PE for the US REITs industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 5.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.33%, as per the Simply Wall St company report.

Modiv Industrial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's significant debt load of $280 million and high leverage ratio of 47.6% could strain future financial performance, as interest expenses may limit net margins.

- Modiv Industrial's reliance on a fixed interest rate debt strategy, while protective in the short term, may limit financial flexibility and impact earnings if interest rates decline further.

- The company's cautious acquisition strategy could delay potential revenue growth, as their hesitance to make acquisitions until market conditions improve may result in slower expansion of revenue sources.

- Tariff-related uncertainties and economic opacity can introduce volatility that adversely affects rental income stability and tenant leases, impacting revenue predictability.

- The potential reliance on equity issuance to manage upcoming debt and preferred stock maturities can dilute existing share values and dampen earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $18.0 for Modiv Industrial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $49.1 million, earnings will come to $2.2 million, and it would be trading on a PE ratio of 138.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of $15.95, the analyst price target of $18.0 is 11.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.