Key Takeaways

- High upfront costs from acquisitions and investments could depress near-term earnings, but aim for redevelopment upside over time.

- Lease expirations and potential refinancing challenges could create revenue and expense pressures if market conditions remain tough.

- Kilroy Realty's strategic tenant relationships, favorable market trends, and acquisitions could sustain revenue growth, improve earnings, and enhance occupancy in key regions.

Catalysts

About Kilroy Realty- Kilroy Realty Corporation (NYSE: KRC, the “company”, “Kilroy”) is a leading U.S.

- The company's strategy includes increasing their presence in certain markets through acquisitions, even at higher initial costs, aiming for potential upside from redevelopment over time. This could lead to higher capital expenditures and affect net earnings in the near term before realizing potential long-term benefits.

- Kilroy's significant focus on non-core asset dispositions, including their land sales strategy, could potentially lead to lower capitalized interest and affect net operating income if not executed as planned given market conditions.

- The company's increasing investment in spec suites to meet demand might lead to higher upfront costs and could impact net margins if the demand does not materialize as expected.

- The lease expiration schedule indicates potential future occupancy challenges, especially in 2026, which could impact revenue if they do not successfully renew or replace expiring leases.

- Planned debt maturities and expected refinancing in higher interest rate environments could lead to increased interest expenses and potentially impact net earnings, especially if market conditions remain challenging.

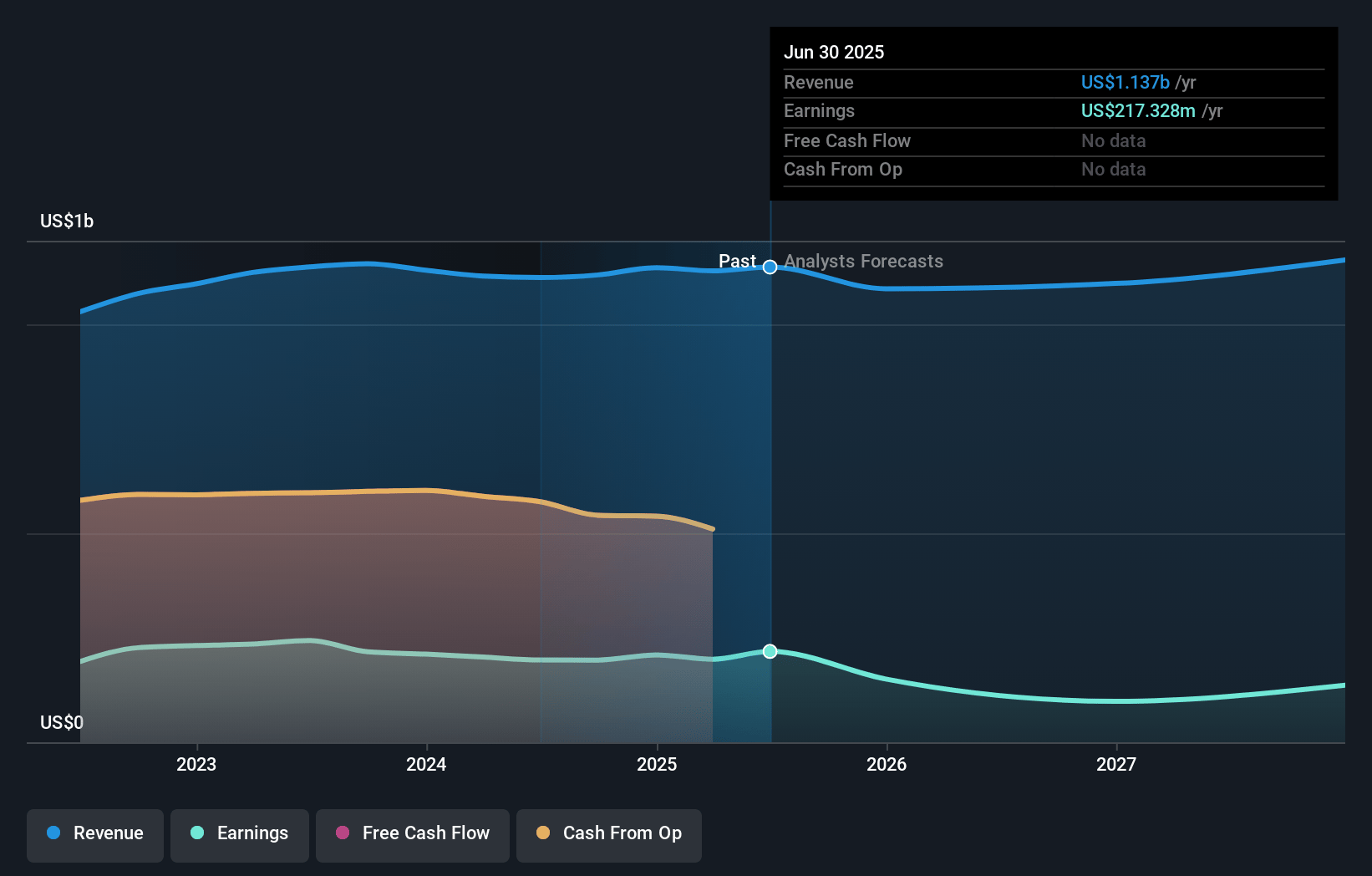

Kilroy Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kilroy Realty's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.6% today to 12.7% in 3 years time.

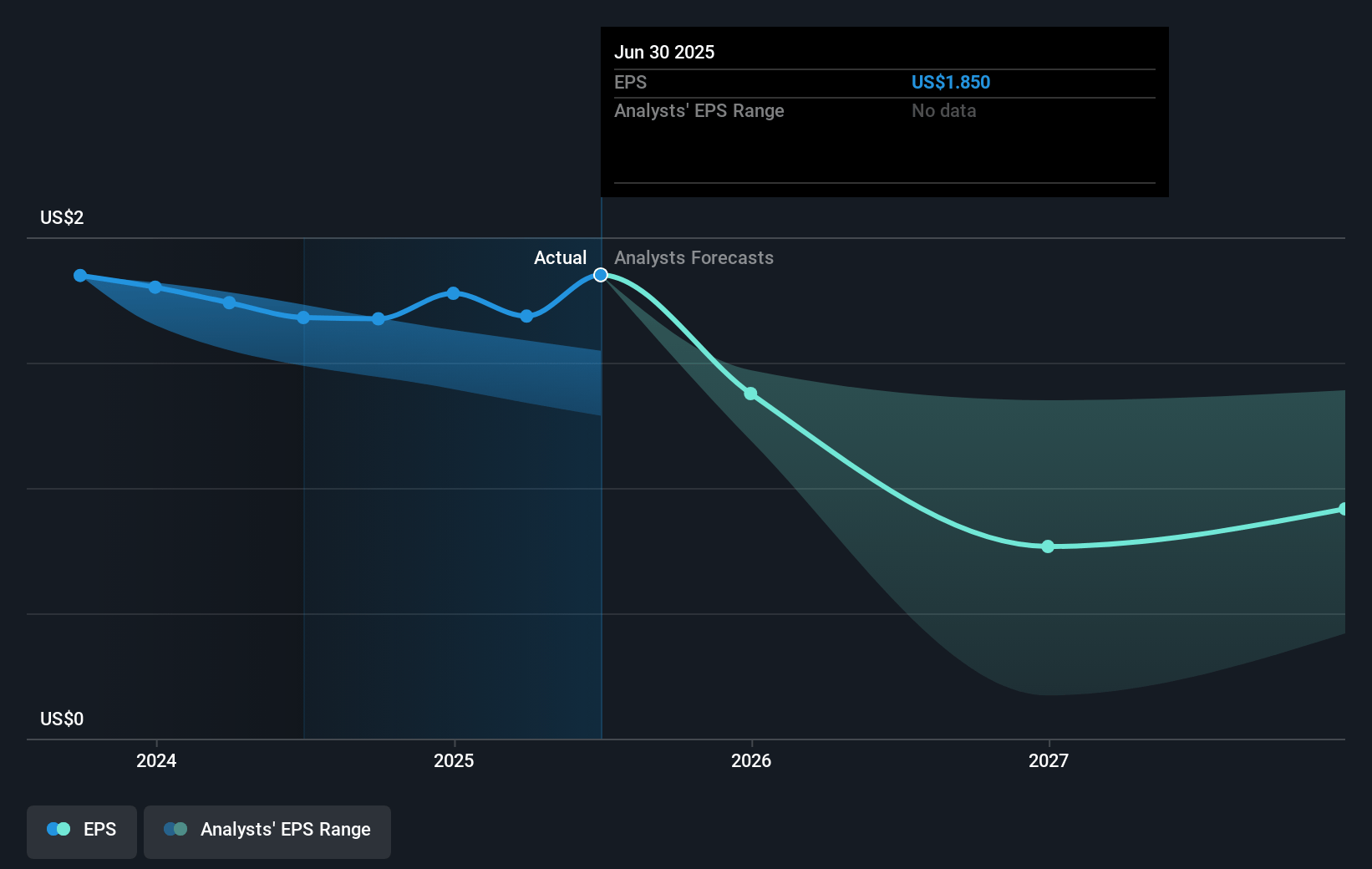

- Analysts expect earnings to reach $155.4 million (and earnings per share of $1.38) by about January 2028, down from $196.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $188.4 million in earnings, and the most bearish expecting $114.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.5x on those 2028 earnings, up from 24.3x today. This future PE is greater than the current PE for the US Office REITs industry at 28.9x.

- Analysts expect the number of shares outstanding to decline by 1.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

Kilroy Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kilroy Realty's high-quality, well-amenitized portfolio and strategic tenant relationships have driven strong demand, particularly in Bellevue and South Lake Union, which could lead to sustained revenue growth and stable occupancy rates.

- The recent SAP renewal and new lease with NVIDIA highlight continued robust demand and successful leasing activity, potentially enhancing net margins through steady rental income.

- Amazon's return-to-office policy and similar trends among West Coast employers could boost physical occupancy in Kilroy's markets, potentially leading to stronger earnings as office spaces experience higher demand.

- The ongoing strength in VC investment and business formation, particularly in the AI industry in the Bay Area, suggests a favorable long-term revenue growth outlook as Kilroy capitalizes on this trend.

- Kilroy's strategic acquisition of Junction at Del Mar demonstrates an ability to achieve compelling risk-adjusted returns, which could result in improved earnings and cash flow stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $44.2 for Kilroy Realty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $59.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $155.4 million, and it would be trading on a PE ratio of 39.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of $40.45, the analyst's price target of $44.2 is 8.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives