Key Takeaways

- Rapid growth in generative AI and tech sectors, along with tenant demand for premium, sustainable spaces, are driving higher occupancy and rent potential for Kilroy.

- Strong focus on high-quality life science developments and prudent financial management position Kilroy for long-term growth, earnings stability, and investment flexibility.

- Persistent pricing power erosion, rising vacancy risks, large development exposures, geographic concentration, and increased leasing concessions all threaten Kilroy Realty’s long-term margins and revenue stability.

Catalysts

About Kilroy Realty- Kilroy Realty Corporation (NYSE: KRC, the “Company”, “Kilroy”) is a leading U.S.

- Kilroy is seeing a surge in leasing demand tied to the rapid growth of generative AI and tech sectors, particularly in West Coast innovation hubs like San Francisco and Seattle, driven by new AI business formation, RTO mandates, and expanding footprints of tech firms—this should fuel higher future occupancy and rental income growth.

- Investor and tenant preference for sustainable, energy-efficient, and amenity-rich office and life science buildings is accelerating, and Kilroy's industry-leading portfolio of LEED-certified, high-quality assets is capturing disproportionate demand, which will likely drive both sustained rent premiums and improved net operating margins.

- Expansion and sustained tenant engagement in Kilroy’s life sciences developments—most notably the KOP Phase 2 project in South San Francisco, where users are seeking large, scalable lab space—position Kilroy to participate in powerful secular growth in biotechnology, supporting robust future revenue and net income as new leases convert and stabilize.

- The ongoing shift toward consolidating into best-in-class, mixed-use, and flexible work environments is creating a flight-to-quality that disproportionately benefits Kilroy's modern, premium assets and campus settings, supporting long-term occupancy and allowing for stronger rent roll-ups that directly boost earnings power.

- Prudent balance sheet management, monetization of non-core land and assets, and redeployment into high-yielding development or share repurchases provide Kilroy significant financial flexibility, enabling opportunistic investments that will support long-run earnings stability, capacity for buybacks, and potential upside to EPS.

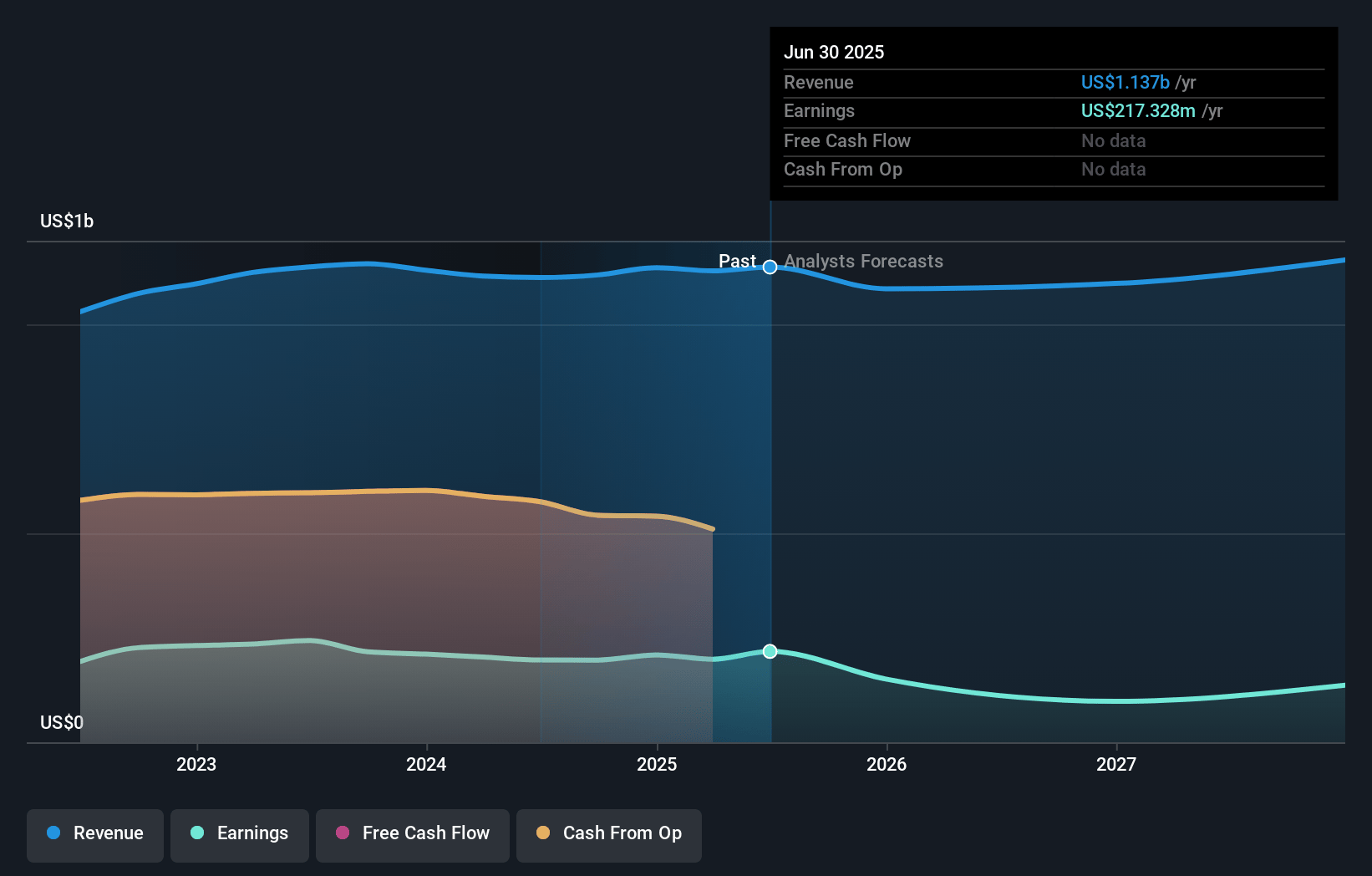

Kilroy Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kilroy Realty compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kilroy Realty's revenue will grow by 2.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 17.6% today to 13.3% in 3 years time.

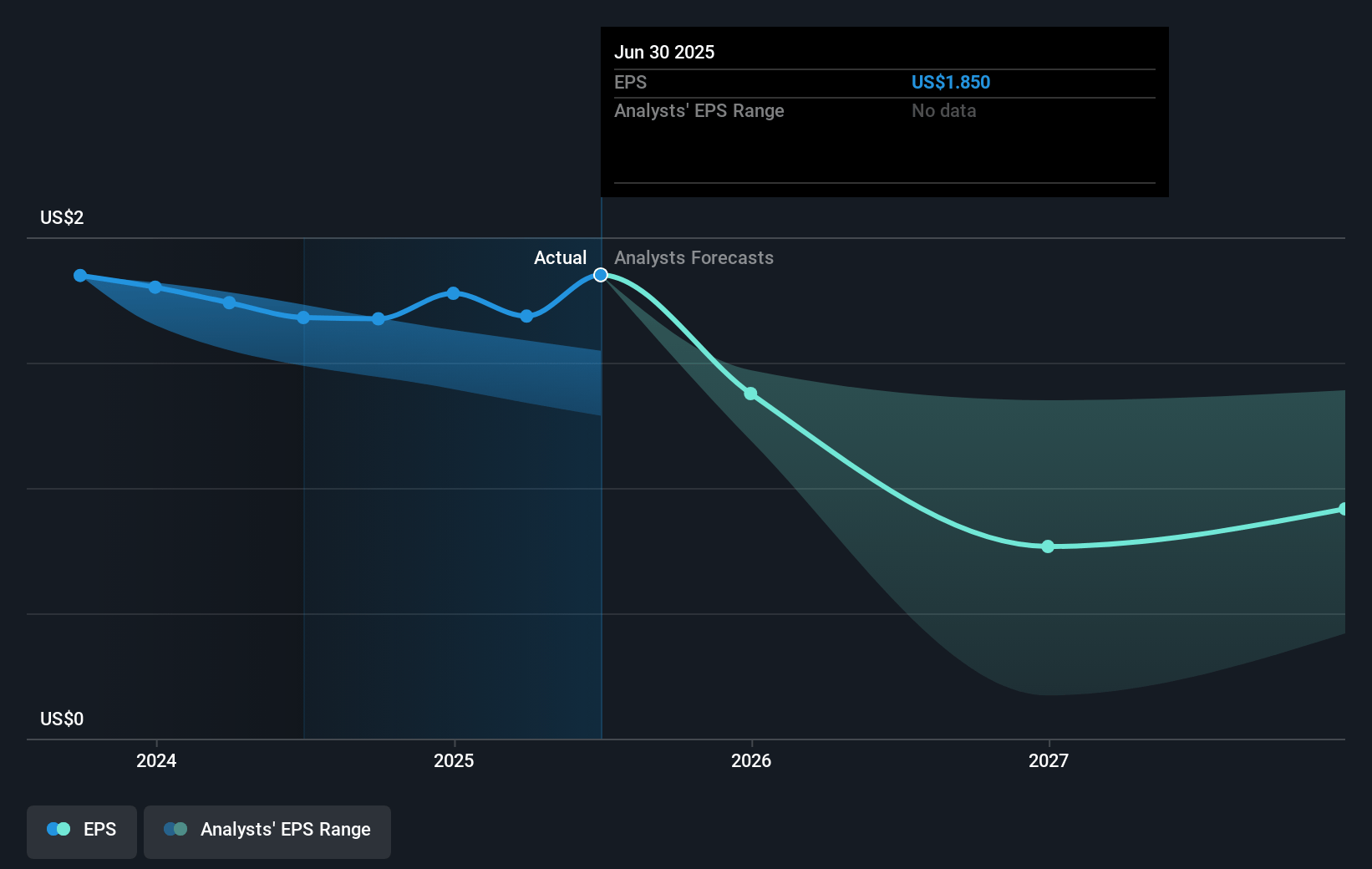

- The bullish analysts expect earnings to reach $160.6 million (and earnings per share of $1.36) by about July 2028, down from $198.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.9x on those 2028 earnings, up from 22.6x today. This future PE is lower than the current PE for the US Office REITs industry at 50.1x.

- Analysts expect the number of shares outstanding to grow by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.93%, as per the Simply Wall St company report.

Kilroy Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent negative re-leasing spreads (reported at negative fifteen point eight percent on a GAAP basis and negative twenty-three percent on a cash basis in the quarter), along with overall lower base rent renewals, highlight ongoing pricing power erosion, which threatens long-term net margins and earnings growth for Kilroy Realty.

- Reported quarter-end office occupancy dropped to eighty-one point four percent, coupled with a three hundred basis point decline in occupancy year-over-year; this trend, exacerbated by hybrid and remote work adoption, signals structurally higher vacancy risks that will weigh on future revenue stability and net operating income.

- Kilroy’s substantial ongoing development commitments (notably KOP 2 and the Flower Mart redevelopment) require large amounts of capital, and if leasing momentum falters or interest capitalization ceases earlier, the company could face balance sheet constraints and higher debt ratios, reducing funds from operations and overall return on equity.

- The company’s heavy concentration in West Coast urban markets, particularly San Francisco, Los Angeles, and Seattle, leaves it vulnerable to regional economic volatility and continued tech sector uncertainty, thus increasing the risk of top-line revenue declines if demand weakens or large tenants do not renew.

- A highly competitive and structurally oversupplied office environment forces Kilroy to offer aggressive concessions and tenant improvements to secure leases, which, in an industry shifting towards flexible workspace providers and lower space per employee, further compresses margins and threatens asset values over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kilroy Realty is $51.2, which represents two standard deviations above the consensus price target of $38.07. This valuation is based on what can be assumed as the expectations of Kilroy Realty's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $59.0, and the most bearish reporting a price target of just $33.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $160.6 million, and it would be trading on a PE ratio of 48.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of $37.98, the bullish analyst price target of $51.2 is 25.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.