Last Update07 May 25Fair value Decreased 4.62%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Strategic focus on grocery-anchored centers and rapid space upgrades drive expectations for stable revenue and improved occupancy.

- Strong financial position and stock repurchases indicate management's confidence and potential for positive earnings impact.

- Uncertain economic conditions and tenant risks may hinder Kimco Realty's revenue growth, earnings potential, and net margins due to increased credit loss provisions and interest expenses.

Catalysts

About Kimco Realty- Kimco Realty (NYSE: KIM) is a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the United States.

- Kimco Realty's strategic focus on high-quality grocery-anchored shopping centers has led to signing 583 leases with significant rent spreads, contributing to robust revenue growth expectations.

- The company's ability to backfill and upgrade spaces quickly after tenant bankruptcies like Party City and Big Lots suggests potential for improved occupancy and revenue stability.

- Strategic acquisitions and structured investment programs create a pipeline for future external growth, potentially increasing net income and revenue.

- Financial strength, as demonstrated by $2 billion in liquidity and recent debt repayment, provides flexibility to capitalize on growth opportunities, potentially impacting earnings positively.

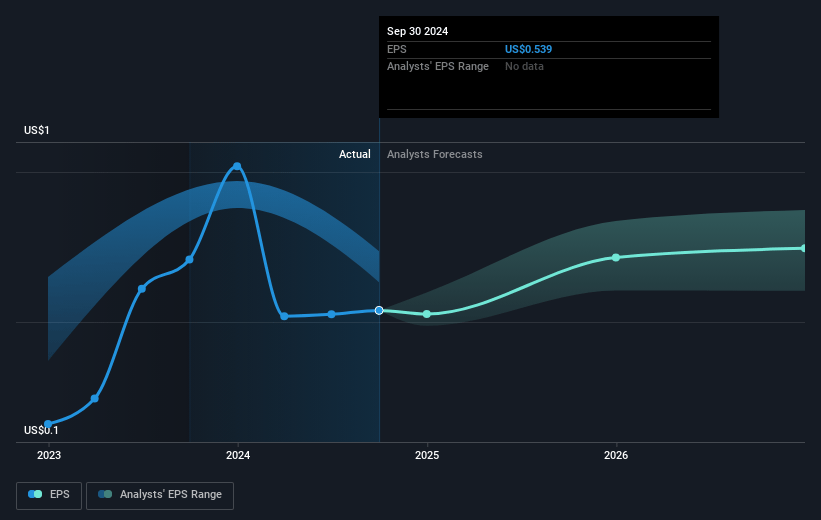

- Stock repurchases at significant discounts suggest management confidence in future earnings growth and could lead to increases in earnings per share (EPS).

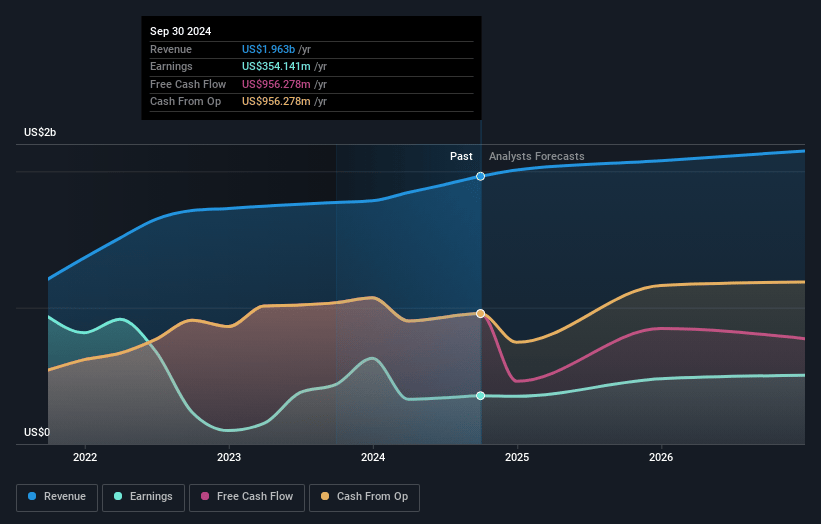

Kimco Realty Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kimco Realty's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.9% today to 23.5% in 3 years time.

- Analysts expect earnings to reach $540.6 million (and earnings per share of $0.81) by about May 2028, up from $515.4 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $615.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.9x on those 2028 earnings, up from 27.2x today. This future PE is greater than the current PE for the US Retail REITs industry at 28.4x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Kimco Realty Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The macroeconomic environment remains uncertain with potential impact from tariffs, trade dynamics, and the broader economic landscape, which could hinder transaction volumes and adversely affect revenue growth.

- The outlook for transaction volumes and cap rates remains cautious, which could limit accretive acquisition opportunities and impact future earnings potential.

- Bankruptcy and tenant credit risks, highlighted by the Party City, Big Lots, and JOANN cases, may result in temporary occupancy dips and increased credit loss provisions, potentially affecting net income and margins.

- Higher interest expenses and lower interest income relative to structured investments may pressure net income, particularly in the context of ongoing market volatility and rising interest rates.

- Dispositions of long-term ground leases and non-income producing assets are being targeted as a funding strategy, but reliance on such transactions in uncertain markets could pose risks to anticipated revenue inflows and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.036 for Kimco Realty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $540.6 million, and it would be trading on a PE ratio of 37.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of $20.61, the analyst price target of $24.04 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.