Last Update 06 Sep 25

Despite a modest decline in the future P/E ratio, indicating marginally improved earnings expectations, Independence Realty Trust’s consensus analyst price target remained unchanged at $21.04.

What's in the News

- The company repurchased zero shares under its buyback program between April 1 and June 30, 2025, with no change since the May 18, 2022 announcement.

- Raised full-year 2025 earnings guidance to $0.475–$0.535 per share, up from previous guidance of $0.19–$0.22.

Valuation Changes

Summary of Valuation Changes for Independence Realty Trust

- The Consensus Analyst Price Target remained effectively unchanged, at $21.04.

- The Future P/E for Independence Realty Trust has fallen slightly from 84.96x to 82.92x.

- The Discount Rate for Independence Realty Trust remained effectively unchanged, moving only marginally from 7.44% to 7.52%.

Key Takeaways

- Strong Sun Belt demand, technology adoption, and strategic asset recycling support higher occupancy, improved margins, and resilient revenue growth in multifamily rentals.

- Elevated homeownership barriers extend renter tenure, reinforcing long-term pricing power, stable cash flows, and enhanced earnings potential.

- Persistent oversupply, competitive pressures, and reliance on asset sales create uncertainty for revenue growth, margin stability, and long-term earnings potential in core markets.

Catalysts

About Independence Realty Trust- Independence Realty Trust, Inc. (NYSE: IRT) is a real estate investment trust that owns and operates multifamily communities, across non-gateway U.S.

- The tapering of new multifamily supply and a 43% year-over-year reduction in deliveries projected for IRT's Sun Belt-focused markets in 2026 positions the company for a reacceleration of rent growth and stronger occupancy as demand continues to outpace incoming inventory, which should drive future revenue and NOI growth.

- Sustained strong demographic tailwinds-including millennial and Gen Z household formation and Sun Belt migration-are reflected in rising lead and tour volumes and high retention rates, supporting expectations for high occupancy and steady rent roll, which directly underpin future top-line revenue and stabilized net operating margins.

- Ongoing capital recycling-selling older, higher CapEx assets to acquire newer, lower CapEx communities with higher growth profiles in high-demand regions-allows IRT to enhance portfolio quality, capture operating synergies, and improve overall net margins and earnings growth potential.

- Accelerated implementation of technology, such as AI-driven leasing tools and market cluster acquisitions in Orlando, is delivering expense efficiencies and scale-driven operating synergies, which will lower G&A and property management costs, enhancing operating margins and supporting long-term FFO per share growth.

- High affordability barriers for single-family homeownership, underpinned by elevated home prices and mortgage rates, continue to extend renter tenure and bolster demand for mid-market multifamily rentals, strengthening IRT's pricing power and cash flow visibility, positively impacting future revenue stability and earnings resilience.

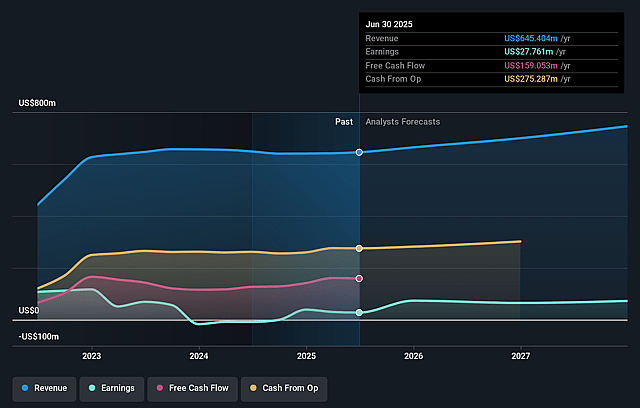

Independence Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Independence Realty Trust's revenue will grow by 5.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 10.8% in 3 years time.

- Analysts expect earnings to reach $82.3 million (and earnings per share of $0.35) by about September 2028, up from $27.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $52.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 85.0x on those 2028 earnings, down from 148.2x today. This future PE is greater than the current PE for the US Residential REITs industry at 31.7x.

- Analysts expect the number of shares outstanding to grow by 3.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Independence Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing and unexpected oversupply in key Sun Belt markets such as Dallas, Denver, and Charlotte is leading to negative new lease trade-outs and suppressed rent growth, which directly pressures revenue and net operating income (NOI).

- Aggressive leasing concessions from new Class A apartment deliveries are attracting tenants away from IRT's predominantly Class B portfolio, making it harder to push rents and increasing the risk of stagnating or declining earnings growth.

- Reliance on disposing older, higher CapEx assets to fund acquisitions poses a risk if market conditions change or if projected accretive acquisitions underperform, which could lead to lower returns on invested capital and potentially compress margins.

- Lower-than-expected revenue growth, even as expense reductions have helped offset this in the near term, indicates underlying softness that could reverse if operating costs begin to rise again or if supply pressures persist, constraining long-term earnings power.

- Delays or inaccuracies in supply forecasts-such as deliveries being pulled forward into current periods-signal that IRT's core growth markets may continue to face volatility, making sustained blended rent growth and occupancy improvement less predictable and putting medium

- to long-term revenue and FFO-per-share growth at risk.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.036 for Independence Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $19.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $759.4 million, earnings will come to $82.3 million, and it would be trading on a PE ratio of 85.0x, assuming you use a discount rate of 7.4%.

- Given the current share price of $17.62, the analyst price target of $21.04 is 16.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.