Last Update07 May 25Fair value Decreased 0.32%

Key Takeaways

- Rapid digital adoption and ESG pressures are eroding demand for physical storage, driving up compliance costs and threatening Iron Mountain’s core business margins and growth.

- Expanding aggressively in data centers raises execution and integration risks, while market oversupply and high debt levels expose Iron Mountain to profitability and financing challenges.

- Diversified expansion into data centers, digital platforms, and asset management is driving sustained high-margin growth, operating leverage, and global market presence.

Catalysts

About Iron Mountain- Iron Mountain Incorporated (NYSE: IRM) is trusted by more than 240,000 customers in 61 countries, including approximately 95% of the Fortune 1000, to help unlock value and intelligence from their assets through services that transcend the physical and digital worlds.

- The relentless shift towards fully digital document management is expected to accelerate, further eroding demand for Iron Mountain’s high-margin physical records storage services and putting continued downward pressure on legacy revenue and net margins as high-volume customers transition away from traditional storage.

- Data center markets face the risk of significant oversupply as competitors and hyperscale cloud providers aggressively build new capacity, creating the potential for pricing pressure, diminished leasing activity, and declining returns on Iron Mountain’s substantial data center investments, which could negatively impact both revenue and overall profitability.

- Iron Mountain’s aggressive global expansion and acquisition-fueled growth in data centers and asset lifecycle management heightens execution risk, with substantial capital commitments and the possibility that integration challenges or underperforming assets may lead to future impairment charges and lower net income.

- Persistent ESG and sustainability pressures threaten to increase compliance and operational costs for Iron Mountain’s energy-intensive physical storage and data center businesses, potentially forcing higher capital expenditures or driving away environmentally-conscious customers, directly impacting margins and earnings growth.

- Iron Mountain’s elevated debt levels and reliance on low-cost financing leave it exposed to rising interest rates and tighter credit markets, which would elevate interest expense, constrain growth investments, and diminish future earnings and cash flow coverage for dividends.

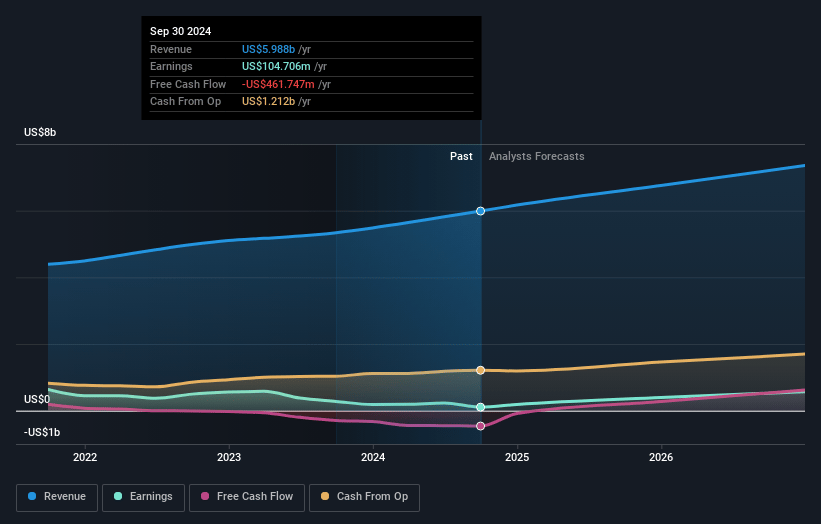

Iron Mountain Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Iron Mountain compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Iron Mountain's revenue will grow by 5.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.9% today to 7.1% in 3 years time.

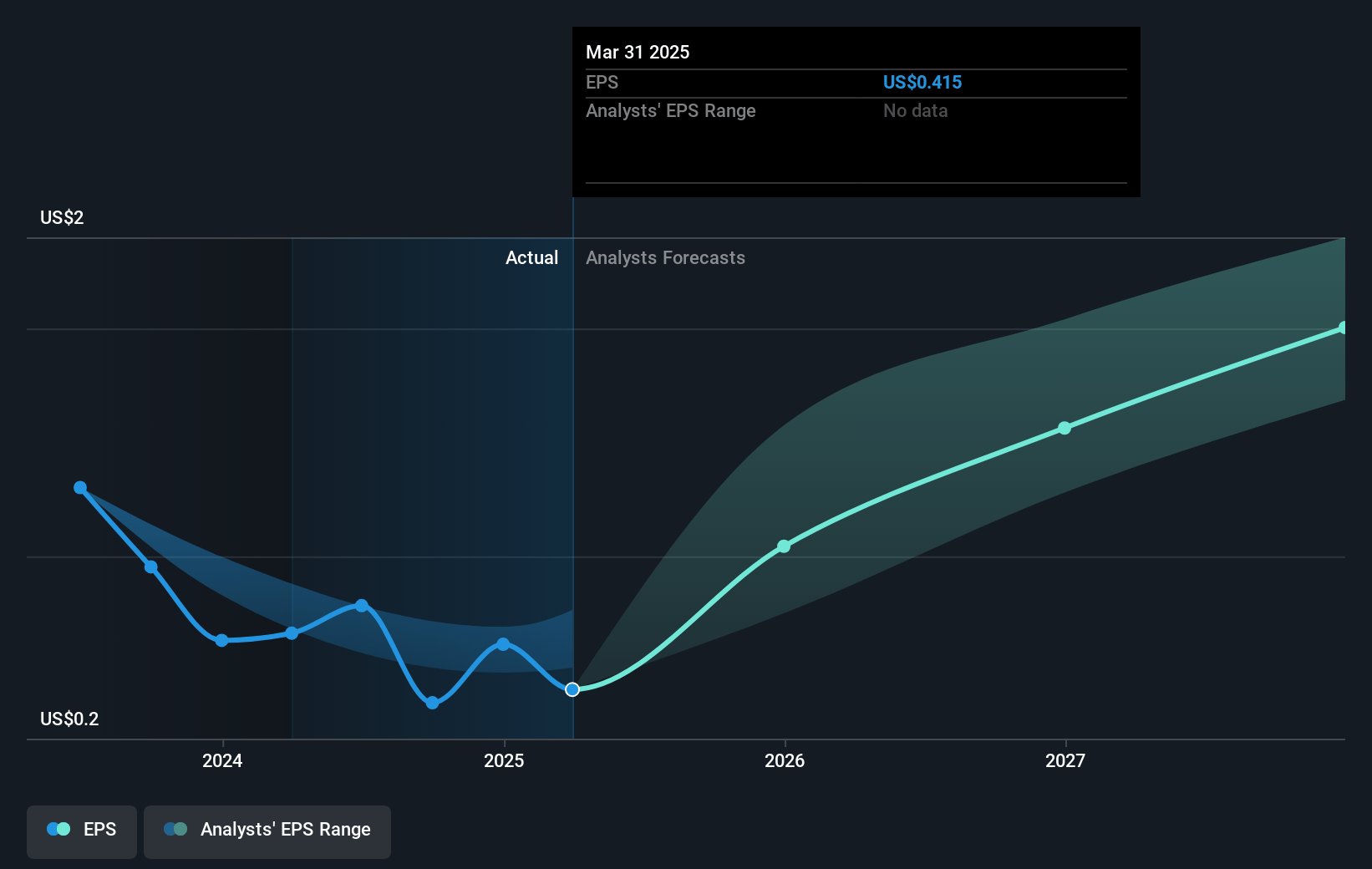

- The bearish analysts expect earnings to reach $514.8 million (and earnings per share of $1.69) by about May 2028, up from $122.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 45.5x on those 2028 earnings, down from 235.2x today. This future PE is greater than the current PE for the US Specialized REITs industry at 29.5x.

- Analysts expect the number of shares outstanding to grow by 0.65% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

Iron Mountain Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Iron Mountain is delivering consistent double-digit growth, with all-time high quarterly revenues and robust organic growth across its diversified businesses, suggesting the company’s cross-selling strategy and broader product portfolio are structurally increasing revenues and operating leverage.

- The company’s expansion into data centers, digital platforms, and asset life cycle management leverages long-term digitalization and regulatory trends, driving sustained customer demand and providing recurring, higher margin revenue streams, directly supporting stronger earnings and net margins.

- The Data Center segment is experiencing significant organic growth and pricing power, evidenced by 24% organic storage growth, strong market pipelines in North America, Europe, and India, and rising per kilowatt prices, all of which reinforce both top-line growth and margin expansion.

- The Asset Life Cycle Management business is showing strong momentum, with 44% revenue growth in the quarter and a shift toward higher-margin enterprise business, which enhances blended EBITDA margins and provides resilience against cyclical risks.

- Ongoing international expansion and strategic tuck-in acquisitions are broadening Iron Mountain’s customer base and geographic footprint, enabling access to large, fragmented markets and supporting long-term sustainable revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Iron Mountain is $63.04, which represents two standard deviations below the consensus price target of $115.0. This valuation is based on what can be assumed as the expectations of Iron Mountain's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $44.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $7.3 billion, earnings will come to $514.8 million, and it would be trading on a PE ratio of 45.5x, assuming you use a discount rate of 7.4%.

- Given the current share price of $97.31, the bearish analyst price target of $63.04 is 54.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.