Key Takeaways

- Legalization and increased financing access threaten the company's core business model, diminishing premium lease rates and long-term earnings potential.

- High tenant concentration and evolving industry trends expose the company to default risks, vacancy, and reduced demand for specialized facilities.

- Expanding cannabis demand, prudent property management, financial strength, and strategic investments position the company for stable revenue, lower risk, and enhanced shareholder value.

Catalysts

About Innovative Industrial Properties- A real estate investment trust (REIT) focused on the acquisition, ownership and management of specialized industrial properties leased to experienced, state-licensed operators for their regulated cannabis facilities.

- The potential removal of federal cannabis restrictions could enable cannabis operators to access traditional financing and real estate solutions, significantly reducing the company's specialized client base and eroding its ability to command premium lease rates, resulting in long-term pressure on rental revenue and jeopardizing future earnings growth.

- Structurally higher interest rates threaten to elevate borrowing costs and lower property values, which would compress acquisition yields and put sustained pressure on net margins and overall profitability, especially if debt levels increase as IIPR pursues new investments.

- The company's high tenant concentration risk-evidenced by multiple recent defaults and ongoing use of security deposits to cover lost rent-indicates that even isolated tenant failures can cause disproportionate drops in revenue and higher vacancy rates, directly impairing earnings and net cash flow going forward.

- Yield compression from increased financing options and greater competition in the cannabis real estate market as legalization progresses will likely drive down future lease rates, dampening IIPR's ability to maintain current levels of rental income, limiting earnings growth, and increasing the risk of underperforming properties.

- Environmental regulatory tightening and advancements in cultivation technology could reduce the long-term demand for IIPR's energy-intensive, highly specialized indoor facilities, diminishing occupancy rates and impairing net operating income as the market shifts towards less costly and more flexible alternatives.

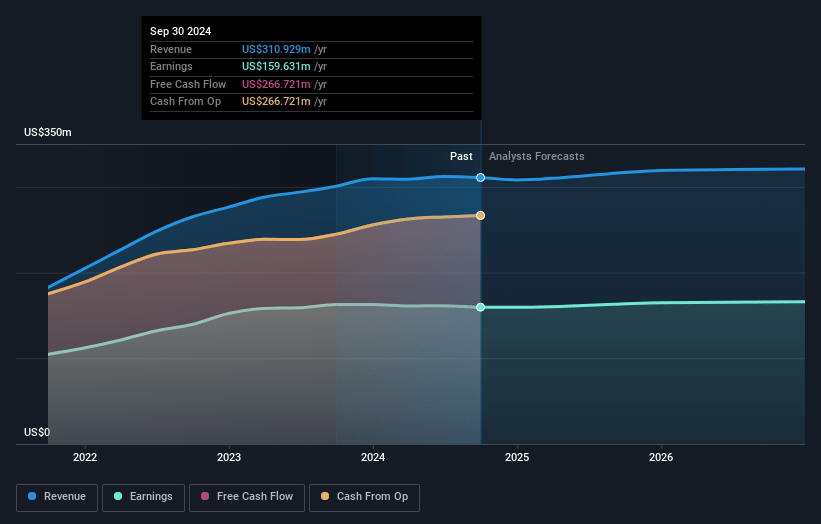

Innovative Industrial Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Innovative Industrial Properties compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Innovative Industrial Properties's revenue will decrease by 9.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 48.8% today to 43.6% in 3 years time.

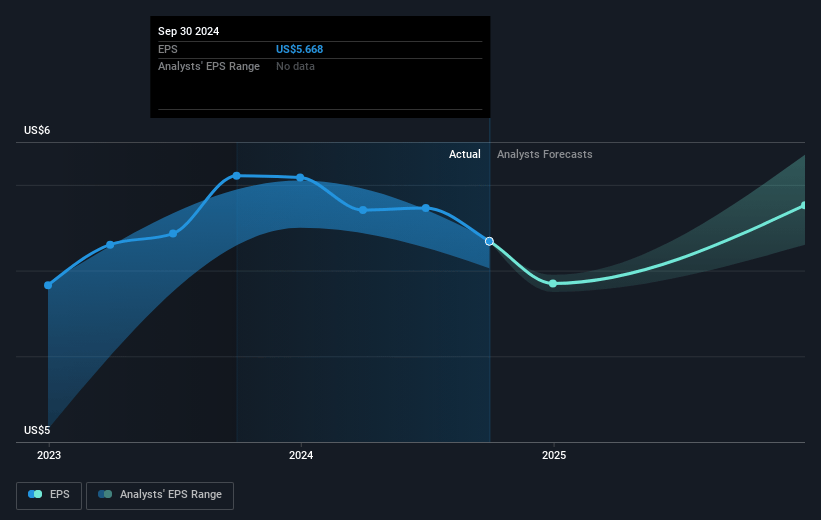

- The bearish analysts expect earnings to reach $98.1 million (and earnings per share of $3.4) by about July 2028, down from $148.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.4x on those 2028 earnings, up from 10.3x today. This future PE is lower than the current PE for the US Industrial REITs industry at 28.2x.

- Analysts expect the number of shares outstanding to decline by 1.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

Innovative Industrial Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Progress on state-level and potential federal cannabis legalization, coupled with a forecasted 7.2% annual growth in U.S. cannabis sales through 2029, indicates expanding demand for specialized real estate, which could drive higher occupancy and revenue for IIPR.

- Management has demonstrated the ability to quickly re-tenant properties with strong operators, as seen in the re-leasing of nearly 1 million square feet since late 2023, which supports stable or potentially improving rental income and limits prolonged vacancy losses.

- The company maintains a strong balance sheet with only $291 million in fixed-rate debt maturing in 2026, a low debt to gross assets ratio of 11%, and robust liquidity of over $220 million, all of which provide financial resilience and flexibility to pursue value-accretive opportunities that could support future earnings.

- Significant interest from a broad pipeline of new, more financially stable cannabis operators-especially as IIPR refreshes its tenant base-reduces credit risk over time and positions the company for greater revenue and margin stability.

- Strategic share repurchases and capital recycling, along with an ongoing disciplined investment approach, may enhance shareholder value and support returns, ultimately benefiting net margins and potentially driving positive movements in the company's share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Innovative Industrial Properties is $45.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Innovative Industrial Properties's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $224.9 million, earnings will come to $98.1 million, and it would be trading on a PE ratio of 15.4x, assuming you use a discount rate of 7.5%.

- Given the current share price of $54.83, the bearish analyst price target of $45.0 is 21.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.