Key Takeaways

- Increased office leasing and capitalizing on AI sector growth could lead to significant future revenue and net margin improvements.

- Asset sales and balance sheet enhancements offer flexibility for managing debt, bolstering financial stability and earning capacity.

- Intense competition, leasing challenges, liquidity constraints, and revenue instability highlight future risks to Hudson Pacific Properties' earnings and financial stability.

Catalysts

About Hudson Pacific Properties- Hudson Pacific Properties (NYSE: HPP) is a real estate investment trust serving dynamic tech and media tenants in global epicenters for these synergistic, converging and secular growth industries.

- Hudson Pacific Properties is seeing increased office leasing activity, with office leasing up nearly 20% year-over-year and significant new deals in the pipeline, indicating potential future revenue growth.

- The company's cost-cutting initiatives have already produced significant savings, with expectations for further reductions, likely improving net margins and earnings.

- Hudson Pacific Properties is capitalizing on the growth of AI companies, which are heavily investing in office space in the Bay Area, potentially boosting future revenue.

- The anticipated increase in California's film and television tax credit could stimulate demand for the company's studio operations, leading to potential rises in revenue and net margins.

- Asset sales and balance sheet improvements are providing flexibility to handle upcoming debt maturities, potentially enhancing financial stability and future earnings capacity.

Hudson Pacific Properties Future Earnings and Revenue Growth

Assumptions

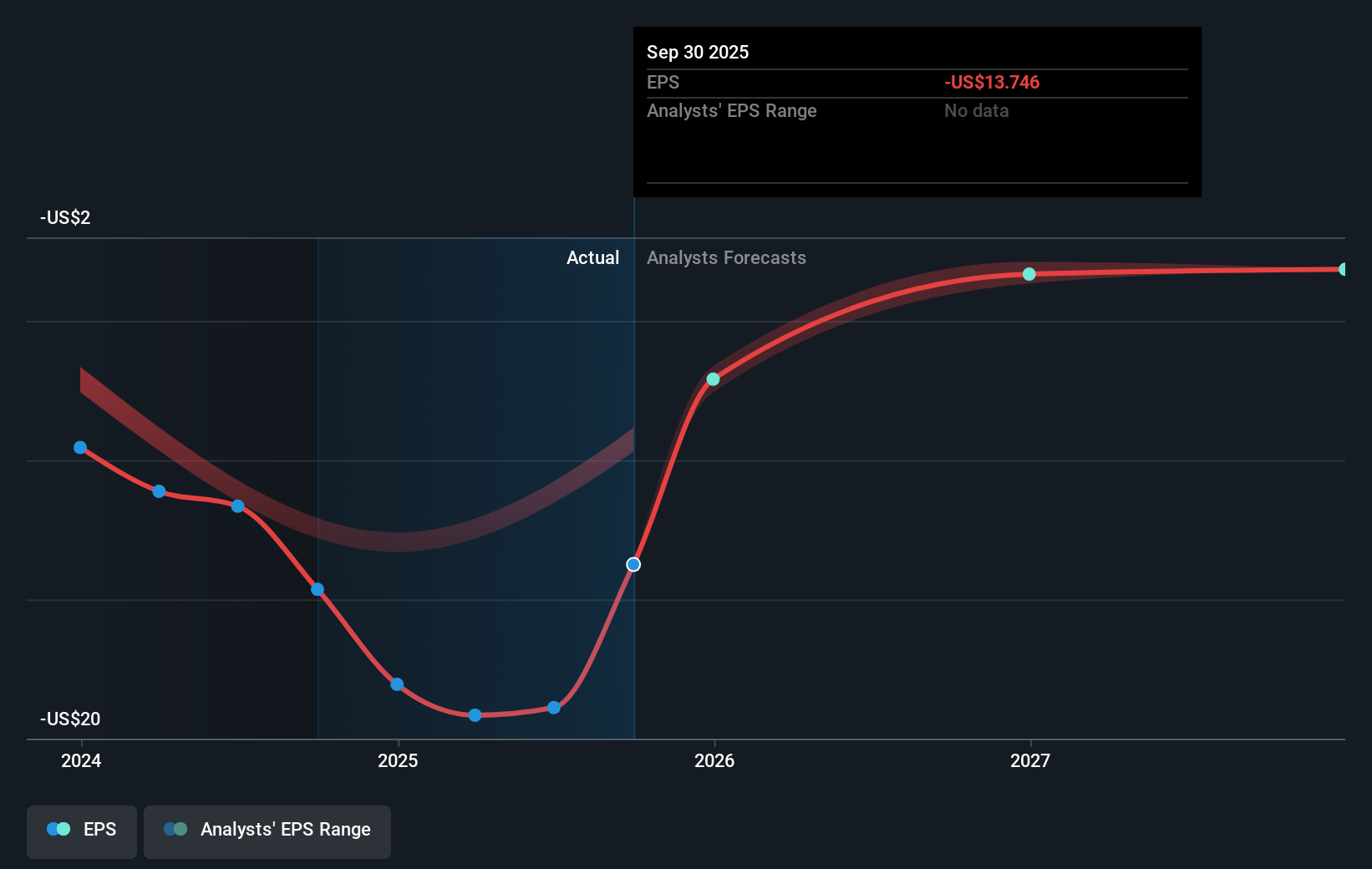

How have these above catalysts been quantified?- Analysts are assuming Hudson Pacific Properties's revenue will grow by 2.8% annually over the next 3 years.

- Analysts are not forecasting that Hudson Pacific Properties will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Hudson Pacific Properties's profit margin will increase from -47.2% to the average US Office REITs industry of 6.0% in 3 years.

- If Hudson Pacific Properties's profit margin were to converge on the industry average, you could expect earnings to reach $53.2 million (and earnings per share of $0.14) by about July 2028, up from $-386.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.6x on those 2028 earnings, up from -2.5x today. This future PE is lower than the current PE for the US Office REITs industry at 50.1x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Hudson Pacific Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hudson Pacific Properties is facing significant competition in the office leasing market, with tenants having numerous options, potentially impacting future revenue and net margins.

- There is ongoing uncertainty in leasing spreads, with cash rent spreads down significantly, which could adversely affect revenue and net effective rent growth prospects.

- The impairment taken on the Quixote business due to slower-than-expected recovery post-strike indicates future risks to earnings from revenue contributions of studio operations.

- A significant decline in fourth-quarter revenue compared to the previous year, primarily due to property sales and tenant exit, highlights potential stability issues in revenue streams.

- The modifications to the credit facility suggest potential liquidity constraints and the need for continued asset sales or financings, posing a risk to earnings and leverage ratios.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.24 for Hudson Pacific Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $1.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $888.8 million, earnings will come to $53.2 million, and it would be trading on a PE ratio of 32.6x, assuming you use a discount rate of 11.6%.

- Given the current share price of $2.57, the analyst price target of $3.24 is 20.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.