Key Takeaways

- Strong tenant relationships contribute to sustained revenue growth and reduced vacancy risks, positively impacting future earnings and asset valuations.

- Strategic investments and improved operational efficiencies are expected to boost AFFO, net margins, and overall earnings while maintaining a strong balance sheet.

- Increased competition, concentration risk in the carwash sector, and reliance on existing relationships may pressure investment yields and hinder earnings growth.

Catalysts

About Essential Properties Realty Trust- A real estate company, acquires, owns, and manages single-tenant properties in the United States.

- Essential Properties Realty Trust's strong tenant relationships, with 79% of its investments generated from existing relationships, indicate a reliable source of sustained revenue growth and lower vacancy risks impacting future revenue positively.

- The company expects to invest $900 million to $1.1 billion in 2025 with cap rates slightly below 2024 levels due to anticipated competition, suggesting strategic growth in quality assets at consistent yields, potentially boosting AFFO and overall earnings.

- As capital markets stabilize, the projected competitive market could lead to lower cap rates, improving asset valuation and increasing the company's attractiveness, enhancing net margins in the long run.

- Improved operational efficiencies and scaling effects are anticipated to decrease G&A as a percentage of revenue, driving stronger net margins and contributing to higher overall earnings.

- Essential Properties maintains a well-leveraged balance sheet with pro forma leverage of 3.5x and substantial liquidity, positioning it to opportunistically expand its portfolio, safeguarding earnings and shareholder value growth.

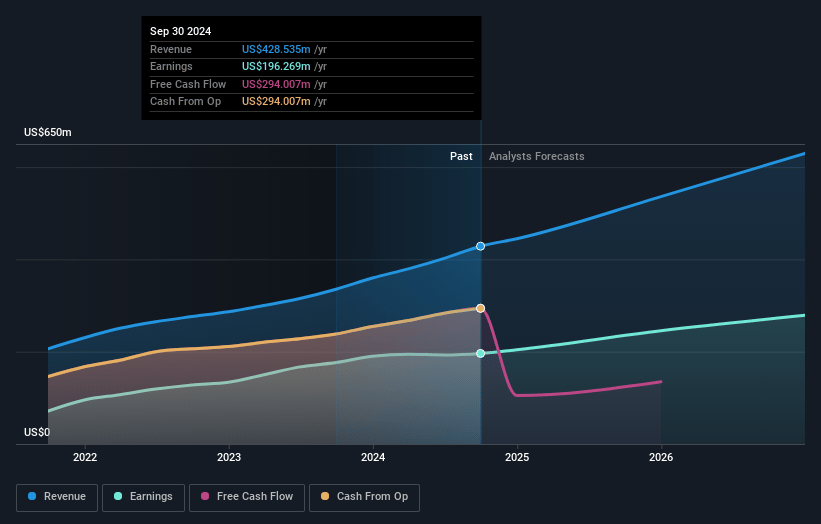

Essential Properties Realty Trust Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Essential Properties Realty Trust's revenue will grow by 17.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.8% today to 40.5% in 3 years time.

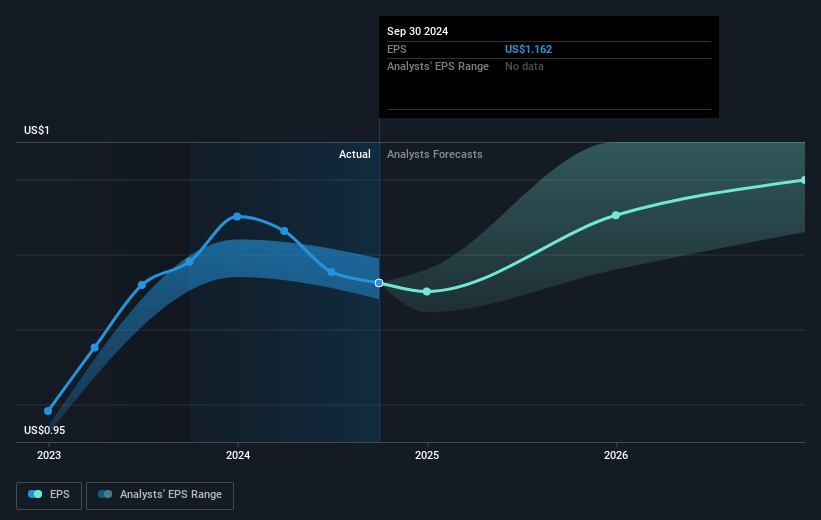

- Analysts expect earnings to reach $282.3 million (and earnings per share of $1.37) by about January 2028, up from $196.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $323.4 million in earnings, and the most bearish expecting $235 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.7x on those 2028 earnings, up from 28.5x today. This future PE is greater than the current PE for the US REITs industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 5.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

Essential Properties Realty Trust Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company anticipates modest cap rate compression due to increased competition as capital markets normalize, which could pressure investment yields and potentially affect future earnings growth.

- The potential impact of hurricanes and severe weather events on 103 properties in FEMA-affected regions poses a risk if insurance delays or costs negatively influence net margins.

- The significant exposure to the carwash industry exceeding their soft ceiling highlights concentration risk, which could impact revenue and profitability if that segment underperforms.

- Incremental dilution from unsettled forward equity creates a headwind to AFFO per share, which could negatively impact earnings growth if share price forces adjustments.

- A high proportion of investments derived from existing relationships limits diversification and may hinder revenue growth if those relationships do not scale or face competitive pressures.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.69 for Essential Properties Realty Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $29.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $697.8 million, earnings will come to $282.3 million, and it would be trading on a PE ratio of 31.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of $31.9, the analyst's price target of $35.69 is 10.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives