Key Takeaways

- Strategic investments in experiential assets and theater upgrades aim to boost revenue by meeting consumer demand and enhancing experiences.

- Strengthened liquidity and a focused spin-off strategy are expected to enhance strategic operations and financial resilience.

- Risks from natural disasters, rising insurance costs, and declining theater revenue coverage may impact EPR Properties' future earnings and profitability.

Catalysts

About EPR Properties- EPR Properties (NYSE:EPR) is the leading diversified experiential net lease real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry.

- The new $1 billion revolving credit facility strengthens EPR Properties' liquidity and financial positioning, expected to support strategic investments and improve future earnings.

- Investments in non-commodity experiential assets like climbing gyms and hot springs are likely to meet growing consumer demand for wellness-focused experiences, which could boost revenue over time.

- The planned modernization and upgrades of theaters by major chains could enhance the consumer experience, potentially increasing attendance and boosting revenue and net margins as theaters recover.

- The spin-off of Topgolf into a separate entity is expected to enhance strategic focus and improve operations, which may contribute positively to earnings from EPR's Topgolf properties.

- Strengthening the film release slate through 2025 is expected to drive a recovery in box office performance, potentially improving revenue and net earnings associated with EPR’s theater portfolio.

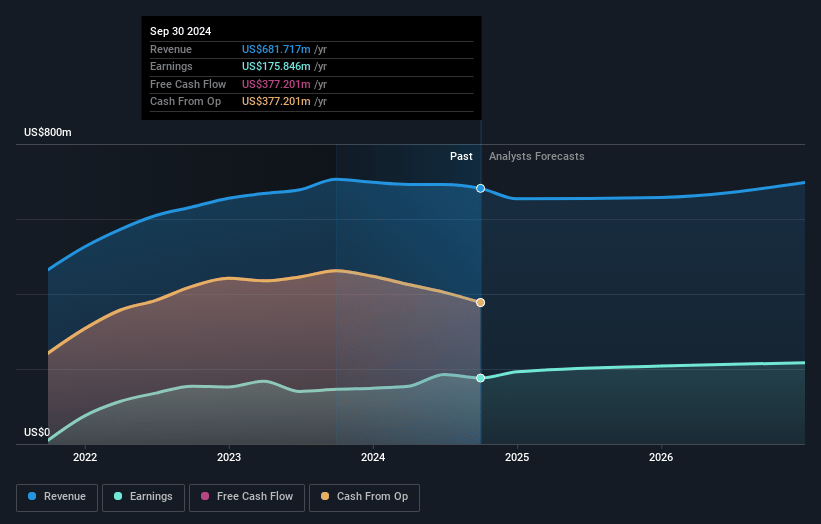

EPR Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EPR Properties's revenue will decrease by 0.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 25.8% today to 31.0% in 3 years time.

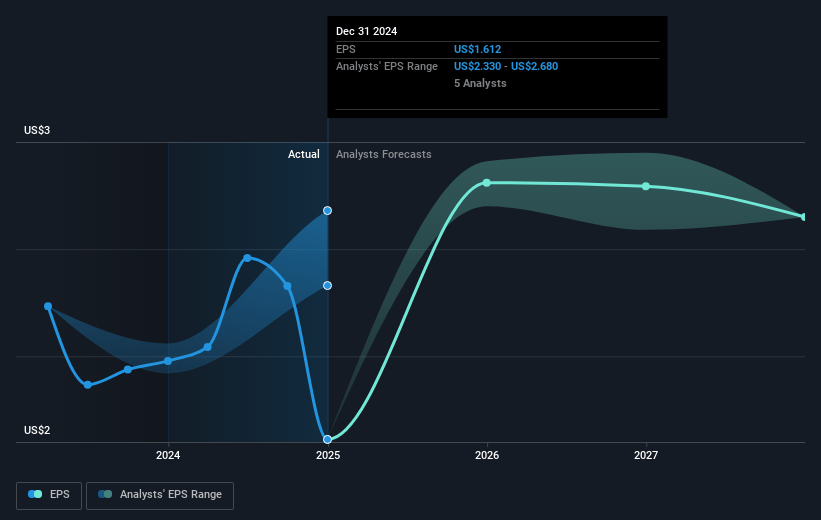

- Analysts expect earnings to reach $216.1 million (and earnings per share of $2.67) by about January 2028, up from $175.8 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $242.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, up from 20.2x today. This future PE is lower than the current PE for the US Specialized REITs industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 2.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.06%, as per the Simply Wall St company report.

EPR Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- EPR Properties faces risks from natural disasters, as evidenced by the significant damage to their hotel properties in St. Petersburg Beach due to Hurricanes Helene and Milton, leading to impairment charges and potential losses. This could impact future earnings and asset valuations.

- The company's theater coverage has declined due to production calendar issues and past writers' and actors' strikes, which could affect the stability and growth of revenue from their theater investments.

- There is a noted decrease in EBITDARM in certain properties influenced by expense pressures and slight revenue decreases, which could negatively impact net margins if such conditions persist.

- Significant increases in insurance and interest costs, especially in hurricane-prone areas like Florida, may affect overall profitability and net margins if similar climate-related incidents reoccur.

- EPR Properties revealed a slight overall decline in portfolio coverage and specific theater assets, suggesting potential future revenue volatility if box office performance does not continue its recovery as forecasted.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $48.73 for EPR Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $54.0, and the most bearish reporting a price target of just $43.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $696.2 million, earnings will come to $216.1 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 7.1%.

- Given the current share price of $47.01, the analyst's price target of $48.73 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives