Key Takeaways

- Strong urban travel demand and shifting work trends are expected to boost occupancy, rates, and provide a more resilient revenue base.

- Strategic asset renovations and disciplined expense management support margin expansion, while flexible capital allocation options offer potential for enhanced earnings growth.

- Persistent softness in leisure and group segments, elevated expenses, challenging acquisition environments, and regulatory disruptions threaten DiamondRock's revenue growth, margins, and capital deployment effectiveness.

Catalysts

About DiamondRock Hospitality- A self-advised real estate investment trust (REIT) that is an owner of a leading portfolio of geographically diversified hotels concentrated in leisure destinations and top gateway markets.

- The company is poised to benefit from strengthening group and business travel demand in urban markets, supported by a higher group revenue pace for 2026 (currently up double digits) and an improving corporate booking environment; this is likely to drive higher occupancy and accelerate RevPAR and earnings growth.

- The ongoing trend of millennials and Gen Z prioritizing travel experiences, combined with the expansion of flexible, remote, and hybrid work, is expected to increase both leisure and midweek bleisure demand, which should lift both occupancy and average daily rates, supporting topline revenue growth and a more resilient revenue base.

- Repositioning and renovation projects-most notably the integration of the Cliffs at L'Auberge in Sedona and ongoing asset recycling-are expected to yield stabilized double-digit cash returns and drive 25–50 basis points of portfolio RevPAR growth in 2026, enhancing net operating income margins and future FFO growth.

- Operational cost control, evidenced by below-industry expense growth (excluding one-off property tax increases) and efficiency in labor management, is expected to continue supporting margin expansion and improving cash flow conversion into earnings.

- Significant unused share repurchase authorization and a recently upsized, flexible credit facility provide avenues for accretive capital allocation, supporting per-share FFO growth and potential upside to future earnings through opportunistic buybacks at implied high cap rates.

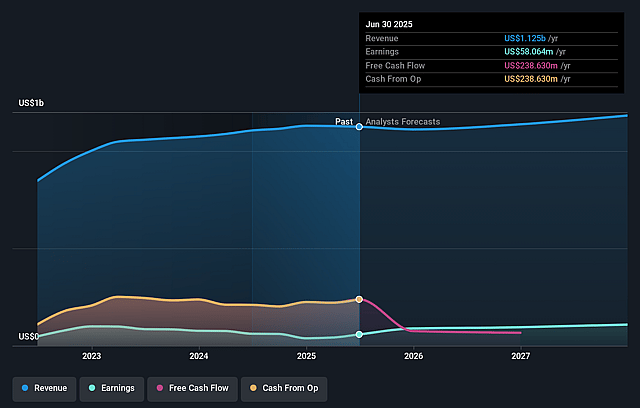

DiamondRock Hospitality Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DiamondRock Hospitality's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 10.0% in 3 years time.

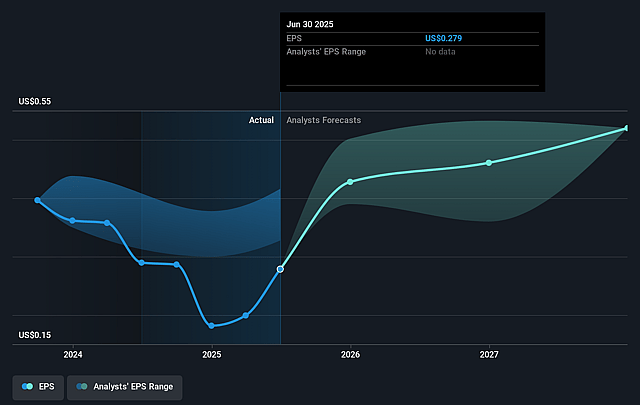

- Analysts expect earnings to reach $117.9 million (and earnings per share of $0.52) by about September 2028, up from $58.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.8x on those 2028 earnings, down from 29.5x today. This future PE is lower than the current PE for the US Hotel and Resort REITs industry at 29.5x.

- Analysts expect the number of shares outstanding to decline by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.86%, as per the Simply Wall St company report.

DiamondRock Hospitality Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Resort portfolio RevPAR declined significantly (down 6.3% comparable, 3.9% total) with further declines outside of impacted properties, indicating persistent softness in the leisure travel segment and raising concerns about the resilience of DiamondRock's revenue and margins in what has historically been a high-performing segment of their business.

- Group room revenue growth has been muted (up only 0.8%) and conversion rates remain sluggish due to continued reticence in an uncertain environment; with group typically accounting for 30% of portfolio revenue, prolonged softness in group bookings poses long-term risks to revenue growth and earnings stability.

- Expense pressures remain elevated in key urban markets, particularly with a larger-than-expected property tax increase in Chicago and 3.1% wage inflation, resulting in a 97 basis point contraction in hotel EBITDA margins; such taxation or wage risks in major urban centers could erode future net margins and diminish operating leverage.

- Asset recycling and acquisitions face headwinds as new resort and urban asset cap rates are tight after factoring in needed capital expenditures, making external growth via transactions less accretive; combined with the company's relatively small size, this could limit future ROI on capital deployment and pressure future earnings growth.

- Regulatory and policy disruptions, such as changes impacting foreign investment and local market volatility (e.g., delays in Sedona due to permitting), have recently hampered asset dispositions and project execution, exposing DiamondRock to long-term risks around revenue disruption, increased capex, and slower path to realizing asset value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.136 for DiamondRock Hospitality based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $117.9 million, and it would be trading on a PE ratio of 19.8x, assuming you use a discount rate of 8.9%.

- Given the current share price of $8.36, the analyst price target of $9.14 is 8.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.