Key Takeaways

- Repositioning toward upscale, experiential hotels aligns with rising demand for premium travel, supporting stronger margins and long-term asset value growth.

- Focused property upgrades, flexible balance sheet management, and catering to “bleisure” trends are driving higher earnings resilience and future dividend potential.

- Structural shifts in travel demand, rising costs, heavy capital needs, and strong alternative lodging competition threaten DiamondRock’s revenue stability, margins, and market share.

Catalysts

About DiamondRock Hospitality- A self-advised real estate investment trust (REIT) that is an owner of a leading portfolio of geographically diversified hotels concentrated in leisure destinations and top gateway markets.

- DiamondRock’s strategic repositioning towards high-end, resort-oriented, and experiential hotels is capitalizing on the sustained global shift in travel preferences toward premium leisure experiences, enabling the company to command higher average daily rates and superior occupancy for key assets—which will support robust revenue and net margin growth as affluent and international travel demand accelerates.

- The aging, wealthier population of Baby Boomers and Gen X is fueling increased spending on experiential travel, leading to both longer and more frequent hotel stays at upscale and resort properties; as DiamondRock’s portfolio is particularly aligned with this trend, the company is well positioned to drive sustained RevPAR growth and higher net asset value over the long term.

- Ongoing capital recycling into property renovations and brand repositioning—such as recent major upgrades in San Diego, Sedona, Boston, and New Orleans—has demonstrated the ability to meaningfully boost property-level NOI and RevPAR post-renovation, setting the stage for higher future EBITDA and margin expansion as these updated assets reach stabilization.

- The rise in remote and hybrid work is stimulating steady “bleisure” travel, expanding midweek and shoulder-season demand; DiamondRock’s urban and lifestyle properties are already seeing encouraging business transient and group recovery, which is likely to provide resilience and incremental upside to both revenues and earnings throughout multiple economic cycles.

- A disciplined approach to debt reduction and balance sheet flexibility, including mortgage refinancing and opportunistic share repurchases, is reducing interest expenses and focusing capital on high-return investments. This positions DiamondRock for improved per-share earnings growth and dividend potential as the travel and hospitality cycle continues to normalize and expand.

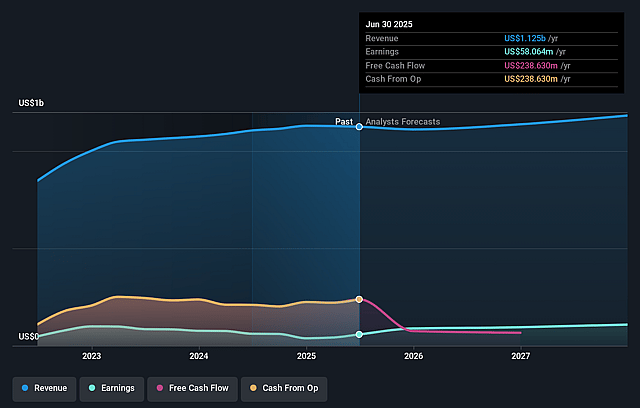

DiamondRock Hospitality Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on DiamondRock Hospitality compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming DiamondRock Hospitality's revenue will grow by 2.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.7% today to 11.0% in 3 years time.

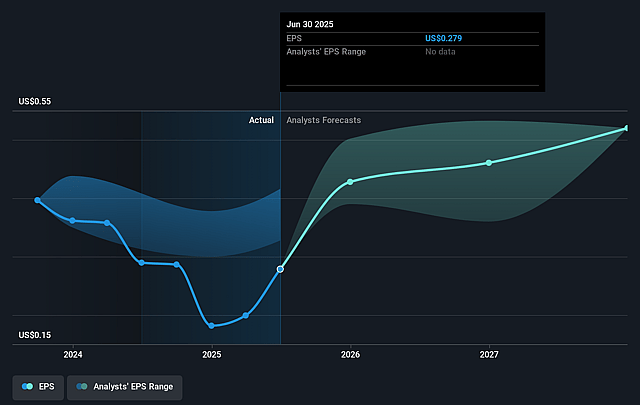

- The bullish analysts expect earnings to reach $134.1 million (and earnings per share of $0.6) by about August 2028, up from $41.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 38.0x today. This future PE is lower than the current PE for the US Hotel and Resort REITs industry at 27.3x.

- Analysts expect the number of shares outstanding to decline by 0.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.98%, as per the Simply Wall St company report.

DiamondRock Hospitality Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating adoption of remote and hybrid work models is structurally reducing demand for corporate travel and large-scale conferences, which is already reflected in cautious group booking trends and soft group conversion rates; this poses a long-term risk of lower occupancy and weaker revenue growth for DiamondRock’s urban hotel portfolio.

- DiamondRock’s high geographic concentration in established urban and resort markets increases vulnerability to localized economic downturns or over-supplied markets, as highlighted by recent RevPAR declines at Florida properties and difficult comps in Chicago and Boston, resulting in potentially volatile or declining revenues.

- Persistent inflation in wages and utility costs is expected to continue in the sector, with wage and benefit costs for DiamondRock projected to rise by 3 to 3.5 percent for the year; if revenues remain flat or decline, this cost pressure could compress net margins and operating earnings over time.

- Rising competition from short-term rental platforms such as Airbnb and Vrbo threatens to further pressure DiamondRock’s average daily rates and occupancies, especially in drive-to and leisure destinations, risking an erosion of revenue and market share for traditional hotel REITs.

- Heavy and recurring capital expenditure requirements for property renovations and compliance with sustainability and ESG standards could restrain free cash flow and net margins if revenue growth stalls, as substantial investment in property upkeep was highlighted in the call and is required to remain competitive in mature, supply-constrained markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for DiamondRock Hospitality is $11.27, which represents two standard deviations above the consensus price target of $9.18. This valuation is based on what can be assumed as the expectations of DiamondRock Hospitality's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $8.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $134.1 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of $7.69, the bullish analyst price target of $11.27 is 31.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.