Key Takeaways

- Focus on increasing free cash flow and strategic asset sales to boost returns and support shareholder value.

- Capital expenditure management and operational efficiencies aim to drive revenue growth, improve margins, and enhance earnings.

- Rising interest expenses, muted RevPAR growth, and earnings pressure from renovations risk negatively affecting DiamondRock Hospitality's profitability and shareholder returns.

Catalysts

About DiamondRock Hospitality- A self-advised real estate investment trust (REIT) that is an owner of a leading portfolio of geographically diversified hotels concentrated in leisure destinations and top gateway markets.

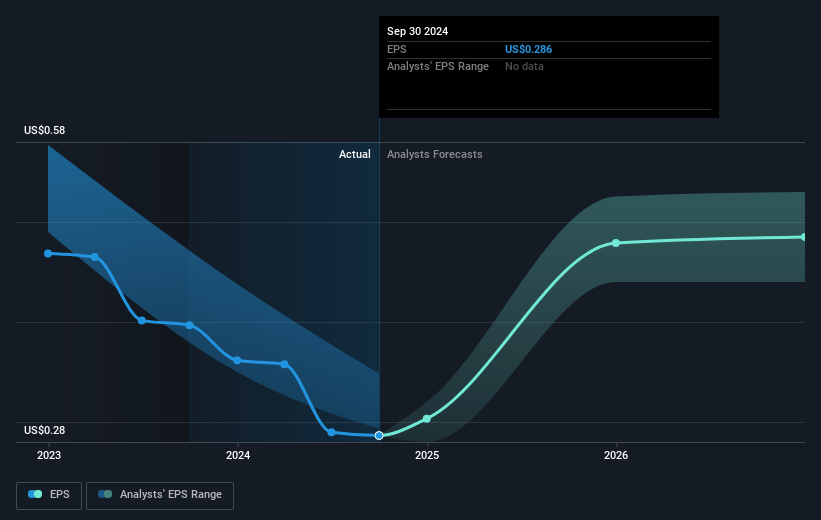

- The company is focusing on increasing earnings per share by preserving and creating more free cash flow, which can be returned to shareholders through share repurchases and dividends or reinvested to generate higher earnings, thereby potentially boosting net margins and future EPS.

- DiamondRock Hospitality is actively managing its capital expenditure projects, such as the redevelopment of Orchards Inn Sedona, to maximize ROI. A strategic approach to capital expenditures can enhance future EBITDA and cash flow.

- The company completed room renovations and rebranding efforts at multiple properties, including Bourbon Orleans and Westin San Diego Bayview. These efforts aim to drive an increase in RevPAR and total revenue, which should contribute to stronger earnings growth.

- They have implemented business intelligence tools that improve financial reporting and data analysis, leading to better cost management and operational efficiencies, anticipated to positively impact net margins.

- Strategic asset sales, like the recent sale in Washington D.C., reduce future capital expenditure obligations and redeploy capital into higher-yield opportunities, which may enhance the company's overall free cash flow and asset returns.

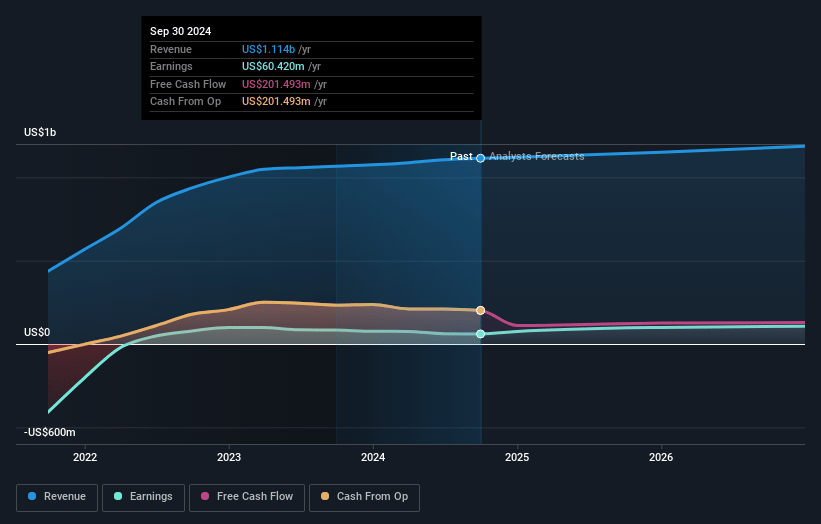

DiamondRock Hospitality Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DiamondRock Hospitality's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 8.7% in 3 years time.

- Analysts expect earnings to reach $104.2 million (and earnings per share of $0.45) by about April 2028, up from $38.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.3x on those 2028 earnings, down from 39.3x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 19.1x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

DiamondRock Hospitality Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company anticipates refinancing $300 million in maturing mortgage loans at a higher interest rate, which could increase interest expenses and negatively impact net margins and earnings.

- Florida resorts face ongoing earnings headwinds due to post-pandemic visitation challenges and inflation, leading to a 5.8% decline in RevPAR, potentially affecting overall revenue growth.

- The expected 1% to 3% RevPAR growth for 2025 remains modest, with projections at the lower end of expectations; this could limit significant increases in revenue and EBITDA.

- CapEx projects, such as the Orchards Inn renovation, may cause EBITDA disruption, and overly optimistic occupancy projections at certain hotels could lead to reduced return on investment, pressuring earnings.

- The subdued transaction market and potential forced renovations with uncertain returns at some properties could hinder effective capital recycling and profitability, impacting free cash flow and shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.068 for DiamondRock Hospitality based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $104.2 million, and it would be trading on a PE ratio of 22.3x, assuming you use a discount rate of 7.9%.

- Given the current share price of $7.19, the analyst price target of $9.07 is 20.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.