Last Update01 May 25Fair value Decreased 12%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Strategic capital allocation changes, including dividend adjustments, aim to enhance growth by capitalizing on evolving government real estate needs.

- Expansion into long-term government leases and proactive asset management strengthens revenue stability and supports future earnings growth.

- Financial changes, reliance on government leases, and debt exposure introduce risks to Easterly Government Properties' revenue stability and investor confidence.

Catalysts

About Easterly Government Properties- Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

- Easterly Government Properties has implemented strategic changes to its capital allocation strategy, including a dividend reduction and reverse stock split, to free up capital for growth and accretive investments. This move is expected to enhance future revenue and earnings growth by allowing the company to capitalize on shifting government real estate needs.

- Aligning the dividend philosophy with peers and improving dividend coverage enables Easterly to strengthen its balance sheet, providing flexibility for acquisitions and development opportunities. This is likely to impact future earnings positively by ensuring efficient capital use.

- The DOGE initiative's shift toward leased government facilities presents a significant market opportunity for Easterly, positioning it to expand leasing relationships and increase revenue through new government contracts as demand for such facilities rises.

- Easterly's expansion into long-term, noncancelable leases, such as the new federal courthouse in Medford and the D.C. acquisition, aims to bolster its revenue stability and ensure long-term earnings growth, given the extended lease terms and government backing.

- Proactive asset management, such as the repositioning with the state of New Mexico, enhances Easterly's ability to increase cash flow and reduce risk, supporting net margin improvement and future revenue growth through strategic tenant selection and retention.

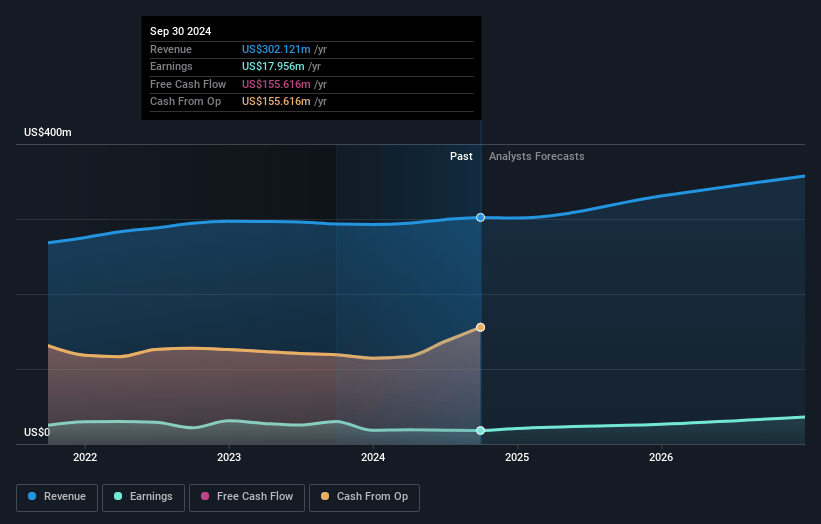

Easterly Government Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Easterly Government Properties's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.6% today to 8.5% in 3 years time.

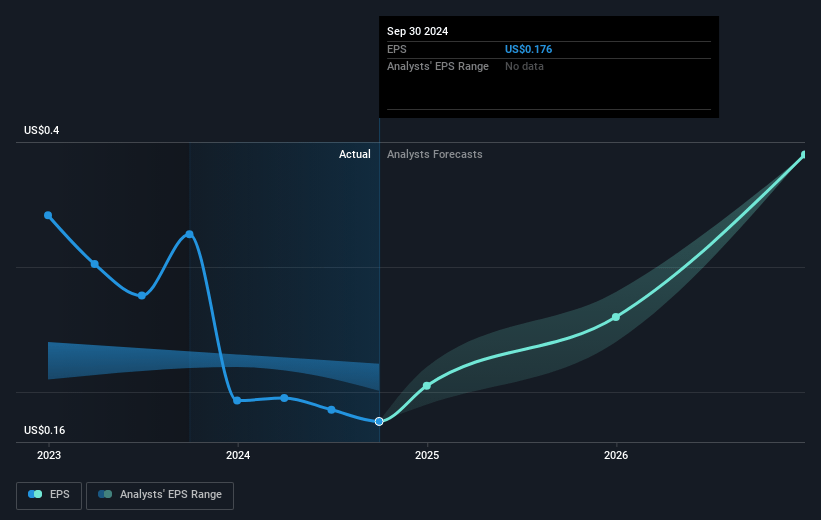

- Analysts expect earnings to reach $33.6 million (and earnings per share of $0.76) by about May 2028, up from $17.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 50.8x on those 2028 earnings, up from 49.4x today. This future PE is lower than the current PE for the US Office REITs industry at 64.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.09%, as per the Simply Wall St company report.

Easterly Government Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent reduction of Easterly Government Properties’ quarterly dividend and reverse stock split might indicate potential financial constraints, which could negatively impact investor confidence and overall earnings.

- Dependence on state and local government leases, although diversifying, could introduce risks if those governments face budget cuts or financial instability, potentially affecting revenue stability.

- Exposure to the Department of Government Efficiency (DOGE) initiative poses a risk, as future policy changes or efficiency measures could lead to reduced lease renewals or cancellations, influencing long-term revenues.

- The competitive real estate development landscape, particularly in government facilities, relies heavily on continued strategic partnerships and market conditions, impacting future capital allocation and potential revenue.

- Significant reliance on debt instruments and changes in credit market conditions could increase borrowing costs and financial liabilities, impacting net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.292 for Easterly Government Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $393.4 million, earnings will come to $33.6 million, and it would be trading on a PE ratio of 50.8x, assuming you use a discount rate of 8.1%.

- Given the current share price of $20.02, the analyst price target of $23.29 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.