Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and operational efficiencies are projected to enhance earnings and improve net margins.

- Expansion into government-adjacent sectors and leveraging financial relationships are expected to boost revenue and earnings growth.

- Political shifts and interest rate changes pose risks to Easterly Government Properties' government contracts and cost of capital, impacting growth and revenue stability.

Catalysts

About Easterly Government Properties- Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

- Easterly Government Properties is executing on accretive acquisitions, with a pipeline of roughly $1.5 billion in opportunities, expected to drive 2% to 3% core FFO per share growth year-over-year. (Impacts revenue and earnings)

- The company is achieving operational efficiencies, finding significant savings across the organization, which should improve net margins. (Impacts net margins)

- By expanding into government-adjacent sectors with high credit tenants like Northrop Grumman, Easterly is materially expanding its total addressable market, likely leading to increased revenues. (Impacts revenue)

- The company is focused on maintaining a targeted payout ratio below 100% by the end of 2026, aiming for sustained dividend coverage and potentially benefitting cash flow and earnings stability. (Impacts earnings and cash flows)

- Easterly is leveraging relationships with equity and debt providers to support its acquisition strategy, expecting to maintain a spread of 50 to 100 basis points above cost of capital, which should enhance earnings growth. (Impacts earnings)

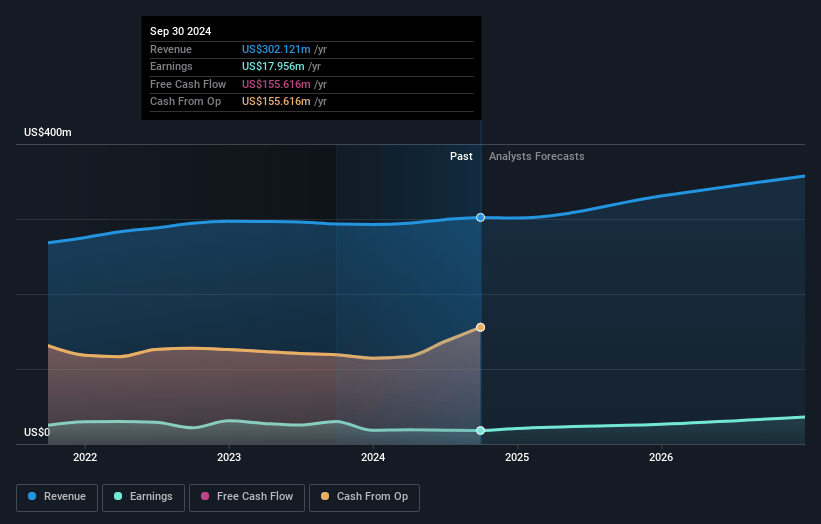

Easterly Government Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Easterly Government Properties's revenue will grow by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 9.2% in 3 years time.

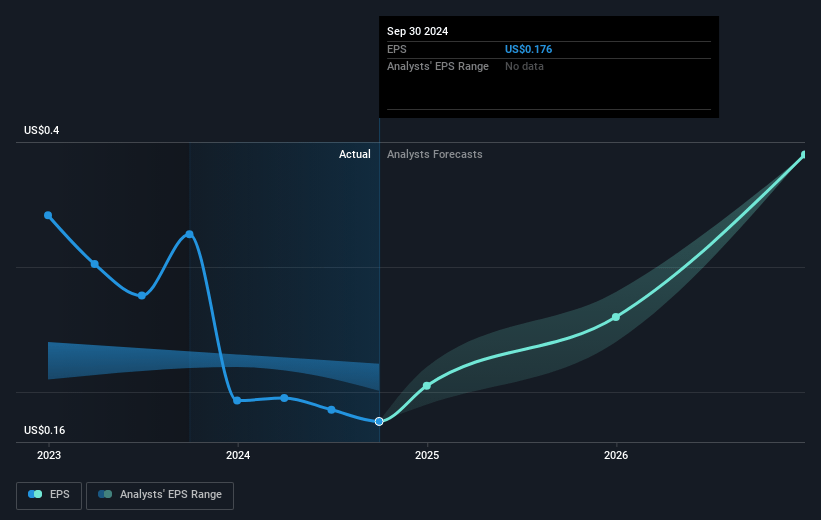

- Analysts expect earnings to reach $36.1 million (and earnings per share of $0.38) by about January 2028, up from $18.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.0x on those 2028 earnings, down from 66.8x today. This future PE is greater than the current PE for the US Office REITs industry at 27.5x.

- Analysts expect the number of shares outstanding to decline by 6.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.45%, as per the Simply Wall St company report.

Easterly Government Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Political uncertainty, particularly related to potential changes in U.S. government priorities or administration, could affect Easterly Government Properties' focus on mission-critical government areas, impacting revenue and earnings from government contracts.

- Interest rate fluctuations and changes in market dynamics could affect Easterly’s cost of capital, making it challenging to maintain the projected growth targets and potentially impacting net margins.

- Execution risk in expanding into government-adjacent spaces with defense contractors like Northrop Grumman, where leasing demands could vary, might affect revenue stability and earnings if expected tenant requirements are not met.

- Reliance on external acquisition strategy amid potential price dislocations in the market can pose risks if assumed spreads between acquisition yields and cost of capital are not realized, which could impact core FFO growth and revenue projections.

- Geographic and strategic concentration, such as substantial investments near military bases or specific government sectors, may expose the company to heightened risk from policy changes or shifts in defense focus, impacting long-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.67 for Easterly Government Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $391.5 million, earnings will come to $36.1 million, and it would be trading on a PE ratio of 41.0x, assuming you use a discount rate of 7.5%.

- Given the current share price of $11.35, the analyst's price target of $12.67 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives