Key Takeaways

- Persistent rental demand and demographic trends in key markets drive high occupancy, rent growth, and tenant retention for stable long-term revenue.

- Strategic recycling into higher-growth properties and disciplined balance sheet management enhance portfolio quality, margins, and position for further growth.

- Increased exposure to volatile institutional and secondary markets, high leverage, and challenging market conditions may constrain growth, earnings stability, and financial flexibility.

Catalysts

About Centerspace- An owner and operator of apartment communities committed to providing great homes by focusing on integrity and serving others.

- Strong ongoing rental demand in Midwest and secondary markets, driven by U.S. housing shortages and high barriers to homeownership, positions Centerspace for sustained high occupancy and steady rent growth, bolstering revenue and NOI over the long term.

- Demographic shifts, such as millennials delaying or foregoing homeownership due to affordability challenges, are likely to structurally increase demand for multifamily rentals in Centerspace's markets, supporting both top-line growth and tenant retention.

- Strategic capital recycling-redeploying proceeds from the sale of lower-margin, less desirable assets in St. Cloud and Minneapolis into newer, higher-growth properties in Salt Lake City and Colorado-enhances average portfolio quality, improves NOI margins, and supports earnings growth as integration is realized.

- Portfolio repositioning into markets with stable economic bases, strong job growth, and limited new multifamily supply (such as Salt Lake City) increases long-term growth potential and reduces risk of occupancy or rent declines, resulting in higher, more resilient net margins.

- Continued disciplined balance sheet management, including maintaining below-peer leverage and extending debt maturities at favorable rates, provides financial flexibility for opportunistic acquisitions or share buybacks, paving the way for improved long-term earnings and shareholder returns.

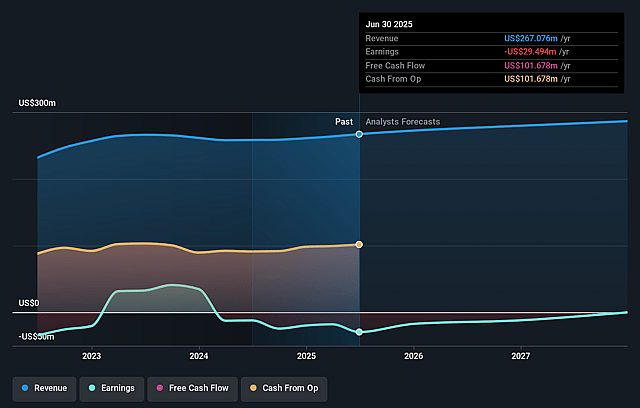

Centerspace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Centerspace's revenue will grow by 2.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -11.0% today to 4.7% in 3 years time.

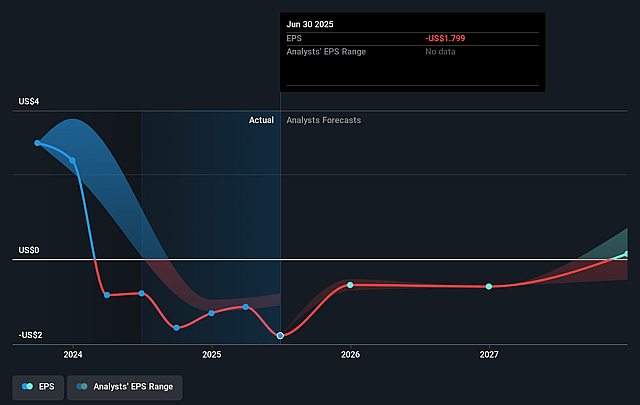

- Analysts expect earnings to reach $13.3 million (and earnings per share of $0.49) by about September 2028, up from $-29.5 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $84.8 million in earnings, and the most bearish expecting $-12.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 115.8x on those 2028 earnings, up from -33.4x today. This future PE is greater than the current PE for the US Residential REITs industry at 31.7x.

- Analysts expect the number of shares outstanding to grow by 1.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

Centerspace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Centerspace's strategic shift toward institutional markets (e.g., Salt Lake City and Denver) exposes the company to higher acquisition cap rates and near-term earnings dilution (~$0.06–$0.08/share in 2025, annualizing to ~$0.15), risking short

- to medium-term earnings and FFO growth if expected market tailwinds (job gains, supply constraint) do not materialize as projected.

- The portfolio's geographic concentration in secondary and tertiary Midwest markets, while driving currently strong performance, subjects the company to significant exposure to localized economic slumps, demographic stagnation (e.g., university enrollment declines in St. Cloud), and a greater risk of revenue and occupancy volatility from small market disruptions.

- High leverage (targeting low to mid 7x net debt/EBITDA by year-end) relative to peer REITs constrains Centerspace's balance sheet flexibility; prolonged tight credit conditions or inability to deleverage as planned could lead to higher borrowing costs, reduced acquisition capacity, and compressed net margins.

- Competitive pressures and record supply in Denver and other institutional markets have resulted in negative rent growth and liberal concessions in these segments, dampening renewal lease rates and offsetting gains elsewhere, which could depress aggregate revenue and require further concessions in the face of rising operating expenses (e.g., insurance, property taxes).

- Ongoing capital recycling and emphasis on asset sales in markets with weakening fundamentals (e.g., St. Cloud, parts of Minneapolis) may create asset sale timing risk and impairments (evidenced by the $14.5M write-down), potentially leading to further near-term FFO dilution and reductions in book value if transaction markets soften or sale prices are lower than underwritten.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $67.591 for Centerspace based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $79.0, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $284.9 million, earnings will come to $13.3 million, and it would be trading on a PE ratio of 115.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $58.87, the analyst price target of $67.59 is 12.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.