Key Takeaways

- Strategic changes, including new leadership and digitization, are set to boost operational efficiency and revenue through new organic opportunities.

- The cancellation of low-yield projects and focus on existing assets will enhance profitability, improve margins, and increase cash flow.

- High deployment costs and competition are challenging future growth, while asset write-offs and strategic reviews signal potential issues in capital management and stability.

Catalysts

About Crown Castle- Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

- Crown Castle is expecting sustained demand for its towers, small cells, and fiber assets due to increasing wireless and broadband data usage, which should drive network investments and improve revenue growth.

- The organizational and strategic changes, including welcoming Cathy Piche as leader of the tower business and digitizing the tower portfolio, are anticipated to enhance operational efficiency and boost revenue growth from new organic opportunities.

- The mutual cancellation of 7,000 low-yield nodes from the backlog will reduce future capital expenditure by about $800 million and improve future returns, positively impacting net margins and earnings.

- Changes to enhance profitability in the fiber solutions business, focusing on colocation activities within existing footprints, are expected to drive higher returns and increased cash flow, positively affecting earnings.

- Comprehensive master lease agreements (MLAs) with major customers are expected to provide more stable and predictable revenue growth while reducing customer capital and operational budgeting, impacting both revenue and net margins.

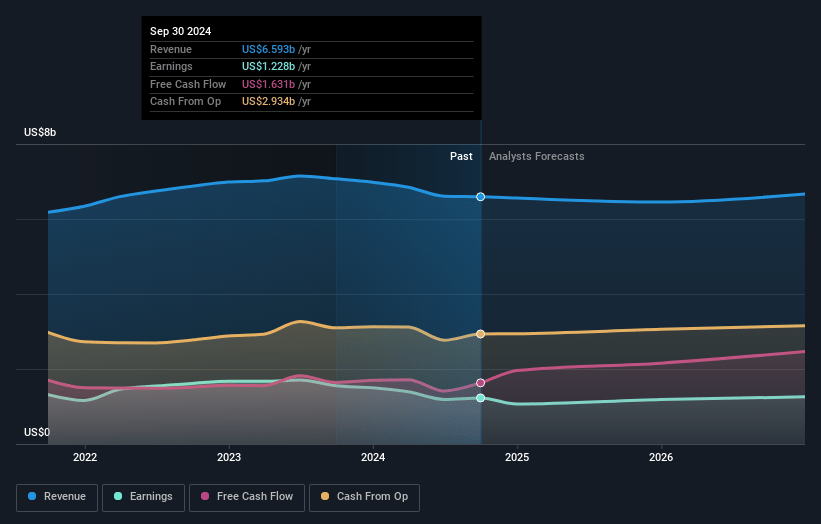

Crown Castle Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Crown Castle's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.6% today to 19.6% in 3 years time.

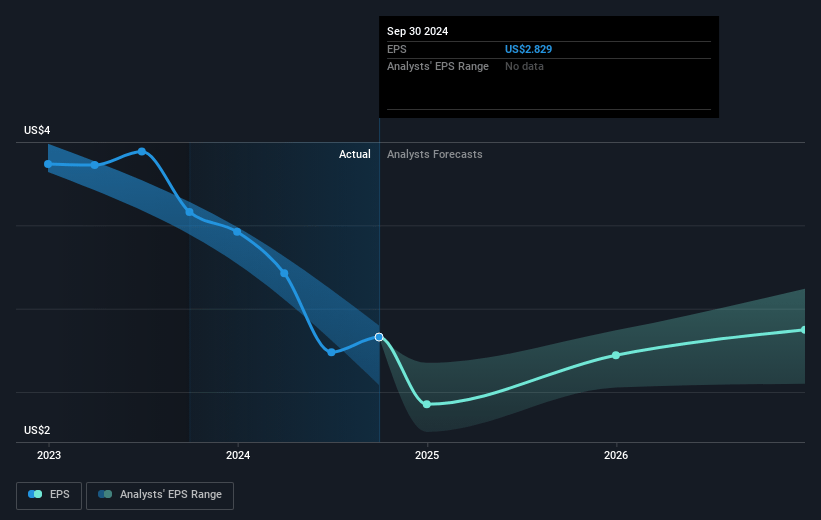

- Analysts expect earnings to reach $1.4 billion (and earnings per share of $3.14) by about January 2028, up from $1.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.3x on those 2028 earnings, up from 31.8x today. This future PE is greater than the current PE for the US Specialized REITs industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 0.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.91%, as per the Simply Wall St company report.

Crown Castle Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The cancellation of approximately 7,000 contracted small cell nodes due to high deployment costs indicates a potential challenge in managing capital expenditures effectively, which could impact future earnings.

- The expectation of a $125 million to $150 million asset write-off related to the small cell business suggests potential issues in asset valuation and misallocation of resources, impacting net income.

- The adjustments and reductions in future capital requirements highlight ongoing challenges in evaluating profitable investment opportunities, possibly affecting long-term revenue growth.

- Intensifying competition from private tower companies and the complexity of negotiating MLAs (Master Lease Agreements) might constrain the company’s ability to gain market share and achieve projected revenue growth.

- The strategic review of the fiber business and potential divestitures suggest market uncertainties and possible structural vulnerability, which could disrupt the stability of long-term revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $111.18 for Crown Castle based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $84.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.0 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 43.3x, assuming you use a discount rate of 6.9%.

- Given the current share price of $89.75, the analyst's price target of $111.18 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives