Key Takeaways

- Strong business travel demand and strategic asset management are set to enhance Apple Hospitality REIT's revenue and net margins.

- Targeted acquisitions and effective capital management support potential earnings growth amid favorable economic trends.

- Slow RevPAR growth, rising costs, and high leverage could limit revenue potential and affect earnings amid challenging market conditions.

Catalysts

About Apple Hospitality REIT- Apple Hospitality REIT, Inc., formed in November 2007 as a Virginia corporation, together with its wholly-owned subsidiaries (the “Company”), is a self-advised real estate investment trust (“REIT”) that invests in income-producing real estate, primarily in the lodging sector, in the United States (“U.S.”).

- Apple Hospitality REIT anticipates improved business travel demand, driving growth in midweek occupancy and ADR, which could increase overall revenue given the favorable supply dynamics.

- The company has been strategically disposing of lower-performing assets and acquiring properties with stronger growth profiles, likely improving net margins through optimized capital allocation.

- Share repurchases have been a focus for the company, leveraging the undervaluation of their stock to potentially increase EPS as shares are bought back at attractive prices compared to recent asset sales.

- Recent acquisitions in high-growth markets like Las Vegas and Washington, D.C. are yielding high returns, positioning the company to benefit from continued favorable economic and demographic trends, thus enhancing future earnings.

- The company is actively managing capital expenditure effectively, which includes planned renovations and acquisitions funded by sales, leading to potential improvements in operating margins due to lower near-term CapEx needs.

Apple Hospitality REIT Future Earnings and Revenue Growth

Assumptions

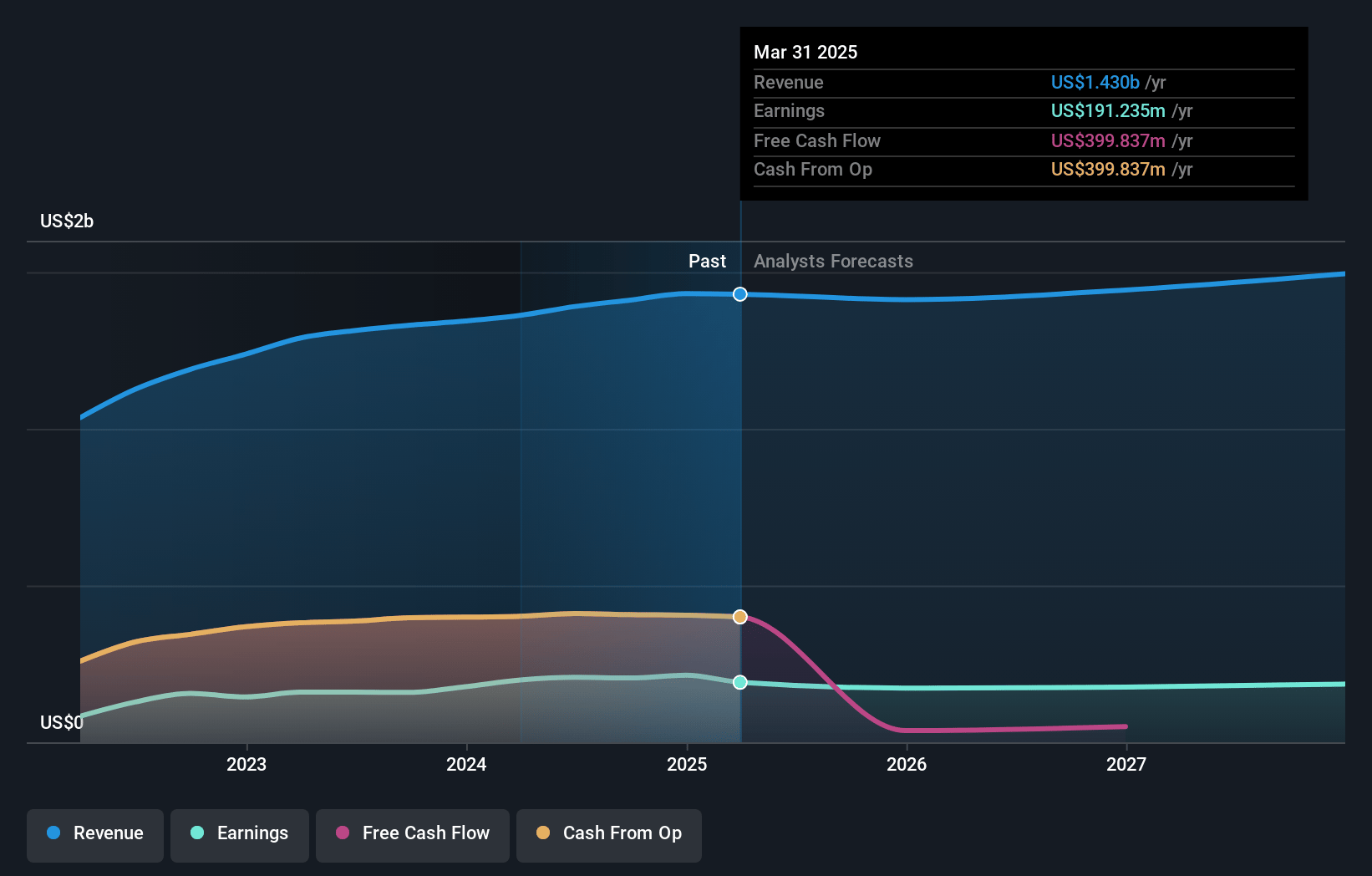

How have these above catalysts been quantified?- Analysts are assuming Apple Hospitality REIT's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 14.5% today to 13.4% in 3 years time.

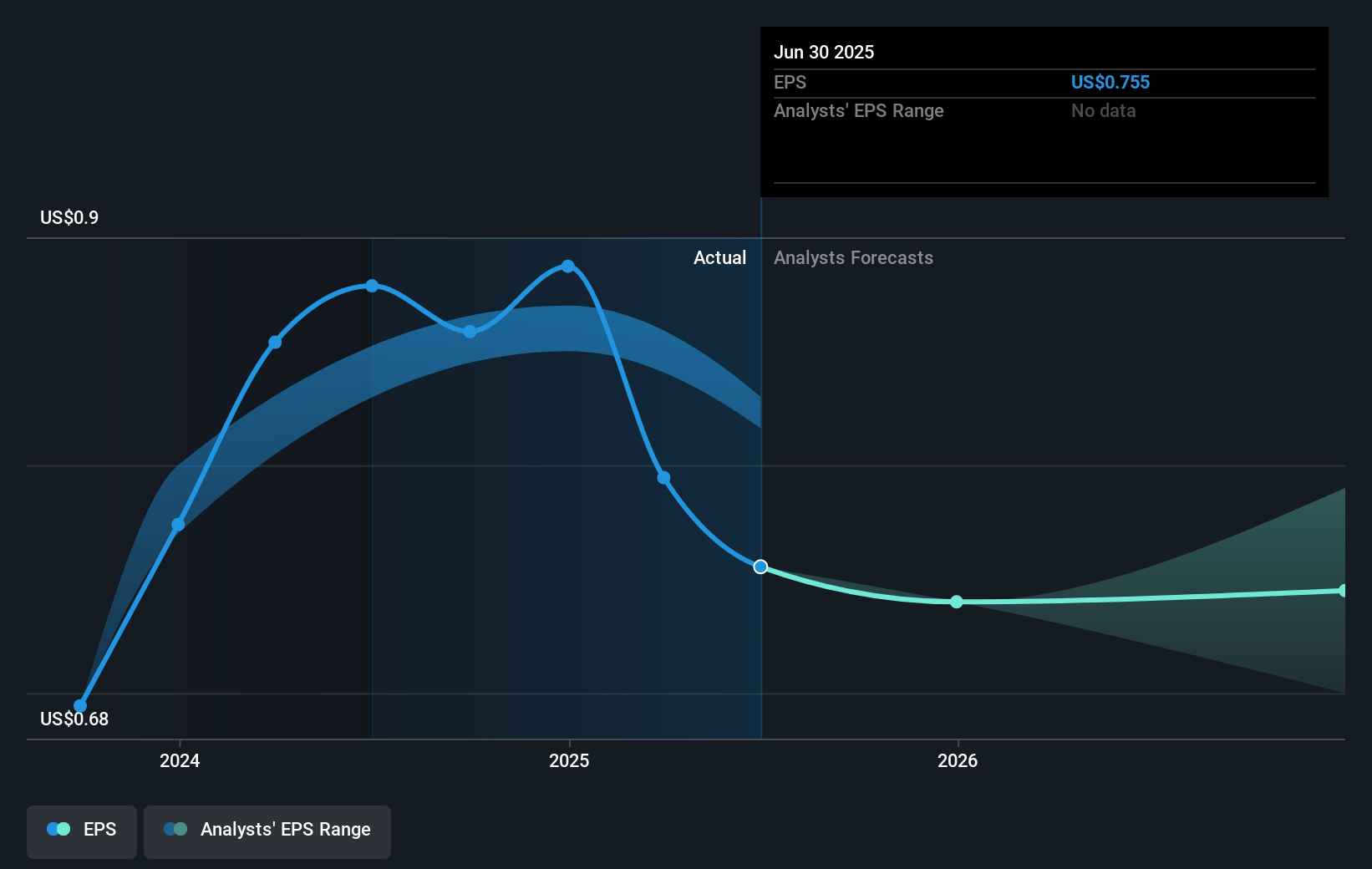

- Analysts expect earnings to reach $205.4 million (and earnings per share of $0.86) by about January 2028, up from $205.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, up from 18.4x today. This future PE is greater than the current PE for the US Hotel and Resort REITs industry at 18.4x.

- Analysts expect the number of shares outstanding to decline by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Apple Hospitality REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slow RevPAR growth of only 1% compared to the previous year and reliance on rate improvements over occupancy to drive growth could limit revenue potential.

- Rising payroll costs, particularly in sales and maintenance, increased by 12% and 8% respectively, which might compress net margins.

- The transaction market remains challenging, with a wide bid-ask spread deterring quicker asset disposition or acquisition to reposition the portfolio, potentially affecting capital allocation and earnings.

- High leverage with approximately $1.5 billion of total debt outstanding leading to interest expenses, impacting earnings especially in a rising interest rate environment.

- Pipeline issues with construction and supply limitations, resulting in reliance on acquisitions with competitive market pricing, can restrict growth and affect future earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.14 for Apple Hospitality REIT based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $205.4 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $15.7, the analyst's price target of $17.14 is 8.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives