Last Update29 Jul 25Fair value Decreased 11%

A lower analyst price target for American Homes 4 Rent reflects a notable decline in its future P/E ratio despite a slight improvement in net profit margin, resulting in a revised fair value of $40.92.

What's in the News

- American Homes 4 Rent dropped from the Russell 1000 Dynamic Index.

- The company repurchased 0 shares from January 1 to March 31, 2025; total buybacks since 2015 stand at 11,653,421 shares (5.26%) for $188.2 million.

- Reaffirmed 2025 guidance: Core revenues growth of 2.50%–4.50%, Core NOI growth of 2.25%–4.25%.

Valuation Changes

Summary of Valuation Changes for American Homes 4 Rent

- The Consensus Analyst Price Target has fallen from $45.40 to $40.92.

- The Future P/E for American Homes 4 Rent has significantly fallen from 67.52x to 58.19x.

- The Net Profit Margin for American Homes 4 Rent has risen slightly from 14.51% to 15.18%.

Key Takeaways

- Elevated development and maintenance costs from tariffs and material fluctuations may compress net margins if not passed to renters.

- Competition and shifting consumer preferences in key markets could challenge revenue growth and impact expectations negatively.

- Strong demand, strategic diversification, and a unique development program position American Homes 4 Rent for stable revenue growth and improved financial resilience.

Catalysts

About American Homes 4 Rent- AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

- The increase in homeownership costs, driven by high mortgage rates and increased insurance expenses, may lead to a further gap between renters and homeowners. This could reduce demand and impact revenue growth as fewer families choose to rent (revenue).

- American Homes 4 Rent's continuation of its lease expiration management strategy could result in short-term increases in turnover, potentially raising operating expenses and affecting net margins adversely (net margins).

- Potential new tariffs and fluctuations in labor and material costs could elevate development and maintenance costs, leading to compressed net margins if these cost increases cannot be passed through to renters (net margins).

- Potential headwinds in the macroeconomic environment, such as job market fluctuations, may disrupt the leasing dynamics, ultimately affecting occupancy rates and revenue growth (revenue).

- The company's current strategy and geographic footprint focus, particularly in markets like North Florida and Texas, where competition from public builders is increasing, may challenge revenue growth expectations if consumer preferences shift or supply becomes saturated (revenue).

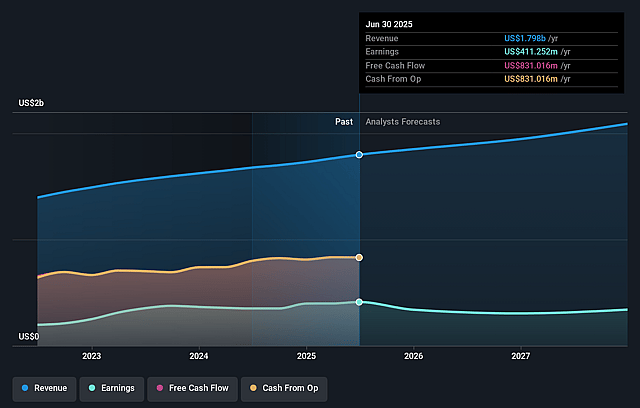

American Homes 4 Rent Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Homes 4 Rent's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.9% today to 14.4% in 3 years time.

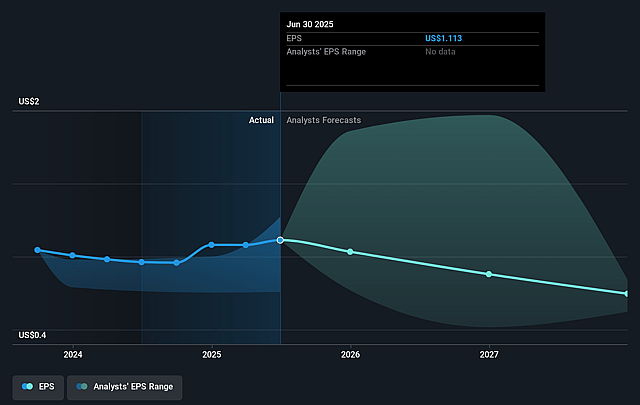

- Analysts expect earnings to reach $314.4 million (and earnings per share of $1.16) by about August 2028, down from $411.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $568.9 million in earnings, and the most bearish expecting $261 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 67.6x on those 2028 earnings, up from 31.5x today. This future PE is greater than the current PE for the US Residential REITs industry at 32.0x.

- Analysts expect the number of shares outstanding to grow by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.15%, as per the Simply Wall St company report.

American Homes 4 Rent Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- American Homes 4 Rent (AMH) is experiencing strong demand due to a persistent supply and demand imbalance in the U.S. housing market, positioning the company for continued revenue growth.

- AMH's unique in-house development program allows them to deliver new inventory to an undersupplied market, which can provide a strong foundation for sustained, future revenue and earnings.

- The company benefits from a high resident retention rate, exceeding 70%, and has an industry-leading customer experience, reflected by a national Google score of 4.7 out of 5 stars, contributing to stable and potentially consistent revenue streams.

- The positive revision of AMH's credit rating by S&P Global suggests improved access to capital markets and a stronger financial position, potentially stabilizing or improving net margins and earnings.

- AMH's strategic focus on high-quality markets and intentional geographic diversification within its portfolio limits its exposure to localized economic downturns, therefore maintaining stable or potentially improving financial results across varying market conditions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.55 for American Homes 4 Rent based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $36.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $314.4 million, and it would be trading on a PE ratio of 67.6x, assuming you use a discount rate of 7.2%.

- Given the current share price of $34.98, the analyst price target of $40.55 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.