Key Takeaways

- Strategic asset management and acquisitions improve revenue and margins, leveraging income-producing assets and capital recycling.

- Operational and cost-efficiency efforts enhance financial flexibility and profitability, with a focus on leasing and asset dispositions.

- Reliance on land sales and tenant stability poses risk to consistent revenue, with economic uncertainty potentially impacting commercial real estate demand and financial performance.

Catalysts

About Alexander & Baldwin- Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

- The company has introduced a new ATM program and recently recast its credit facility, which extends its revolving credit maturity date to 2028, supporting future capital access and financial flexibility, likely positively impacting earnings through reduced interest expense and improved liquidity.

- The company has executed acquisitions, such as the 81,500-square-foot industrial asset in Oahu, through capital recycling, suggesting potential growth in revenue and net margins as they invest in income-producing assets and streamline operations.

- A focus on operational excellence and strong leasing activity with 71 executed leases is driving up blended rent spreads by 15.3%, which is expected to increase revenue and enhance net operating income as new tenants occupy the spaces.

- Asset dispositions, particularly from selling noncore assets like the Waipouli Town Center, provide liquidity for more strategic, higher-yield investments, allowing the company to potentially boost earnings and enhance overall asset management performance.

- Reduction in general and administrative expenses projected for 2024—from between $29.5 million to $31.5 million down to a range of $29 million to $30.5 million—implies potential improvements in net margins and overall profitability through streamlined cost structures.

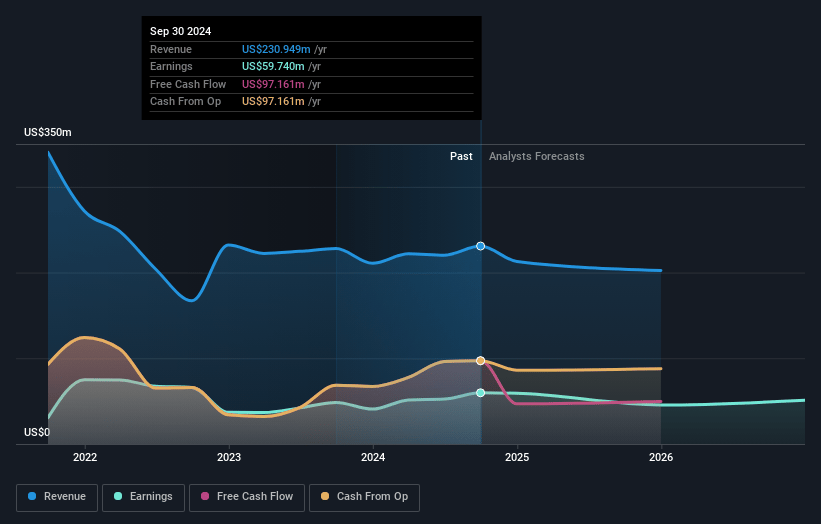

Alexander & Baldwin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alexander & Baldwin's revenue will decrease by -6.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.9% today to 23.5% in 3 years time.

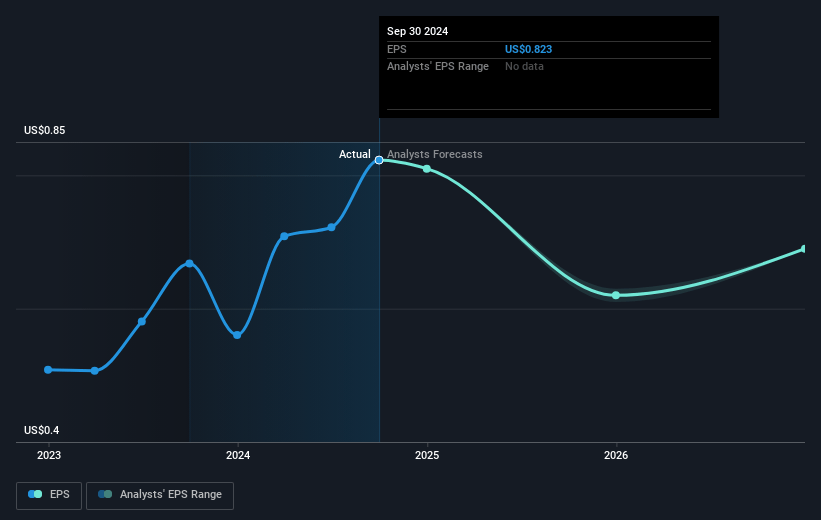

- Analysts expect earnings to reach $44.1 million (and earnings per share of $0.59) by about January 2028, down from $59.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 44.6x on those 2028 earnings, up from 21.8x today. This future PE is greater than the current PE for the US REITs industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

Alexander & Baldwin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's financial outlook is significantly influenced by one-time land sales and investments, which poses a risk to future revenue consistency and may impact earnings if these sources are not sustained.

- The potential move-outs of significant tenants in Q4 could lead to increased vacancies and lower occupancy rates, adversely affecting net operating income and potentially compressing net margins.

- Alexander & Baldwin's acquisition strategy relies on the availability and timely recycling of capital from asset sales, which could lead to revenue volatility and increased financial risk if these transactions do not proceed as planned.

- The company's reliance on its revolving credit facility and ATM program for liquidity introduces interest rate risk, which could increase financial expenses and impact earnings if interest rates rise significantly.

- The economic uncertainty affecting Hawaii, such as reduced visitor arrivals due to external factors like the Maui wildfires, could negatively impact commercial real estate demand and, in turn, future revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.9 for Alexander & Baldwin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.6, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $188.2 million, earnings will come to $44.1 million, and it would be trading on a PE ratio of 44.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of $17.95, the analyst's price target of $21.9 is 18.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives