Key Takeaways

- Rising demand for senior care and strategic asset recycling are driving sustained revenue, margin, and earnings growth, supported by favorable demographic trends and limited new supply.

- Integrated care campuses, operational efficiencies, and disciplined growth strategies enhance occupancy resiliency, cash flow stability, and long-term expansion opportunities.

- Increased focus on senior housing and skilled nursing heightens exposure to regulatory, reimbursement, execution, labor, and supply-demand risks, potentially increasing earnings and occupancy volatility.

Catalysts

About American Healthcare REIT- A Maryland corporation, is a self-managed real estate investment trust, or REIT, that acquires, owns and operates a diversified portfolio of clinical healthcare real estate properties, focusing primarily on senior housing, skilled nursing facilities, or SNFs, outpatient medical, or OM, buildings and other healthcare-related facilities.

- The company is benefiting from strong and accelerating demand for senior care, supported by a rapidly aging U.S. population, which is driving occupancy gains, higher rates, and robust same-store NOI growth across both its Trilogy and SHOP segments; this is directly supporting rising revenues and higher earnings guidance.

- Strategic capital deployment through recycling of older, lower-growth properties into newer, higher-yielding senior housing assets positions the portfolio to capture long-term rent growth and margin expansion, especially as new supply remains constrained; this is expected to underpin sustained improvements in net operating income and margins.

- The company's differentiated focus on integrated care campuses enables it to dynamically respond to shifting care needs (e.g., from skilled nursing to assisted living), improving occupancy resiliency and revenue per occupied room (RevPOR), which stabilizes cash flows and supports long-term earnings growth.

- Enhanced operating efficiency is anticipated as regional operators and SHOP assets increasingly leverage Trilogy's scale advantages in data-driven revenue management, quality of care, and procurement-an operational model that should translate into expanding net margins over time.

- Disciplined balance sheet management, a robust pipeline of $300+ million in accretive acquisitions, and strategic partnerships with new operators provide clear visibility into external growth, favoring future AFFO and dividend growth, especially as demographic and healthcare trends steadily increase the addressable market.

American Healthcare REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming American Healthcare REIT's revenue will grow by 8.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.9% today to 5.8% in 3 years time.

- Analysts expect earnings to reach $156.0 million (and earnings per share of $2.22) by about July 2028, up from $-40.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $179.7 million in earnings, and the most bearish expecting $135.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 62.5x on those 2028 earnings, up from -145.3x today. This future PE is greater than the current PE for the US Health Care REITs industry at 36.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

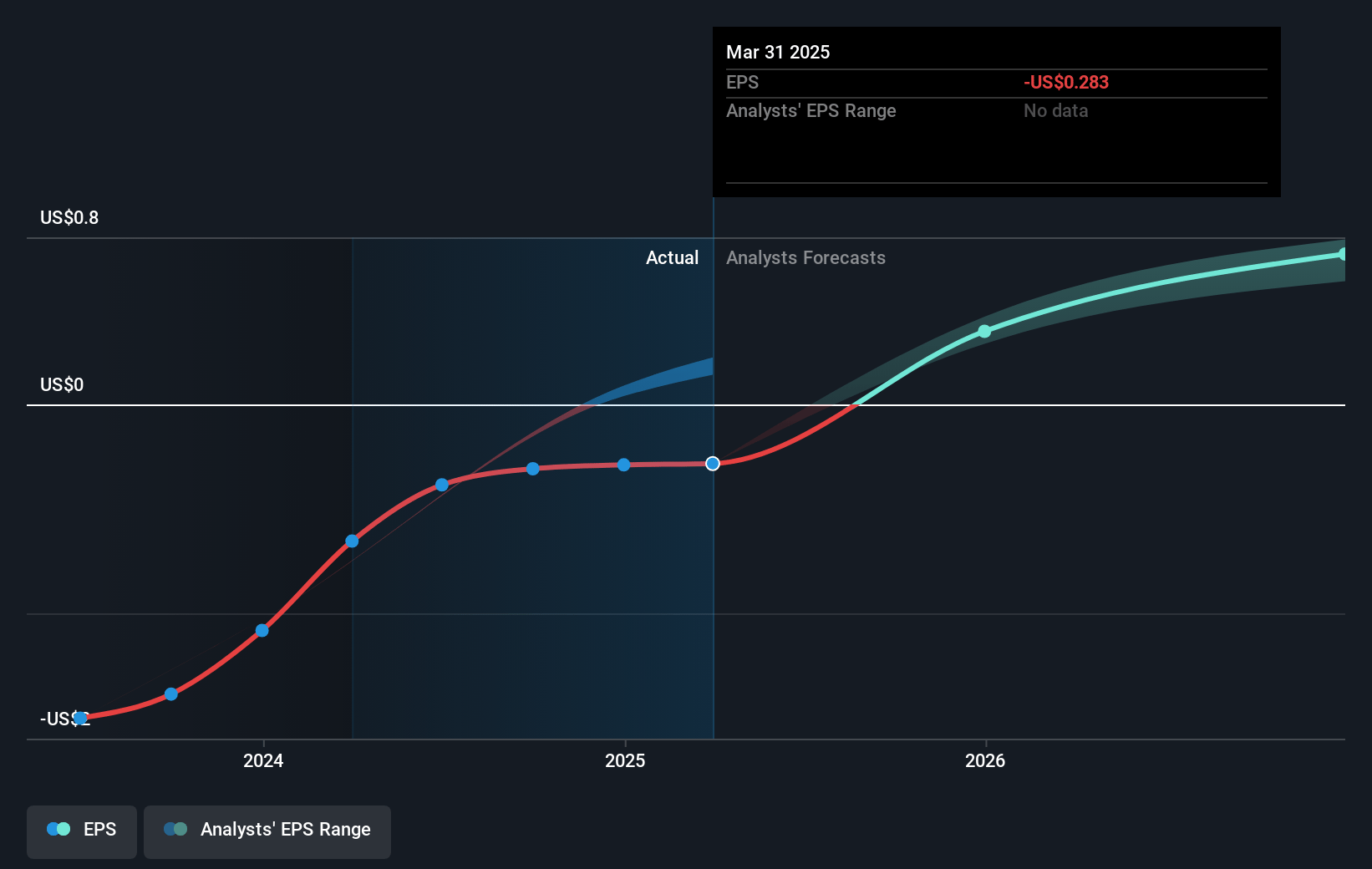

American Healthcare REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's increasing concentration in the Senior Housing Operating Properties (SHOP) and Trilogy segments, and shrinking exposure to medical office buildings (MOBs) and triple-net leases, heightens exposure to cyclical risks in senior living and skilled nursing, including regulatory changes and shifts in healthcare reimbursement-raising potential volatility in occupancy and revenue.

- Heavy reliance on continued strong performance in government-funded (Medicaid/Medicare) reimbursement and value-based care programs in Trilogy's markets exposes the company to policy risk; adverse changes, reimbursement caps, or stricter value-based requirements could pressure rent collections, operator profitability, and net operating income margins.

- The company's substantial acquisition pipeline and ongoing portfolio repositioning depends on timely and successful integration of new properties and operators; execution risk, including regulatory approval delays, integration missteps, or overestimating new markets and partners, could dampen expected growth, strain resources, and negatively impact earnings.

- Limited new supply in the senior housing sector currently supports high occupancy and rental rates, but this could reverse longer-term; rising development costs and muted construction starts, if not offset by sustained demand, may lead to an eventual supply/demand imbalance, capping future rent growth and compressing net margins if oversupply emerges when development economics normalize.

- Elevated labor costs and persistent workforce shortages in healthcare and senior living continue to pressure tenant/operator profitability; if wage inflation outpaces revenue growth or operators struggle to attract and retain staff, this could directly affect tenant creditworthiness, increase lease default risk, and reduce both occupancy and overall revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.5 for American Healthcare REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $156.0 million, and it would be trading on a PE ratio of 62.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $37.09, the analyst price target of $40.5 is 8.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.