Key Takeaways

- Strategic investment in newer assets and improving occupancy rates boost Sabra's revenue potential and earnings stability.

- Improved financial strength, operational leverage, and strong tenant performance enhance Sabra's earnings growth and cash flow sustainability.

- Dependence on skilled nursing and Medicare/Medicaid reimbursement risks impacting growth due to limited opportunities, competition, and regulatory uncertainties.

Catalysts

About Sabra Health Care REIT- As of September 30, 2023, Sabra’s investment portfolio included 377 real estate properties held for investment (consisting of (i) 240 Skilled Nursing/Transitional Care facilities, (ii) 43 senior housing communities (“Senior Housing - Leased”), (iii) 61 senior housing communities operated by third-party property managers pursuant to property management agreements (“Senior Housing - Managed”), (iv) 18 Behavioral Health facilities and (v) 15 Specialty Hospitals and Other facilities), 12 investments in loans receivable (consisting of two mortgage loans and 10 other loans), five preferred equity investments and two investments in unconsolidated joint ventures.

- Sabra Health Care REIT has shown sequential quarters of improving occupancy rates in its SNF portfolio and its SHOP portfolio, leading to increased revenue generation potential in these core areas.

- The company has been making strategic, high-quality investments in newer vintage assets, supporting future revenue growth and ensuring stronger earnings stability.

- Sabra's management reported that operating leverage is contributing significantly to cash NOI growth, resulting in improved margins and enhanced earnings prospects.

- A credit rating upgrade from Moody's demonstrates improved financial strength, which could lead to better borrowing terms and support earnings growth.

- Sabra is leveraging strong tenant performance in senior housing and skilled nursing, which is expected to drive sustainable earnings and maintain high rental coverage ratios, contributing to robust future cash flows.

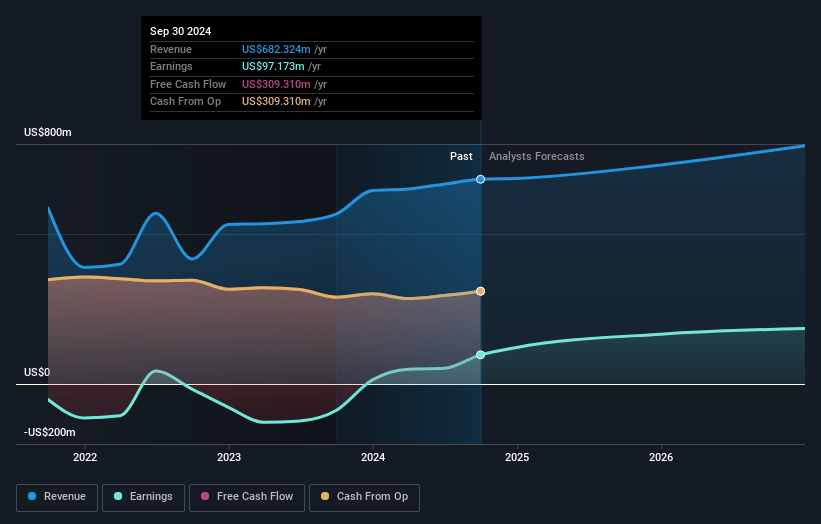

Sabra Health Care REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sabra Health Care REIT's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.2% today to 23.7% in 3 years time.

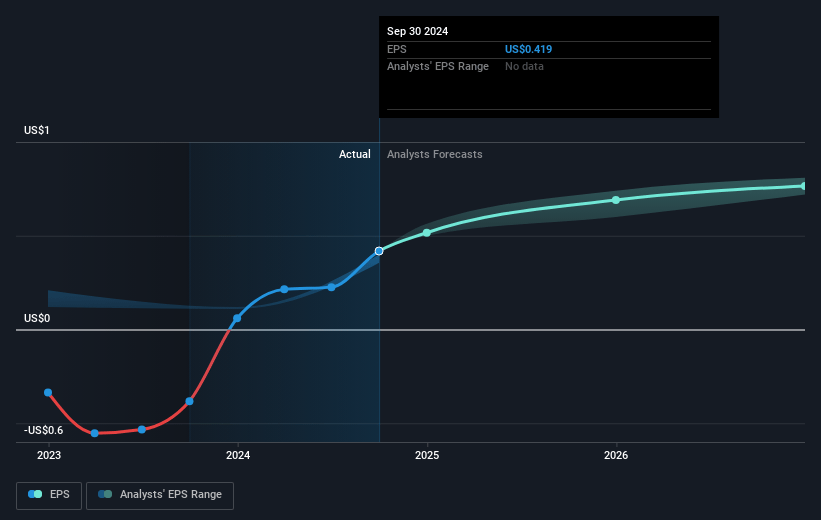

- Analysts expect earnings to reach $188.7 million (and earnings per share of $0.78) by about January 2028, up from $97.2 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $168.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.5x on those 2028 earnings, down from 41.4x today. This future PE is lower than the current PE for the US Health Care REITs industry at 41.4x.

- Analysts expect the number of shares outstanding to grow by 0.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Sabra Health Care REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on skilled nursing facilities (SNF) and the potential for limited skilled nursing opportunities in the market could hinder growth and impact revenue.

- High dependency on Medicare and Medicaid reimbursements, which may see less favorable adjustments in the future, potentially affecting net margins.

- Avamere's percentage rents are a significant contribution, but there's a risk if their performance falters, which could negatively impact earnings.

- Increased competition and changes in lending conditions could impact availability and cost of new acquisitions, affecting revenue growth.

- Ongoing regulatory uncertainties, such as minimum staffing mandates, could increase operational costs and pressure earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.75 for Sabra Health Care REIT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $17.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $795.1 million, earnings will come to $188.7 million, and it would be trading on a PE ratio of 31.5x, assuming you use a discount rate of 7.7%.

- Given the current share price of $17.0, the analyst's price target of $19.75 is 13.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives